3 Central Bank Shocks Unleash Overnight Yield Crash, With Yuan On Verge Of Collapse

There is just one way to describe the plunge in bond yields overnight and the event behind it: the global race to the currency bottom is now rapidly accelerating in its final lap.

The main event, of course, was the latest yuan fixing with the PBOC showing a clear sense of humor when it set the currency at 6.9996, laughably not to be confused with 7 (for at least another 24 hours that is), but just a fraction of a percent away from the critical threshold, and weaker than the 6.9977 expected. The result was a resumption in the offshore yuan selloff, a hit to US equity futures and a drop in Treasury yields. Of course, once the PBOC does finally fix the yuan on the wrong side of 7, all bets are off and watch as the CNH crashes... as far as 7.70 according to SocGen, especially if Trump hikes tariffs to 25%.

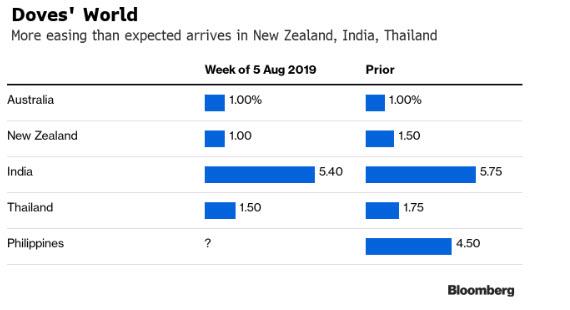

But there was much more in today's iteration of the global race to the currency bottom, when first New Zealand, then India and finally Thailand shocked investor by being far more dovish than expected. Indeed, the three Asian central banks delivered surprise interest-rate decisions on Wednesday as central bankers not only take aggressive action to counter a worsening global economy, but are now frontrunning each other in doing so.

As noted last night, New Zealand’s central bank on Wednesday stunned investors by dropping its benchmark rate by 50 basis points, double the expected reduction and sending the kiwi tumbling. Thailand also surprised all but two in a survey of economists, cutting by 25 basis points. India’s central bank lowered its rate by an unconventional 35 basis points.

The response in the kiwi said it all, while the Australian dollar plunged to a ten year low in sympathy and on expectations that the OZ central bank would be next.

Some more details: the Reserve Bank of India lowered its benchmark rate by an unconventional 35 basis points to 5.4%, its fourth cut this year. New Zealand reduced its rate by 50 basis points to 1%; economists had forecast a 25 basis-point reduction. The Bank of Thailand’s rate cut was the first in more than four years. And it's not over: the Philippines is set to decide monetary policy Thursday, with 24 of 26 economists predicting a 25-point cut. Bangko Sentral ng Pilipinas Governor Benjamin Diokno this week said there’s space for 50 basis points of easing before year’s end. The question is when will Australia join the party and cut to zero or below.

Traders and economists were shocked by the dovish three-peat:

- On New Zealand: "This was not what the market was expecting at all, it’s a shock to many. Considering the data isn’t terrible for New Zealand at all, this is an example of a central bank that’s looking beyond current data and trying to get ahead of the global slowdown." - Kyle Rodda, analyst at IG Markets in Melbourne.

- On Thailand: "With the U.S.-China trade war spilling into currencies, more Bank of Thailand rate cuts may be forthcoming, especially as Bloomberg Economics expects the People’s Bank of China to cut rates later this year" - Tamara Mast Henderson, Bloomberg Asean economist

- On India: "The dovish tone in its policy statement signals further easingmight be in the pipeline to get the economy back on its feet" - Abhishek Gupta, Bloomberg India economist

A big picture recap from Chang Wei Liang, macro strategist of DBS, said it all: "Demand is easing globally, and inflation pressures look set to remain highly restrained. The dovish bias could remain somewhat entrenched, until there are signs of green shoots in Europe/China, and some meaningful reduction in trade anxiety."

Still, the dovish moves by three Asian central banks showed that policy makers still have some power to surprise, and underscore the global shift toward easier policy even after the Federal Reserve‘s unexpectedly hawkish stance last week. Disappointing data may push the European Central Bank to turn toward easier monetary policies when it meets next month.

In short, a race to the bottom, and the US is badly lagging so expect either more rate cuts, more QE or direct currency intervention as Trump gets impatient with the ongoing dollar strength.

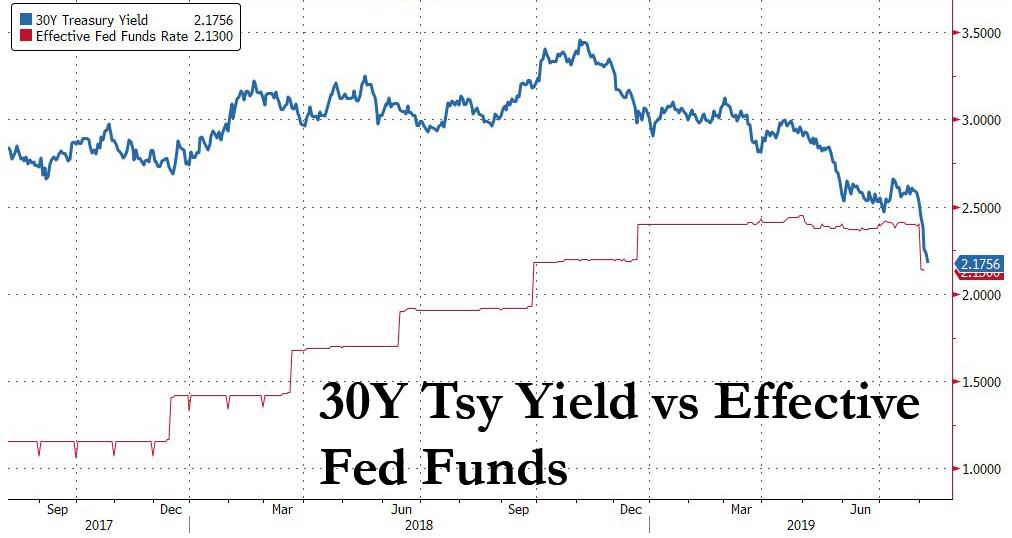

The central bank action, coupled with the ongoing currency war, roiled currencies and pushed bond yields lower. The New Zealand dollar dropped more than 1% against the U.S. currency and the Thai baht slid 0.2%. But nowhere was the plunge in yield more visible than in the US where the 10Y dropped as low as 1.65%, while the 30Y Treasury tumbled to 2.16%, just 3 basis points above the effective Fed Funds rate, meaning the entire US curve is about to be inverted today.

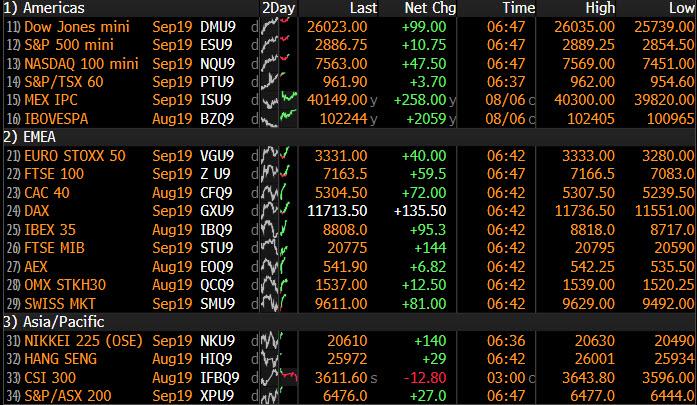

Away from crashing yields, an eerie calm returned to stock markets on Wednesday as the dovish central bank overtures offset fears of an escalating currency war, thanks to some softer rhetoric from Washington.U.S. equity futures extended a rebound and European stocks rallied as markets continued to recover from a brutal selloff at the start of the week.

Caution was on display, however, as noted above with bonds soaring while currencies were roiled by a series of dovish central-bank moves in Asia.

U.S. equity futures turned higher following the dovish central bank three-peat in Asia, after slumping earlier following the PBOC fix.

The MSCI world equity index rose 0.2%. The Stoxx Europe 600 index rose for the first time in four days, led by technology stocks after Microchip’s upbeat demand outlook. Chemicals producers advanced after Bayer and Lanxess agreed to sell their stakes in Currenta, while Glencore fell after its profits missed estimates. Shares were mixed but calmer in Asia, with Japanese stocks closing barely changed while equities in Shanghai declined.

But gold, the Japanese yen and government debt remained in high demand as investors remained wary of riskier assets.

Earlier in the session, Asian stocks inched higher, halting a five-day losing streak, after three central banks in the region delivered surprise rate cuts. Markets however were mixed, with Indonesia climbing and India retreating despite the bigger than expected rate cut. The Topix closed 0.1% higher, supported by Toyota Motor, Sony and Kao. The Shanghai Composite Index declined 0.3%, sliding for a sixth day, as the yuan weakened. Shanghai International Port and large financial firms were among the biggest drags. China’s central bank officials reassured foreign firms that the yuan won’t continue to drop significantly. New Zealand shares jumped in mid-afternoon trading after the central bank cut interest rates by more than economists had forecast. The Sensex fell 0.3% in a choppy session, as the Reserve Bank of India cut the annual economic growth forecast while reducing its benchmark interest rate by more than analysts had expected.

In FX, the star once again was the yuan, which dropped 0.3% to 7.0801 in offshore markets after China’s central bank set the daily fixing just a fraction stronger than the key level of 7 per dollar. The People’s Bank of China lowered the reference rate to 6.9996, an 11 year low. That leaves very little room for it to continue tracking the currency lower while setting the rate stronger than 7, a level that if breached could set the stage for further depreciation. "We had a little bit of recovery yesterday, but this morning we are seeing that stalling due to the PBOC fixing the dollar-yen higher again,” said Thu Lan Nguyen, FX strategist at Commerzbank. “It has caused markets to again be in a bit of a risk-off mode."

Societe Generale SA said the yuan may fall to 7.7 per dollar if the U.S. ramps up tariffs on the nation’s goods, potentially bad news for other emerging markets that have been moving increasingly in lockstep with the currency.“There will be an inflection point for investors to dip their toes in and position for a tactical rally or to monetize carry in high yielders, but not now,” said Jason Daw, the head of emerging market strategy at Societe Generale in Singapore.

The kiwi slumped after the RBNZ surprised the market with a bigger-than-forecast cut. The Australian dollar fell to a 10 year low in sympathy as traders bet the RBA may follow suit. The yen led gains in the Group-of-10 currencies as the PBOC set fixing close to 7 per dollar. India’s rupee fluctuated and the Thai baht slipped after policy makers in both countries lowered borrowing costs. The euro declined with the pound and the U.S. dollar was steady.

Meanwhile, in rates yields were plunging across the board, with the 10-year Treasury yield falling through 1.7% and German rates dropping to a record after industrial production in the euro-region’s biggest economy registered the biggest annual decline in almost a decade. Semi-core bonds and most peripheral notes lead euro-area gains while curves flattened amid relentless search for yield. Money markets now price in more ECB rate cuts after weaker-than-forecast German data, while China fixes the yuan weaker, stoking trade tensions. Bunds rise as industrial production missed the median estimate; core debt underperforms as Germany’s sale of EU4b five-year sees oversubscription fall to 1.2x versus 1.5x prior and undersubcription of 0.78x after accounting for retentions. German 2s30s curve narrows 8bps to 69bps, the flattest since 2008. Money markets price 30bps of ECB rate cuts in June 2020 versus 28bps on Tuesday. Gilts outperform bunds by 1bp and short sterling strip bull flattens.

Traders remain on tenterhooks after Monday’s moves, which included the biggest one-day plunge in global equities since February 2018. An escalation in the trade war between the world’s two biggest economies continues to unnerve investors, even after China said recent yuan depreciation was decided by the market, not Beijing. “We’re likely to see perhaps another shoe drop as the week progresses because this is not getting fixed,” Kristina Hooper, the Atlanta-based chief global market strategist at Invesco Ltd., told Bloomberg TV. “There really is the potential for it to get worse from here.”

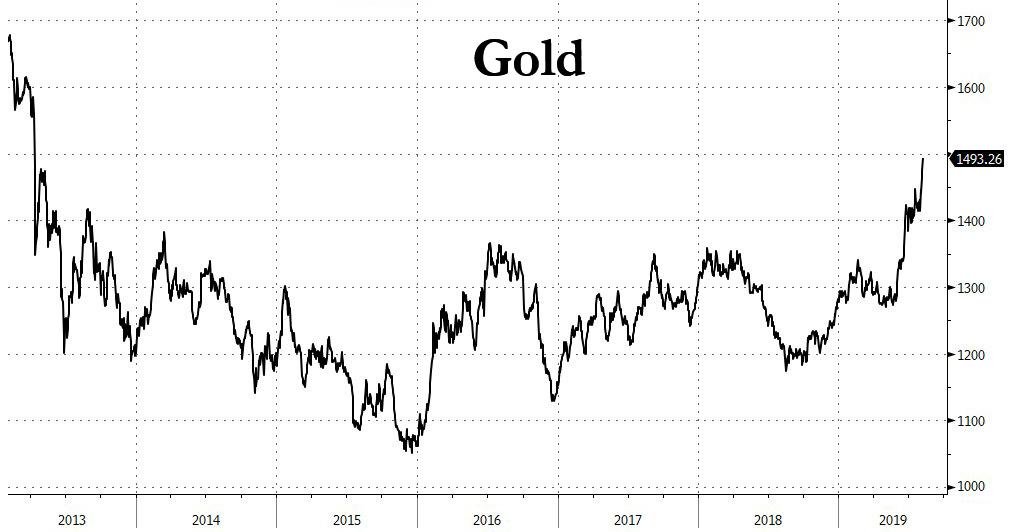

Meanwhile, Gold continued to soar and reached a six-year high of $1,489.76 per ounce. The Japanese yen rose 0.2% to 106.27, although that was still some way from levels seen on Monday when the trade war’s escalation panicked investors.

Finally, in commodity markets, oil prices slipped, with the potential for damage to the global economy and to fuel demand from the Sino-U.S. trade dispute casting a shadow over the market. Brent crude futures were at $58.79 a barrel by 0759 GMT, down 14 cents, or 0.05%, and trading near seven-month lows.

Market Snapshot

- S&P 500 futures up 0.3% to 2,884.25

- STOXX Europe 600 up 0.6% to 369.96

- MXAP up 0.08% to 150.96

- MXAPJ unchanged at 485.95

- Nikkei down 0.3% to 20,516.56

- Topix up 0.05% to 1,499.93

- Hang Seng Index up 0.08% to 25,997.03

- Shanghai Composite down 0.3% to 2,768.68

- Sensex down 0.3% to 36,874.41

- Australia S&P/ASX 200 up 0.6% to 6,519.46

- Kospi down 0.4% to 1,909.71

- German 10Y yield fell 2.9 bps to -0.565%

- Euro down 0.04% to $1.1194

- 10Y yield fell 5.3 bps to 1.162%

- Spanish 10Y yield fell 6.7 bps to 0.164%

- Brent futures down 0.4% to $58.68/bbl

- Gold spot up 0.9% to $1,487.18

- U.S. Dollar Index little changed at 97.72

Top Overnight News from Bloomberg

- Three central banks across Asia Pacific delivered surprise interest-rate decisions Wednesday as policy makers take aggressive action to counter a worsening global economy. New Zealand and India led with bigger-than-expected interest rate cuts, while Thailand’s 25-point reduction was a surprise to all but two in a Bloomberg survey of economists

- The escalating trade war between the U.S. and China is nudging the world economy toward its first recession in a decade with investors demanding politicians and central bankers act fast to change course

- U.S. is still expecting China to visit in September, says Larry Kudlow, the White House’s economic adviser. Things could change in respect to China tariffs, he adds. The U.S. will also take a “careful look” at whether China took steps to reverse the decline in the yuan. In Trump-Xi fight, both leaders make big bets that may backfire

- German industrial production registered its biggest annual decline in almost a decade, highlighting the severity of the trade- inflicted manufacturing slump in Europe’s largest economy

- U.K. house prices fell for a second month in July as the market continued to “tread water” amid economic uncertainty, mortgage lender Halifax said.

- Top European banks, such as Commerzbank, UniCredit, warned of weaker earnings as escalating trade tensions take a toll on their clients and the prospect of lower interest rates erodes their main source of income

- Michael Gove, the minister in charge of planning for a no-deal Brexit, blamed the European Union for failing to engage on a new agreement, deepening the diplomatic standoff between the two sides less than three months before the U.K. is due to leave the bloc

- Italy’s government won’t be able to contain the budget deficit below 2% if it’s going to deliver promised investments and tax cuts, Deputy Prime Minister Matteo Salvini said.

- North Korean leader Kim Jong Un oversaw the test- firing of a “new type” of guided missile Tuesday and the weapon should serve as a warning to the U.S. and South Korea as they conduct joint military drills, the state’s media said

- Gold futures rallied above $1,500 an ounce on sustained demand for the traditional haven as the U.S.-China trade war festers, global growth slows and central banks around the world ease monetary policy.

- Brent crude held losses after falling into bear market as lingering U.S.-China trade concerns dent the outlook for global demand

- The dovish turn sweeping the global economy gathered pace Wednesday as New Zealand shocked markets with a half-percentage point interest-rate cut, sending its currency tumbling

Asian equity markets traded mixed as the region observed caution despite the gains on Wall St. where stocks rebounded from their worst performance of 2019. ASX 200 (+0.6%) was initially indecisive as early gains were nearly wiped out by weakness in energy following a 2% drop in oil and with financials subdued after its largest lender CBA reported a decline in FY profits. However, Australia stocks were then boosted in late trade alongside outperformance in NZX 50 (+1.8%) after the RBNZ over-delivered with a surprise 50bps cut, while Nikkei 225 (-0.4%) was pressured as exporters digested a firmer currency and earnings updates. Hang Seng (U/C) and Shanghai Comp. (-0.3%) were lacklustre as trade concerns lingered and after the PBoC weakened the CNY reference rate to within a whisker of the 7.0000 ‘line in the sand’ level, although losses in the mainland were contained amid reports that China is to revise quota rules for farm product import tariffs in which it will remove soybean oil, rapeseed oil and palm oil import quotas. Finally, 10yr JGBs were underpinned as cautiousness spurred safe-haven demand and with global yields declining amid what some view as an ongoing race to the bottom among some of the world’s major central banks.

Top Asian News

- Singapore Air Picks Crucial Fight Against Emirates in India

- Aussie Dollar Slides to 10-Year Low as Traders Bet on Rate Cuts

- Papua New Guinea Asks for China’s Help to Ease Debt Burden

- Asia Surprises With Cuts in Global Race to the Monetary Bottom

- China Summons Hong Kong Officials to Shenzhen to Discuss Unrest

European equities have extended on opening gains [Eurostoxx 50 +1.3%] following on from a cautious Asia-Pac handover in which the antipodean indices cheered a deeper-than-forecast RBNZ OCR cut whilst upside Japan and China were capped by a firmer JPY and ongoing trade concerns.Major EU bourses are retracing recent losses with gains led by the DAX (+1.2%) as heavyweight Bayer (+7.0%) rallies on the back of its 60% stake sale in Currenta for EUR 1.17bln. The transaction also includes the minority shareholder Lanxess (+5.5%) who is poised to sell its 40% share for around EUR 700mln. Sector wise, healthcare names are lagging with the sector pressured by Novartis (-0.1%) after the US FDA stated that some data from early testing of its Zolgensma treatment was manipulated. Novartis opened lower by 2% before trimming losses. Other individual movers include UniCredit(-3.1%), Commerzbank (-3.1%) and ABN AMRO (-1.9%) post-earnings, in which the former cut its FY 19 revenue forecast and the latter stated it sees a bleaker margin ahead.

Top European News

- Commerzbank, UniCredit See Targets Under Threat From Low Rates

- Ex-HSBC Banker Pleads Guilty in $1.8 Billion French Tax Probe

- Muddy Waters’ Latest Short Is Woodford Holding Burford Capital

- Nordea’s Main Owner Opts to Cut Stake to Ease Capital Burden

In FX, NZD/AUD/INR/THB - The Kiwi is trying to claw back some lost ground, but remains the outright G10 underperformer in wake of the RBNZ’s shock decision to slash the OCR by 50 bp overnight against forecasts for -25 bp, and with Governor Orr indicating that there is more to come in post-policy meeting commentary. In fact, NIRP is not out of the realms of possibility as the Bank strives to hit its dual inflation and jobs target. Nzd/Usd slumped to lows around 0.6379 at one stage, but has subsequently reclaimed 0.6400+ status with key Fib support (0.6367) holding for now, while Aud/Nzd has rebounded further from sub-1.0300 levels to almost 1.0500 as Aud/Usd contains knock-on losses to circa 0.6678 even though RBA easing probability for September has risen in response to the more aggressive/pre-emptive RBNZ action. On that note, remarks from RBA’s Bullock later today may be pertinent. Conversely, the Rupee has strengthened in wake of an above consensus 35 bp reduction in benchmark rates from the RBI, and perhaps the vote split with 2 dissents for -25 bp plus the fact that the Bank has already administered 75 bp worth easing via 3 successive moves is being deemed as enough for now, even though the bias remains accommodative. Usd/Inr now circa 70.8000 within 71.000-70.5910 parameters in contrast to Usd/Thb nearer the top of a 30.9200-6900 range after a surprise ¼ point BoT rate cut and pledge to use other measures to curb Baht strength.

- JPY - Bucking broader trends again, and back on a firmer footing against the Dollar, as US Treasury yields retreat sharply from Tuesday’s fleeting retracement highs and the PBoC nudged the official Usd/CNY nearer 7.0000 to rekindle US-China trade concerns that seemed to abate a tad yesterday. Usd/Jpy is slipping back from just shy of 106.50 as the DXY continues to pivot 97.500 by virtue of greater gains vs riskier currency counterparts more than anything else as GOLD looks poised to breach Usd1500/oz amidst the escalation of trade wars and transition to conflicts of FX interests.

- CHF/GBP/EUR/CAD - All weaker vs the Greenback, or handing back recent gains, with the Franc approaching 0.9800 vs nearly 0.9700 and underlying safe-haven demand offset by prospects of SNB intervention at any time if the Chf appreciates too much. Indeed, Eur/Chf has also bounced further from recent lows between 1.0925-50 confines even though Eur/Usd remains top heavy on the 1.1200 handle amidst increasingly soft/negative Eurozone bond yields. Elsewhere, Cable is also struggling to maintain recovery momentum through 1.2200 and 0.9200 in Eur/Gbp cross terms amidst ongoing Brexit no deal/UK political risk, while the Loonie is straddling 1.3300 ahead of Canadian Ivey PMI prints.

- EM - Notwithstanding the wider swings in risk sentiment and specific factors impacting individual currencies and assets, the Lira revival continues, and the latest reversal in Usd/Try looks rather technical as key support ahead of 5.5000 has now given way.

In commodities, a day of respite thus far for the energy market following this month’s losses of almost 10%, pressured by the global oil demand outlook as the US-China saga intensifies. Yesterday saw the first of the monthly oil reports, the EIA STEO cut its 2019 global oil demand growth forecast by 70k BPD to a 1.0mln BPD Y/Y increase, albeit its 2020 forecast was raised slightly by 30k BPD. Investors will be keeping an eye on the IEA (Aug 6) and OPEC (Aug 16) Monthly reports for some harmony on the short-term global oil demand outlook. On the supply side, the weekly API crude stocks data showed a larger-than-forecast draw (-3.4mln vs. Exp. -2.8mln), the release did little to sway prices but may have underpinned the benchmarks in anticipation for today’s DoE data to confirm the drawdown (headline crude Exp. -2.845mln). Elsewhere, spot gold is inching closer to the key 1500/oz level with futures having already topped the level amid safe-haven inflows as US/China developments, global growth outlook and easing by global Central Banks. Spot gold printed a fresh 6yr peak at 1491/oz during early EU trade. Meanwhile, copper prices have rebounded off worst levels, albeit remain contained near 2yr lows with some support derived from news that Glencore is planning to shut its Mutanda cobalt and copper mine (which produced almost 200k tonnes of copper last year) by the end of 2019 due to lower cobalt prices impacting the economic viability of the project. Finally, Dalian iron ore prices extended its slide for a fifth session amid rising supply and weakening demand.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -1.4%

- 3pm: Consumer Credit, est. $16.1b, prior $17.1b

- 9:30am: Fed’s Evans Holds Media Breakfast in Chicago

DB's Jim Reid concludes the overnight wrap

5 days after my accident and sitting down on a firm surface is starting to be a less harrowing experience again. Nevertheless my coccyx remains sore. I’m still waiting for the call from GAP who must surely want to use me in their advertising campaign as even with a few frays and tears, their trousers managed to hold together and keep my legs from having any external injuries even as I crash landed and skidded. All my cuts and scrapes were from my uncovered arms. I noticed that on Bloomberg’s MVP page, news of my accident has catapulted me several hundred hits ahead of Mr President for the week. So come on GAP, use the publicity and I’ll take a year’s supply of Baby GAP clothes in return.

Despite a fairly light day of newsflow, which might explain the order on Bloomberg’s MVP, markets staged an impressive rebound during the New York trading session yesterday, with the S&P 500 ultimately ending +1.30% higher. At the margin, comments from top Trump economic advisor Larry Kudlow helped to calm markets, with most of the gains coming after he spoke. Kudlow said that “The President and our team is planning for a Chinese visit in September" and "movement towards a good deal would be very positive and might change the tariff situation. But then again, it might not". Despite the wide bid-offer in those remarks, it did seem that it represented a little shift in rhetoric from the White House. It will probably require something much more substantial to be sustainable though. In May/June markets recovered first because of a massive repricing of central banks expectations and then the news of the Trump/Xi meeting. It’s hard to believe that we could get the same impact from fresh central bank repricing which leaves us waiting for a trade de-escalation. This doesn’t feel that imminent but as ever we are a tweet away from a big shift in sentiment one way or another.

To put the recent moves in context, it’s worth highlighting a note DB’s Alan Ruskin did on Friday which looked at asset price performance through three previous periods where tariffs roiled financial markets (link here ). He found that the S&P 500 declined by a median of 10% and that Chinese equities were down less than the S&P. European equities held in a little better but were far from a great place to hide. As for bonds, in the past Bunds generally rallied more than Treasuries although clearly we’re now starting with the Bund curve mostly in negative territory. Growth sensitive commodities like Oil and Copper also struggled while interestingly the usual perceived safe haven assets like Gold and the Yen did not do as well as one might expect – although with the Fed expected to ease further, these assets might be more robust this time round. Food for thought in any case.

This morning in Asia markets are trading mixed with the Nikkei (-0.42%), Hang Seng (-0.37%) and Kospi (-0.15%) all lower while the CSI (+0.02%) and Shanghai Comp (-0.01%) are trading flat. The Japanese yen is up +0.368%, while the yield on 10yr JGBs in now trading below the lower end of the BoJ target range at -0.203% (-1.2bps). The PBoC has fixed the daily reference rate for the onshore yuan overnight at 6.9996 leading the currency to drop -0.34% to trade at 7.0434. Meanwhile, the RBNZ surprised the market by delivering a larger than expected rate cut of 50bps (market expectations were for a 25bps cut) thereby bringing the key policy rate to 1.0%. As a result, the New Zealand dollar (-1.92%, the largest daily decline in 4 months) and Australian dollar (-0.92%) are both trading weak this morning with the later sliding to a 10 year low. Elsewhere, futures on the S&P 500 are trading down -0.44%.

In other trade related news, the US Department of Commerce said yesterday that it will ask the US Customs and Border Protection to collect cash deposits from importers of wooden cabinets and vanities from China based on subsidy rates of as much as 229%. The preliminary response from the Commerce department came after a petition filed earlier this year by the American Kitchen Cabinet Alliance, alleging at least $2 billion in harm from Chinese shipments. The move is expected to affect $4.4bn in imported cabinets from China and while this is small numerically, the optics could weigh on the trade negotiations.

In addition Bloomberg has reported that the US is investigating hundreds of millions of dollars in financial transactions involving three big Chinese banks that allegedly helped finance North Korea’s nuclear weapons program, according to an appeals court opinion unsealed yesterday. Elsewhere, China's Ministry of Commerce official said in an interview with MNI that regardless of the trade talks, China will gradually reduce its holdings of Treasuries, in order to diversify its foreign reserves while adding that "there are many options," for China's reserves, mentioning gold, other governments' bonds, and other assets such as real estate and equities. The combination of this news and the uncertainty around escalating trade war has sent spot gold up this morning at 1485.15 (+0.72% ).

As for yesterday, the DOW and NASDAQ joined the S&P 500 rally, posting gains of +1.21% and +1.39% respectively, each bouncing off their morning lows amid higher-than-average trading volumes. That stemmed 6 consecutive daily losses for the S&P and NASDAQ and 5 for the DOW. Energy stocks (-0.06%) were the only sector to retreat, as Brent crude (-1.20%) slid into one definition of a bear market, as its level of $59.09 is now -20.76% off its April peak of $74.57. In Europe, equities actually traded fairly well through much of the session but a late dip saw bourses close in the red with STOXX 600 in particular down -0.47% and the trade sensitive DAX -0.78% after being up by a similar amount in the morning. The S&P 500 was only +0.38% higher at the European close so there is some catch-up likely. In bond markets, ten-year Treasuries rose as much as +6.4bps in line with the risk-on mood, but subsequently pared their gains to close near flat after a strong three-year auction. The 3y notes saw healthy demand and yielded the lowest in almost two years at 1.433%, ahead of today's 10-year auction. The yield curve ended -1.1bps flatter at 12.1, which is just 1.1bps away from its cyclical low from December. In Europe, yields headed lower with Bunds (-2.0bps) hitting a new record low of -0.536%. Where will it all end!!

From negative yields to (relatively) High Yield. Overnight Nick has published a presentation based note looking at supply and demand trends in EUR HY. It includes the latest data and charts on issuance, redemptions, coupons and transitions between HY and IG (link here ).

Back to yesterday and it was a more typical summer day of light newsflow with the earlier slightly improved tone helped by a comment from the PBoC telling foreign firms that the CNY “won’t keep falling”. Our FX team have argued that some two-way and even a move potentially back below 7.0 in the near-term wouldn’t be a surprise even if the medium path might be further weakness. Indeed our strategists continue to expect additional weakness, forecasting a level of 7.3 versus the dollar for year-end 7.5 by end-2020. Deprecation on that scale would likely be a sticking point with the US, especially since White House trade advisor Peter Navarro took a victory lap on TV yesterday, crediting the stronger CNY fix as evidence that "they heard us." He said "as soon as the president was firm - 'You’re a currency manipulator’ - the Chinese announced that they’re stabilising."

Meanwhile, two regional Fed presidents spoke and sent similar messages to Governor Brainard yesterday, that they are monitoring trade developments closely. St. Louis's Bullard said that the Fed "cannot reasonably react to the day-to-day give-and-take of trade negotiations,” but he did also emphasize that the fall in rates over the last several months in anticipation of Fed rate cuts will take time to feed through to the economy. He stopped short of fully endorsing market pricing, however, saying that he has one more hike "pencilled in" for this year. Separately, San Francisco's Daly noted that trade uncertainty has "re-emerged" and said that "I'm really focusing my attention (on) these headwinds." Bullard is a voting FOMC member this year, though Daly does not vote until 2021.

Meanwhile, there wasn’t much to report in terms of data yesterday. Early on Germany factory orders surprised to the upside in June posting a +2.5% mom rise (vs. +0.5% expected) after a -2.0% fall the previous month (though that was revised up +0.2pp from the initial print). On the other hand, Swedish industrial production, sometimes viewed as a leading indicator for European manufacturing, fell -0.7% yoy, matching its slowest pace since 2016. In the US the sole release was the albeit outdated June JOLTS report which showed that the job opening report slipped to 4.6% from 4.7% in the month prior while the pace of hiring stood pat at 3.8%.

Looking at the day ahead, this morning data releases include June industrial production in Germany, June trade balance in France and July house prices data in the UK. In the US the sole data release is the June consumer credit release. Away from that earnings releases include CVS Health Corp and Glencore.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more