2Y Auction Tails As Foreign Buyers Balk Ahead Of Rate Cut But Directs Soar To 2nd Highest Ever

Image Source: Pixabay

Thanks to this week's accelerate bond auction schedule, the result of Wednesday's FOMC decision, moments ago we got the first of two coupon auctions scheduled for today when the Treasury sold $69 billion in 2Y notes in what was an ok auction.

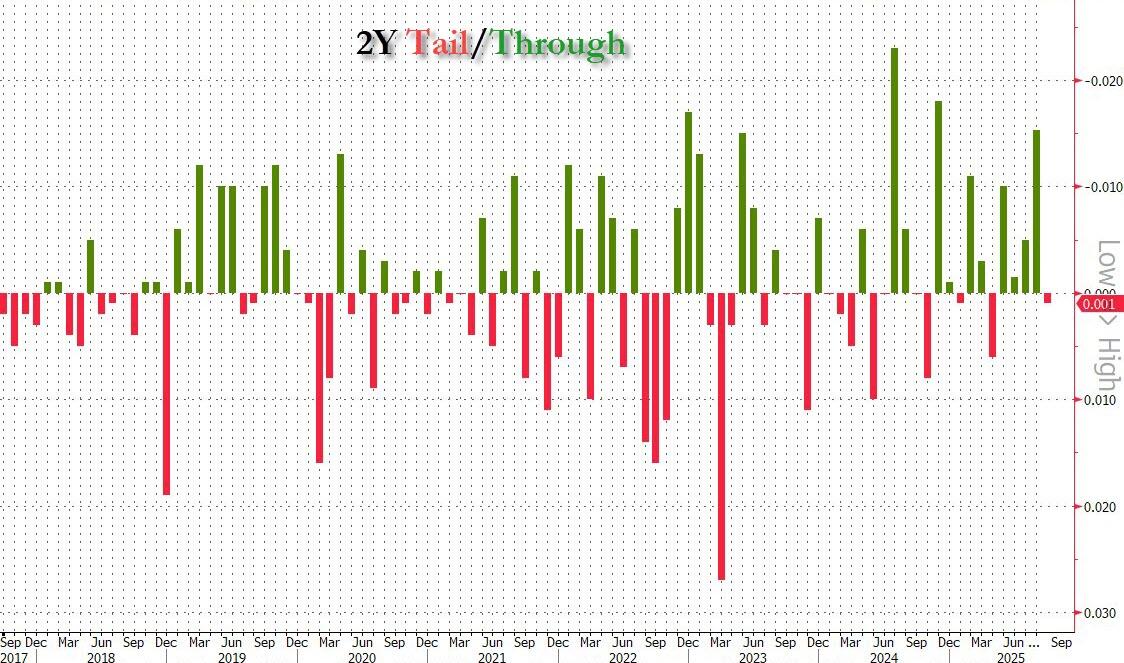

The offering priced at a high yield of 3.504%, down from 3.571% in September and the lowest since August 2022. The bond also tailed the 3.503% When Issued by 0.1bps, the first tail for the tenor since April.

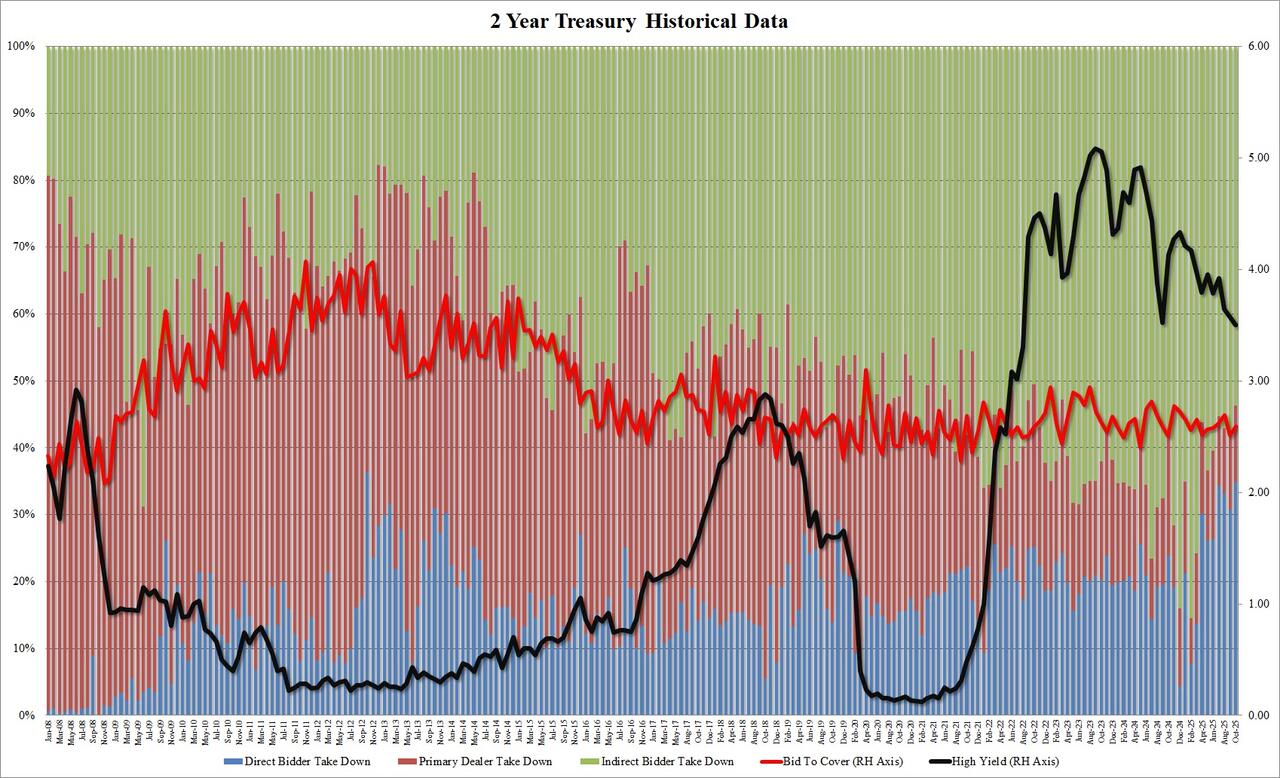

The bid to cover rose modestly from 2.513 in September to 2.590 which was just above the 2.581 six-auction average.

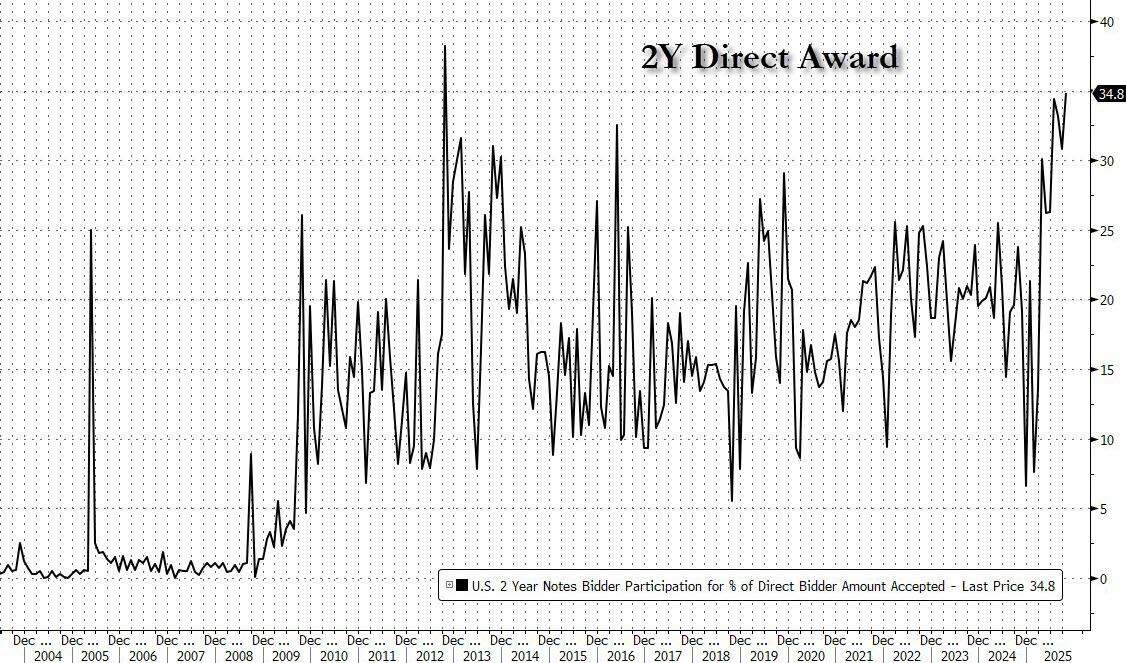

The internals were interesting: while Indirects dropped to just 53.7% from 57.8% in September, the lowest since March 2023 (when banks were blowing up left and right), it was Directs that stole the show by taking down a whopping 34.8%, the second highest on record.

The left 11.6% for Dealers, right on top of the recent average of 11.5%.

Overall, this was a mixed auction, with the tail and drop in foreign demand negatives, but offset by the relentless demand for paper by domestic Direct bidders (i.e. everyone who is not a primary dealer), suggesting that demand remains solid if hardly stellar, especially with the Fed set to cut rates in 2 days.

More By This Author:

Walmart's Thanksgiving Meal Deal Returns To 2019 Low Price LevelsTesla Drops After Q3 Profit Slides, Earnings Miss

"They've Cut It Way Back" - WTI Holds Gains After Trump Comments On Indian Imports, Record US Crude Production

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more