20Y Auction Prices "On The Screws" Amid Solid Foreign Demand

Image Source: Pixabay

With Thursday a holiday, and the Fed statement on Wednesday, it's an especially abbreviated week for bond issuance which is why at 1pm today the Treasury sold $13BN in a 19 Year, 11 Month reopening, which was met with solid demand and passed smoothly.

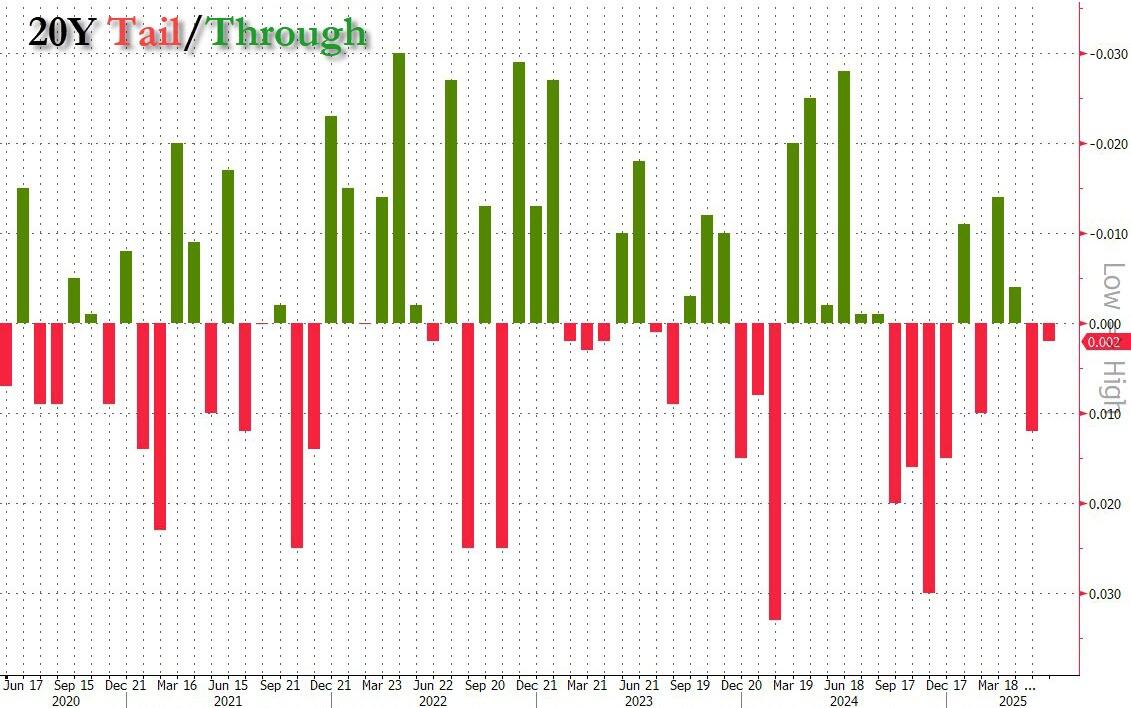

The high yield on today's auction was 4.942%, down from 5.047% last month although the second highest going back to October 2023. The yield printed "on the screws" to the When Issued, which also came 4.942% (unclear why the Bloomberg charts shows it as tailing, expect an immediate correction).

(Click on image to enlarge)

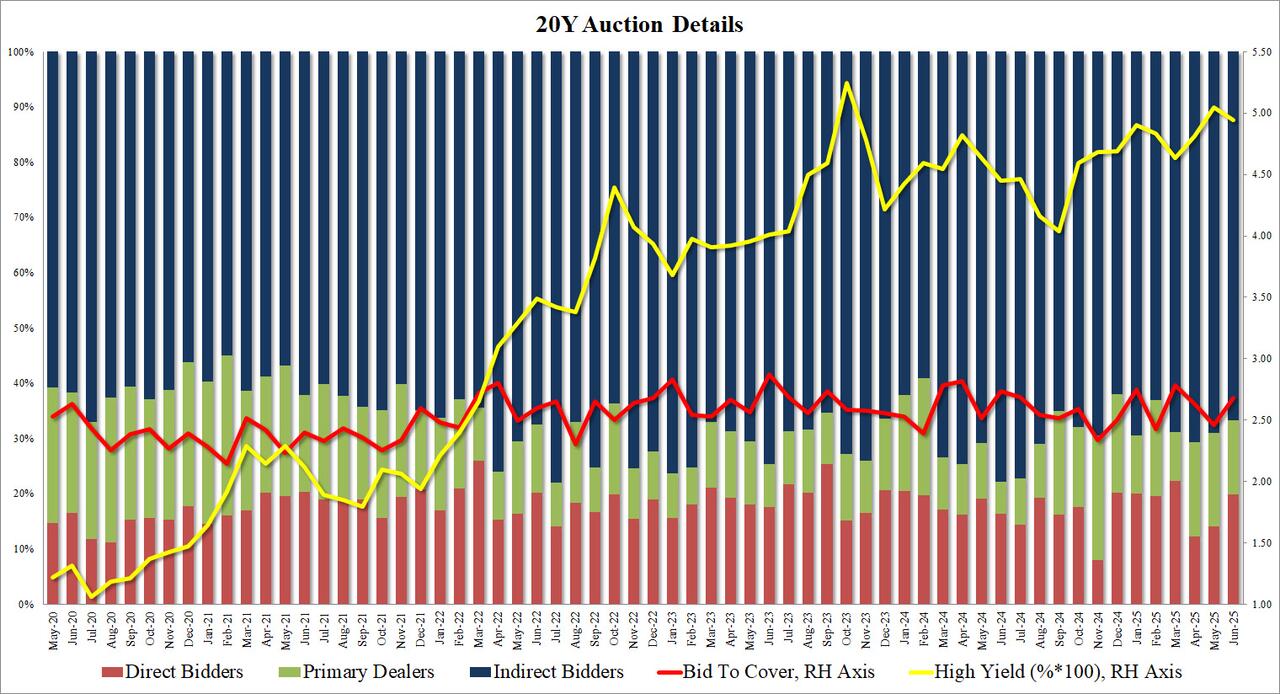

The bid to cover was 2.68, up notably from 2.46 last month and the highest since March (when it was 2.78). It was also 9bps above the 2.59 six-auction average.

The internals were also solid, with Indirects taking down 66.7%, down from 69.0% and just below the recent average of 67.2%. And with Directs awarded 19.9%, Dealers were left holding 13.4%, the lowest since March's 8.8%.

(Click on image to enlarge)

Overall, this was a solid, smooth auction, yet nothing to write home about, and sure enough there was barely any reaction in the secondary market where yields moved by 1bps point higher after the break.

More By This Author:

Taiwan Imposes Export Controls On China's Huawei, Semiconductor Manufacturing International CorpGold Passes Euro As Second-Largest Global Reserve Asset: ECB

Stellar 30Y Auction Stops Through Amid Jump In Foreign Demand

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more