2025 Rewind: The Year U.S. Crypto Policy Finally Shifted

Image: Unsplash/Chris Barbalis

After years of opposition, the U.S. finally embraced cryptocurrency regulation in 2025.

The year 2025 proved to be a defining moment for the U.S. cryptocurrency sector. On July 18, President Donald Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, also known as the GENIUS Act, into law, creating the first comprehensive federal framework for dollar-backed stablecoins.

The legislation imposed reserve requirements, audit standards, and clear supervisory pathways, repositioning stablecoins from experimental instruments to regulated financial infrastructure.

From Regulatory Fog to Federal Rulebook

Before the GENIUS Act, stablecoin issuers functioned in a regulatory gray area, with uneven reserve backing, limited transparency, and frequent disputes over whether tokens should be treated as unregistered securities or commodities. The 2022 collapse of TerraUSD exposed the dangers of these risks.

Approved by the Senate in June 2025 by a 68-30 vote and narrowly passing the House, the GENIUS Act introduced federal rules governing “payment stablecoins.” Key provisions include:

- Reserve: 1:1 with top-quality liquid assets

- Transparency: Monthly reports, annual audits

- Oversight: Federal supervision, full AML/KYC

- Issuers: OCC-chartered non-banks, insured banks, or approved state firms

- SEC Exclusion: Not classified as securities

Following this, banks and payment firms began to adopt and issue stablecoins under the new rules. Issuers began designing dedicated blockchains for stablecoin settlement to ensure compliance, predictable costs, and institutional appeal.

Tether-aligned Stable launched with $28 million in funding, using USDT as the native gas token to cut fee volatility and congestion on general-purpose networks. In August 2025, Circle introduced Arc, an enterprise-focused Layer-1 supporting regulated payments, FX, and tokenized markets via USDC.

Crypto ETFs Gain Traction as Rules Become Clearer

Regulatory momentum also lifted cryptocurrency ETFs. By October 2025, the SEC placed Bitcoin and Ethereum ETFs under a generic listing standard, simplifying oversight and making institutional access easier.

Spot ETFs for Solana, XRP, and Litecoin joined the party in late 2025.

(Click on image to enlarge)

A detailed timeline of all the important crypto developments in 2025.

The Politics of Crypto: Opposition, Oversight, and a New Federal Path

The GENIUS Act and related market-structure bills didn’t sail through quietly. Representative Maxine Waters argued they favored big industry players, calling it a giveaway to “crypto billionaires” and warning of systemic risks.

Still, progress toward clearer rules continued. In July 2025, the House passed the Digital Asset Market Clarity Act to define whether digital tokens fall under SEC or CFTC oversight.

After the ex-SEC Chair Gary Gensler resigned in January 2025, Acting Chair Mark Uyeda and the new SEC chair, Paul Atkins, pushed rules-based oversight, easing uncertainty and boosting ETF and digital asset growth. Simultaneously, President Trump’s Executive Order 14178 created a federal “Crypto Czar” to coordinate U.S. cryptocurrency policy across agencies.

What’s Next for Crypto in 2026?

Cryptocurrency seems to be at an inflection point. Stablecoins and ETFs are becoming a valuable part of the traditional finance ecosystem, but the prices on major coins like Bitcoin and Ethereum haven’t truly exploded like in previous years.

(Click on image to enlarge)

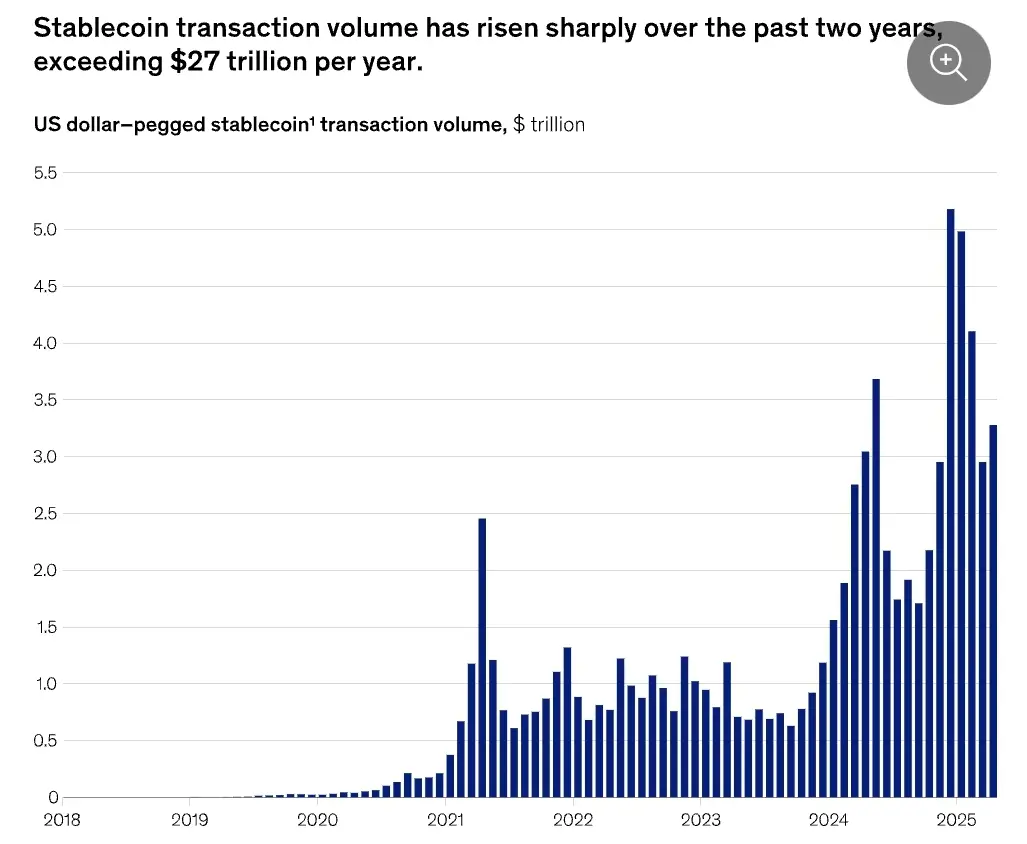

Source: McKinsey & Company

The GENIUS Act set a global standard for stablecoins, with the UK, Singapore, and the EU’s MiCA framework driving adoption of compliant tokens. By year-end, stablecoins topped $250 billion in market cap and accounted for over 30% of on-chain transactions.

Will the overall cryptocurrency market respond in 2026? Or is a bear market in store? Stay tuned.

More By This Author:

ETH And SOL Down Over 50% Triggers Year-End Altcoin Dumping - LiquidChain Moves Against The Flow2025 Rewind: Bitcoin Hits $126K As ETFs, Institutions Power Bull Run

2025 Rewind: Stablecoin Usage Explodes As Overall Market Hits $300B