2021/22 U.S. Stocks Were Mixed So S. American & U.S. Weather Stay Important

Market Analysis

Grain and oilseed prices were on the upswing going into the April USDA reports on concerns about the Black Sea conflict impacting world trade and weather curtailing both US and S American crop prospects. This month’s US latest ending stocks didn’t provide any surprises with their mixed results across the three major crops. By the close of trade, the potential of reduced old-crop wheat & corn exports and new-crop plantings from Ukraine & forecasts of dry weather possibly reducing Brazil’s safrinha corn crop firmed values to their highest levels of the past three weeks.

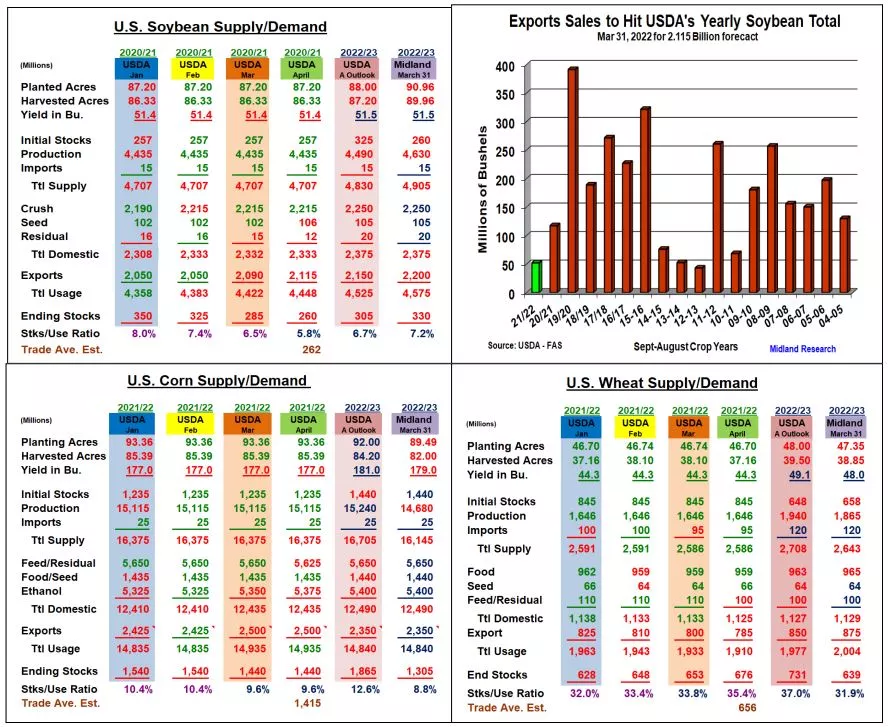

Soybeans lead Friday’s strength. The USDA upped its old crop export outlook by 25 million bu to 2.115 billion bu. when the World Board decreased Brazil’s 2021/22 crop by 2 mmt to 125 mmt. Internationally, 1,1 mtt was cut from Paraguay’s crop while Argentina bean was left unchanged. China’s imports were also shaved another 3 mmt to 91 mmt because of low pork price, Because of the higher 2022 US planting intentions, 4 million additional seed will be needed which were taken out of the residual disappearance. Overall, beans’ US stocks were reduced to 260 million bu. Given the tight world oilseed supplies, the current 52 million of sales to meet the revised US export outlook suggests more overseas demand is likely.

Despite a 4.5 mmt cut Ukraine’s corn exports, the US old -crop exports were left unchanged when the USDA also reduced China’s imports by 3 mmt because of reduced purchases & low pork prices. Twenty-five million US feed demand was shifted to ethanol demand, but corn’s old-crop stocks were left unchanged at 1.44 billion bu this month. Brazil’s total corn crop was raised 2 mmt to 116 on higher plantings this month, but their 2nd crop remains vulnerable to dryness continuing during their pollination.

Wheat’s sluggish exports prompted another 15 million cut in US old-crop demand. The USDA also sliced 10 million from feed demand resulting in their 2021/22 US stocks rising by 25 million to 678 million. The US Plains drought & Ukraine’s overseas trade are wheat’s biggest concerns.

What’s Ahead:

The market’s focus has now switched to 2022’s grain & oilseed output. The Black Sea conflict impact on the region’s 2022 wheat & corn crops and North and South America’s weather over the next 30-45 days on grain and oilseed output & plantings will make prices volatile.

Advance new-crop 2022 sales to 30% in corn and soybeans at current levels. Sell final 10% KC wheat in $11.50 area if new-crop is viable.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more