2016 Predictions: Both Idiocy And Genius

A year ago, Steve Sears of Barron’s asked me to pen a guest column for The Striking Price and use the opportunity to opine on how I saw the volatility landscape unfolding in 2016. Without thinking about it too much, I was fairly certain I was going to devote the column to the many threats that had the potential to spiral out of control during the course of the year, but before I had an opportunity to start translating my thoughts into writing, other pundits started weighing in with their predictions for 2016 and without exception, everyone who ventured a guess on the direction of volatility was adamant that volatility would be substantially higher in 2016 than 2015.

Not wanting to follow the herd and always on the lookout for a more provocative point of view, I decided to fade the consensus, rip up the script in my head and adopt a contrarian outlook: The Case Against High Stock-Market Volatility in 2016. The column began as follows:

“Looking at all the market predictions for 2016, one thing is certain: Almost all of the pundits agree that volatility will be up, making a bet on rising volatility one of the year’s most popular trading ideas.

But, as is the case with much of the investment landscape, when most of the pundits agree about how the future will unfold, it pays to investigate the contrarian point of view.

As to volatility, the contrarian perspective is particularly compelling for 2016 because volatility is notoriously hard to predict; investors have a habit of dramatically overestimating its future level; and, when it comes to forecasting the causes of volatility, “experts” and investors alike have a penchant for fighting the last war.”

Then came January. For those who have tried to put it out of their memory, January was one of the worst first months on record, with the S&P 500 Index falling 7.3% for the month. The bearish trend continued into February, as fears related to China and crude oil had investors selling en masse. By the time stocks found a bottom on February 11th, the S&P 500 Index was down 11.4% -- by some measures the worst beginning for stocks in history. Volatility, of course, was spiking and the VIX had already topped 30.00 on three separate occasions just seven weeks into the year.

My prediction of lower volatility: complete idiocy.

But the year was not over and we still had to grapple with Brexit, the crazy and unpredictable election season in the U.S., a Fed interest rate hike and persistent political turmoil in places like Italy and Brazil. Amazingly, stocks showed a tremendous amount of resiliency and all the VIX spikes were given the Whac-A-Mole treatment as VIX mean reversion emerged as a key theme during 2016.

Now that the year is (almost) in the books, it turns out my contrarian low volatility prediction was spot on and the rest of the pundits ended up on the wrong side of a crowded losing trade, assuming one was patient enough to take a full-year perspective. Genius? Probably not, but definitely more right than wrong, despite my having to wear a dunce cap for the first two months of the year.

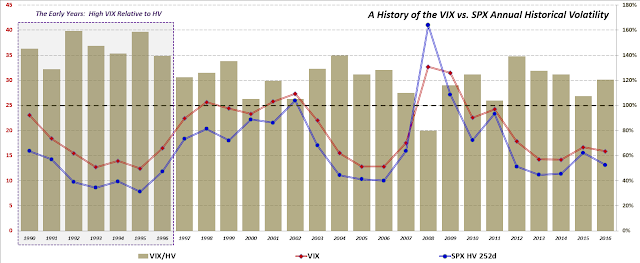

The graphic below shows the annual average VIX and historical volatility going back to 1990. Note that while the average VIX fell from 16.67 to 15.83 this year, there was an even larger drop in realized or historical volatility, which fell sharply from 15.53 to 13.14.

[source(s): CBOE, Yahoo, VIX and More]

As far as takeaways are concerned, there is the obvious lesson regarding the herd mentality and crowded trades. Additionally, there are also issues regarding how investors frame a problem or potential problem. For example, when one expects an increase in volatility they are more likely to be over prepared for that development and/or overreact when there are initial signs of an increase in volatility. Ironically, if investors load up on SPX puts or VIX calls, then this makes it much more difficult for panic to filter into the market. This leads to a theme that has been repeated often in this space: VIX spikes are notoriously difficult to predict and it is also more difficult to anticipate a change in volatility regimes than many believe.

Last but not least, as the graphic above shows, predictions of future volatility almost always overshoot realized volatility, which is why in the last 27 years only the extreme turmoil in 2008 saw realized volatility higher than the VIX over the course of a full year.

As for 2017, when it comes to volatility, expect the unexpected.

Disclosure(s): the CBOE is an advertiser on VIX and More

Disclaimer: "VIX®" is a trademark of Chicago ...

more

Looking back at 2016, my only trading regret is that I didn't buy XIV and simply hold it. Shorting volatility was a great trade, one that I unfortunately missed out on.