2015 Bankruptcy Watchlist: Avoid These Stocks

As promised, it is time to take a look at the companies that won’t be around come 2016. We made some bold predictions last year, and we’re doing the same for 2015 including one stalwart technology company that nobody expects. Every investor needs to shield their portfolio from these rotten eggs.

Just five months ago we put a number of companies on our bankruptcy watchlist for 2014. Since then, one company is already bankrupt and another is well on its way, and the stock prices of two others are down more than 40%.

Call it zealousness, or just good old fashioned over confidence, but we’re adding to our bankruptcy watchlist for 2015.

While everything in me wants to believe that this market will continue to defy gravity and move higher, 2015 could be a painful year for investors that aren’t forward looking.

There seems to be more fads than ever and the pace of tech innovation continues to render more and more products obsolete. Then there’s the halving of oil prices, which will have far reaching effects.

With that in mind, here is the three areas of the market that will see several bankruptcies this year:

2015 Bankruptcy Watchlist No. 1: More Blood In Electronics Retail

Recall how great Circuit City was, right before it went bankrupt in 2008? Well, it looks like we have our first major Circuit City redux. Wall Street has been calling for RadioShack (NYSE: RSH)’s head for well over six months now and it looks like they might finally be getting it.

The electronics retailer is reportedly planning to file for bankruptcy protection later this month. Shares are trading at just around 25 cents a share — a far cry from the $75 the stock traded at in its heyday back in 1999.

Again, GameStop (NYSE: GME) – which we profiled in our last round of bankruptcy predictions — could face the same fate, but there could be a couple electronics retailers that follow RadioShack even sooner than GameStop.

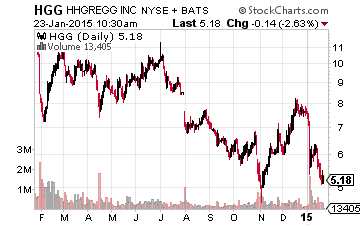

First there’s HHGREGG (NASDAQ: HGG), which lacks the scale, e-commerce presence and purchasing power of Best Buy (NYSE: BBY) to really weather a transition away from buying electronics in stores. The small retailer’s shares have been cut in half over the last year.

And there doesn’t appear to be any relief in sight. HHGREGG’s EBITDA margin is virtually nonexistent — coming in at 0.5% for the trailing twelve months. Once the losses start rolling in, it’ll only be a matter of time before HHGREGG burns through its $40 million in cash on hand.

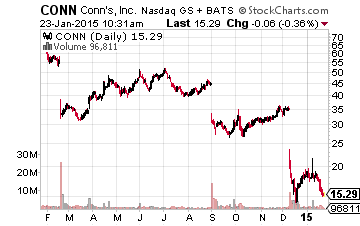

But the big bankruptcy story in electronics retail will be Conn’s (NASDAQ: CONN), which is struggling to get a handle on its large credit portfolio that continues to hemorrhage losses. Shares are down 75% over the last year.

However, the stock is still in trouble. It has $700 million in debt, compared to its $555 million market cap. Its customers owe the company $1.1 billion, but actually collecting that money has been a real issue. The quality of its loan portfolio is in rapid deterioration and the market has no confidence in the company.

Conn’s fired its CFO in December and put the Chief Accounting Officer and former interim CFO of the now bankrupt Cold water Creek in charge of the company’s finances. The fact that Conn’s has a large presence in Texas will also be a big negative as the fall in oil prices leads to a surge in unemployment in the state. It looks like it’s only a matter of time before Conn’s follows the way of Circuit City.

2015 Bankruptcy Watchlist No. 2: All Eyes On Oil & Gas

Another big bankruptcy theme that everyone should be watching is the oil space. This includes a “blood in the streets” moment for oil in 2015. Granted OPEC’s November announcement that it wasn’t cutting production sent a lot of investors into a frenzy, things could get worse.

The big question is; what will be that “blood in the streets” moment? It could well be a bankruptcy of a well-known oil and gas name.

First up will be one of the major offshore drillers.

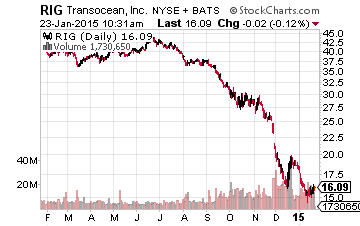

Transocean (NYSE: RIG) is one of the more interesting names in the space, in part, because billionaire activist Carl Icahn is a major shareholder. The other part is its large debt load that could be tough to service if oil remains depressed.

The company trades at a $5.7 billion market cap, while carrying over $10.3 billion in debt. Its debt-to-EBITDA (earnings before interest taxes depreciation and amortization) is a whopping 12x. It pay over $450 million a year in interest, which isn’t a problem when oil prices are high and there’s plenty for work for its rigs. But with the decline in oil prices, Transocean went from generating over a billion dollars in EBITDA per quarter to losing $1.9 billion in the most recent quarter.

Or, will the big bankruptcy in the oil space be one of the over-levered explorers and producers?

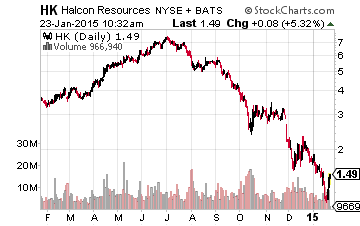

Halcón Resources Corporation (NYSE: HK) fits that bill nicely. This $570 million market cap oil and gas explorer sports a balance sheet loaded with $3.5 billion in debt. Its debt-to-EBITDA is upwards of 7x.

Halcón pays out nearly $40 million a quarter interest expenses. Last quarter it generated $200 million in EBITDA, so it’s not in immediate danger. But there’s only so much that cuts to capital spending can do before interest and fixed operating costs eat into the cash on hand that it does have.

Also, look out for a bankruptcy form one of the newly spun off oil and gas companies that are loaded with debt.

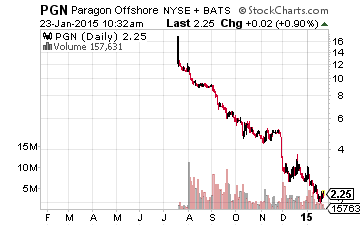

Paragon Offshore (NYSE: PGN) is the offshore driller spinoff from Noble Corp. (NYSE: NE) that started trading at the end of 2014 — shares are down 80% since then. But the real story is that it’s a $180 million market cap company with a $1.7 billion debt load.

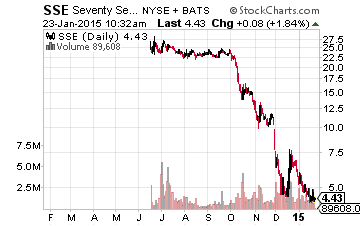

Or there’s the Chesapeake Energy (NYSE: CHK) spinoff, Seventy-Seven Energy (NYSE: SSE), which is also down 80% since it started trading. This oilfield services company has a $224 million market cap and yet carries $1.6 billion in debt.

But, there will also be second order effects of low oil.

With oil have fallen so far, so fast, the fallout will travel beyond the obvious oil players. Consider this: There are a number of banks that have lent a lot of money to explorers who were looking to capitalize on the boom in oil shale. Oil and gas producing companies in the U.S. carried $130 billion in debt in 2010, but that number has ballooned by over 50% to $200 billion currently.

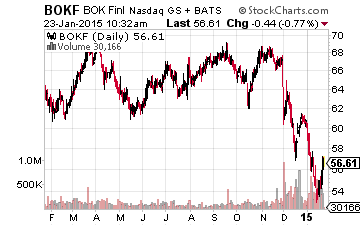

And with oil prices below $50 a barrel, many oil and gas companies won’t be profitable on their wells; meaning, they can’t service their bank debt. BOK Financial (NASDAQ: BOKF) is one name worth watching. Around 20% of its loan portfolio is exposed to the energy industry. And its debt load has ballooned — going from under $500 million to over $3.8 billion in just three years.

Beyond banks, retailers will feel the pressure of higher unemployment in states that are heavily dependent on oil production. Texas, which produces nearly 40% of the U.S.’s oil, is the biggest state to watch.

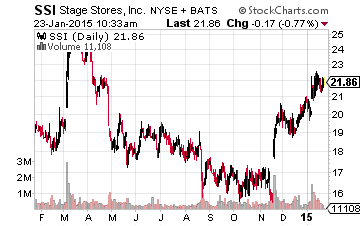

And the retailer to watch here? Stage Stores (NYSE: SSI), where nearly 30% of its store base is located in the state of Texas. The retailer’s EBITDA has been in decline for several years and its profit margin is just 0.8%.

2015 Bankruptcy Watchlist No. 3: Apparel Retail

Retail in general has been a tough industry to own over the last couple years, but the apparel space has been atrocious. This is especially true among teen-focused retailers. Delia’s filed for bankruptcy last month. Whitney Tilson was one of Delia’s biggest champions in the past. Luckily his fund got out of the stock before it went belly up, but other investors like Leon Cooperman weren’t so lucky.

Then WetSeal followed Delia’s into bankruptcy this month. This comes despite the fact that activist investor, Clinton Group, has been involved with the company for a couple years. Is no company safe? That certainly looks to be the case.

So, who’s next?

Cache (NASDAQ: CACH) is the obvious choice. It’s just a matter of time for this women’s apparel retailer. The company’s debt load is six-times its market cap and it has been losing money on an EBITDA basis for over two years now.

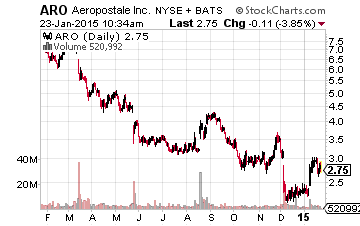

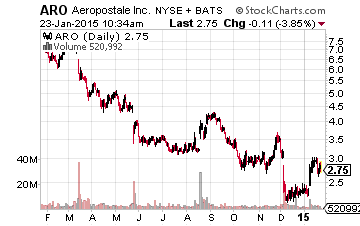

But beyond the obvious, there’s a couple very probable bankruptcies for 2015 in the space. These include bebe stores (NASDAQ: BEBE) and Aeropostale (NASDAQ: ARO). Both have had losses on an EBITDA basis for over a year.

Aeropostale does have over $100 million in cash. But at the same time, it has already lost $100 million on an EBITDA basis over the last twelve months. It took a “lifeline” loan from Sycamore Partners in March of last year, but revenues are still in free fall. Including debt and operating leases, Aeropostale owes over $1 billion — compared to its $225 million market cap.

bebe has no debt and $88 million in cash, but the losses will quickly eat away at that surplus. Over the last twelve months, bebe’s lost $33 million on an EBITDA.

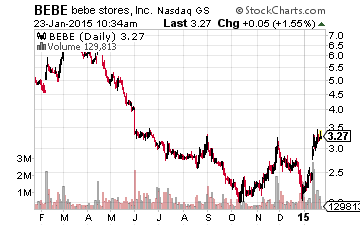

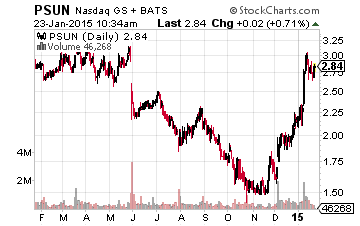

Meanwhile, there are a couple apparel retailers that are closer to bankruptcy than the market believes. Pacific Sunwear (NASDAQ: PSUN) is on the verge of an all out crisis. It’s still profitable on an EBITDA basis, but just barely. And West Coast apparel (think: swim trunks and flip-flops) continues to fall out of favor.

The bigger issue is that Pacific Sunwear is one of the few apparel companies loaded with debt. So it’ll much harder for Pacific Sunwear to stay afloat once earnings do turn negative.

Its net debt stands at $88 million, putting its debt to capital ratio at 85%. Meanwhile, its total operating lease liability is $215 million. All in all, its total contractual obligation liability is $450 million — compared to the company’s sub $200 million market cap. With just $12 million in cash, once the losses start, it’ll be a frenzy to save the company.

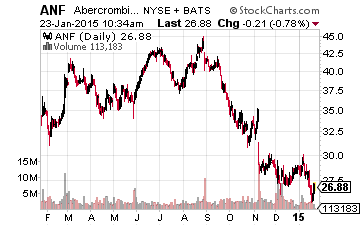

Another big name retailer that’ll take the market by surprise isAbercrombie & Fitch (NYSE: ANF). The company is well over a century old and still generating income, for now. But its revenues have fallen by 13% over the last two years and its brand remains tainted.

Its long-time, controversial CEO, Mike Jeffries, left the company in December. This should have been a positive sign, but shares are basically flat since the news. For now, its balance sheet is in a better position than its major peers, but it still has $2.8 billion in total contractual obligations hanging over its head — compared to a $1.9 billion market cap.

2015 Bankruptcy Watchlist Bonus: Yes, another bonus. In our last bankruptcy watchlist we provided a bonus, a shocking U.S. bankruptcy that would rattle the markets. That company is down over 40% since then and represents the demise of the world’s largest company.

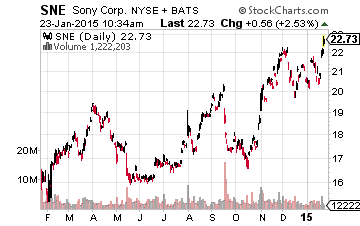

Well, this time we’re taking our bankruptcy prediction international. We’re calling out the $24 billion market cap Japanese company, Sony (NYSE: SNE). But it’s not because of the North Korea hacking. Rather, this company has been notorious at squandering shareholder value and has lost all relevance in the electronics market.

The movie production business is one of its last remaining bright spots, but that can only carry company so far. TVs are a dime a dozen, blu-ray players have never really took off, its smartphone foray has largely been a flop, and the rise of mobile games is already having a lasting impact on gaming systems.

Despite generating some $7 billion a year in revenue, it has an unprecedented ability to lose money — having posted $2 billion in losses over the last twelve months. And 30% of its shareholder equity has vanished over the last five years thanks to losses, with its book value being cut from over $32 a share to just $18 in a half decade.

Don’t be the Wall Street fall guy: It’s hard to envision that one day we might no longer have as many options for buying electronics or that oil prices could fall even lower, but remember to take the emotion out of investing. Just be sure to paint a clear picture of what you own and whether it can be rendered obsolete, no matter how painful the thought might be.

Disclosure: None

The logic behind the $PGN listing is flawed. Comparing market cap of stock price to debt load vis-a-vis comparing to profit

BBY has no real competitor besides WalMart and Amazon. BBY will see 40 soon.

Thanks for this, I think the author makes a lot of sense.

In your post above you say CHK has quality assets and strong balance sheet, so why is it on the list?

By only focusing on the negatives, any company would be a candidate for bankruptcy. I really don't agree with this list.

Agreed. With falling oil prices, companies' costs are falling while Americans are getting extra cash to by more products. That can be a game changer for any company that needs a boost to its bottom line. I'm more optimistic than the author.