10yr To 2yr Yield Curve Is Still Sedate Despite A Constellation Of Bearish Indicators

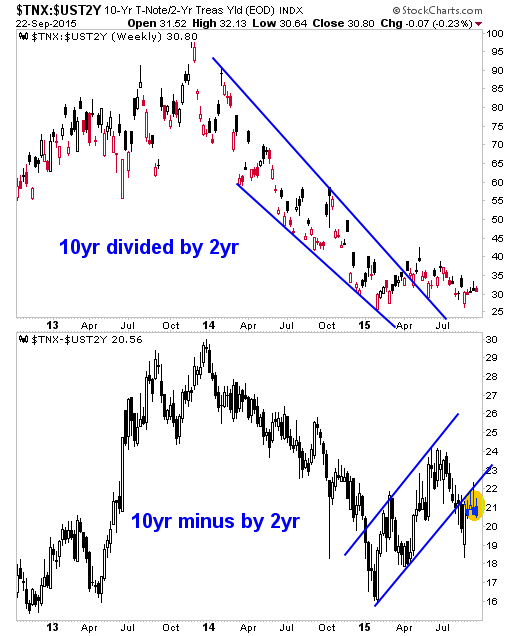

Yesterday Biiwii had a look at the 30’s vs. 5’s, which appear to be bottoming and not a pleasant picture for the stock market. But the most commonly viewed yield spread, the 10’s vs. 2’s is still doing little as it bottom feeds on the 10/2 and loses an uptrend on the 10-2.

This is a neutral stock market picture and given that Operation Twist kicked off the current gold bear market by selling the heck out of very short duration bonds like the 2 year four years ago, still a non-starter for gold.

TED and LIBOR, Palladium vs. Gold, Commodities and Silver vs. Gold, Junk Bonds, etc. are flashing bearish signals. But as of now, the 10 vs. 2 is well under control.

Disclosure: Subscribe to more

10s are used by so many people for so many different reasons, and with them now used as collateral in clearing houses and virtually all swaps, the demand is massive. That is a bad news picture for trying to get banks to lend.