10%+ Yield Dividend Dogs Make Great Investments Per Broker Targets

Allow me to introduce myself, I'm Fredrik Arnold. I'm a dividend dogcatcher by trade.

The Dividend Dogs Rule

"The "dog" moniker is earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fall to where (3) yield (dividend/price) grows higher than their peers. Thus, the highest yielding stocks in any collection become known as "dogs."

I use the following steps to select suitable "dogs" for my kennel:

1. Does it pay a dividend?

2. How much is the dividend?

3. What is the share price, and how many shares will $1,000 buy? (Should be between 2& 200)

4. How much dividend income will that $1,000 worth of shares return in a year? (Best if more than the single share price.)

5. What is the yield? (Dividend divided by price.) (Best if over 4%.)

6. What does the company do? (Best if unique in the industry or sector.)

7. How long has the company been in business?. (Best be 10 years or more.)

8. How many years has the company paid a dividend? (Best be 5 years or more.)

9. How many years in a row has the company raised its dividend? (Best are 5 years or more.)

10. What is the mean target price analysts predict for the stock in one year? (Best if 5% higher or more than the current price.)

11. How many analysts are following the stock? (3 to 9 give the most reliable predictions.)

12. How do analysts rate the stock? 1= Buy; 2= Buy/Hold; 3= Hold; 4= Hold/Sell 5= Sell. (Stock must rate 2.5 or lower.)

13. Buy? Do you? Or don't you? Now? Or wait?

I look forward to sharing my observations and collections based on these principles and more with you here on the TalkMarkets platform.

Here is a recent collection determined from the twelve steps noted above:

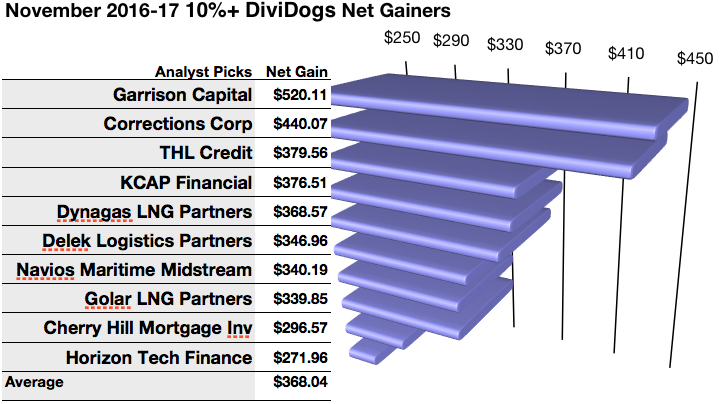

Analysts Allege Ten 10%+ Yield Dogs Could Net 27.2% to 52.01% By November 2017

Five of the ten top dividend yielding 10%+ Yield dogs were among the ten gainers for the coming year based on analyst 1-year target prices. So this month the dog strategy as graded by Wall St. wizards was 50% accurate.

Ten probable profit generating trades were revealed by Thomson/First Call in Yahoo Finance into 2017:

Garrison Capital (GARS) was projected to net$520.11 based on dividends plus a median target price estimate from seven analysts less broker fees. The Beta number showed this estimate subject to volatility 73% less than the market as a whole.

Corrections Corp (CXW) was projected to net$402.07 based on dividend plus median target price estimates from two analysts less broker fees. The Beta number showed this estimate subject to volatility 69% less than the market as a whole.

THL Credit (TCRD) was projected to net$379.56 based on dividends plus a median target price estimate from eight analysts less broker fees. The Beta number showed this estimate subject to volatility 9% more than the market as a whole.

KCAP Financial (KCAP) was projected to net$376.51 based on estimates from two analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 87% more than the market as a whole.

Dynagas LNG Partners (DLNG) was projected to net$368.57 based on dividends plus median target price estimates from eight analystsless broker fees. The Beta number showed this estimate subject to volatility 17% more than the market as a whole.

Delek Logistics Partners (DKL) was projected to net$346.96 based on estimates from five analysts plus dividends less broker fees. The Beta number showed this estimate subject to volatility 30% more than the market as a whole.

Navios Maritime Midstream (NAP) was projected to net$340.19 based on dividends plus a median target price estimate by four analysts less broker fees. The Beta number showed this estimate subject to volatility 85% more than the market as a whole.

Golar LNG Partners (GMLP)was projected to net $339.85 based on a median target price estimate from ten analysts combined with projected annual dividend less broker fees. The Beta number showed this estimate subject to volatility 20% more than the market as a whole.

Cherry Hill Mortgage Investment (CHMI) was projected to net$296.57 based on dividends plus the median target price estimate from four analysts less broker fees. The Beta number showed this estimate subject to volatility 74% less than the market as a whole.

Horizon Tech Finance (HRZN) was projected to net$271.96 based on dividends plus median target price estimates from five analysts less broker fees. The Beta number showed this estimate subject to volatility 4% more than the market as a whole.

Per analyst estimates, the average net gain in dividend and price was 36.8% on $10k invested as $1k in each of these ten dogs. This gain estimate was subject to average volatility 11% less than the market as a whole.

10%+ Yield Dividend Dogs Find 18.6% LESS Return From 5 Lowest-Priced Come November 2017

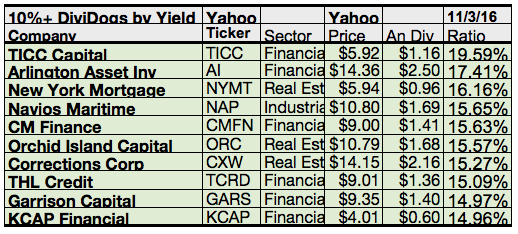

10%+ yield stocks to buy and hold for at least one year were reported based on: (1) Yields over 10%; (2) Minimum $50M Market Capitalization; (3) Price Upside to 2017; (4) Analyst Rated 1.5-3.3; (5) Analyst 1yr. target upsides; (6) Cash Flow Covers Dividend.

As mentioned above, five of eleven Morningstar sectors placed dogs in the top ten 10%+ yielder list for November: financial services, real estate, basic materials, communication services, and energy.

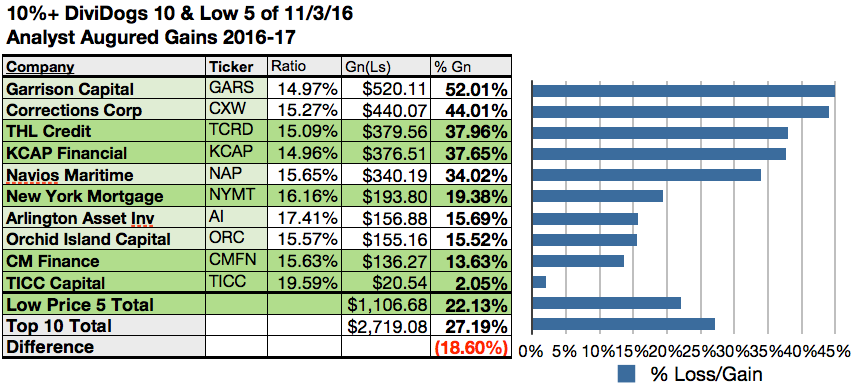

5 Lowest-Priced of the Top Ten Highest-Gaining 10%+ Yield Dogs Were Estimated to Deliver 22.13% Vs. (11) 27.19% Net Gains for All Ten as of November 3, 2016

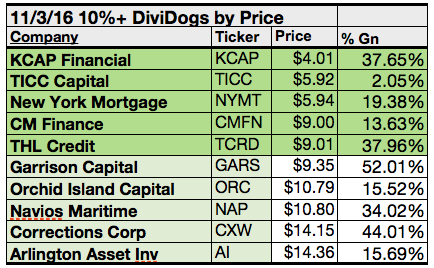

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten 10%+ Yield dividend dog kennel by gains were predicted by analyst 1-year targets to deliver 18.6% LESS net gain than the same amount invested in all ten. The sixth lowest-priced 10+ Yield dividend dog, Garrison Capital (GARS), was projected to deliver the best net gain of 52.01%.

The five lowest-priced 10%+ Safe Yield dogs for November 3 were: KCAP Financial; TICC Capital; New York Mortgage Trust; Prospect Capital; CM Finance; THL Credit. whose prices ranged $4.10 to $9.01.

The higher-priced 10%+ Safe Yield dogs for November 3were: Garrison Capital; Orchid Island Capital; Navios Maritime Midstream; Corrections Corp; Arlington Asset Investment, whose prices ranged from $9.35 to $14.36.

This distinction between five low-priced dividend dogs and the general field of ten reflects the "basic method" Michael B. O'Higgins employed for beating the Dow in his book of the same title from 1991.

The added scale of projected gains based on analyst targets contributed a unique element of "market sentiment" gauging upside potential. It provided a "here and now" equivalent of waiting a year to find out what might happen in the market. It's also the work analysts got paid big bucks to do.

Caution is advised, however, as analysts are historically 20-80% accurate on the direction of change and about 0-20% accurate on the degree of the change.

The stocks listed above were suggested only as reference points for a 10%+ Safe Yield dividend dog stock investment research process into November 2016. These were not recommendations.

Join me for my free webinar: Dividend Dog Catcher Dog of the Year Awards. Register here.

Welcome to the site, I enjoyed your article very much and look forward to more.