10-Year US Treasury Yield Fair Value Estimate: Wednesday, Nov. 15

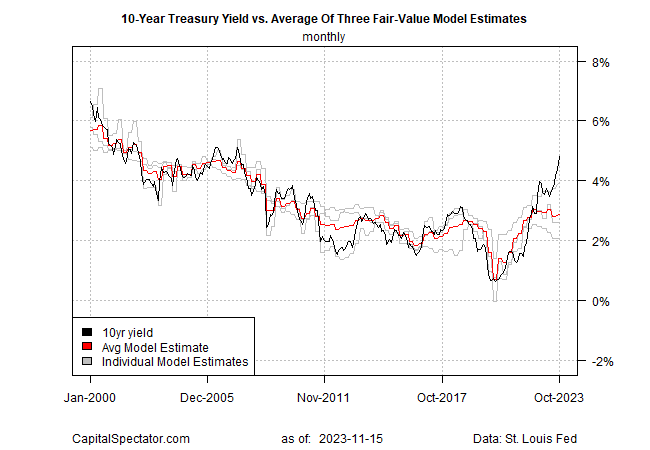

Today’s “fair value” estimate of the US 10-year Treasury yield continues to suggest that the current market rate is unusually lofty and that the spread will soon narrow. Yesterday’s sharp drop in the 10-year yield (triggered by upbeat inflation news for October) suggests that the process of normalizing has started.

Tuesday’s bond market rally cut the 10-year rate to 4.44% (Oct. 14), marking a two-month low (bond prices and yields move inversely).

Meanwhile, CapitalSpectator.com’s fair-value estimate for October (using monthly data) shows that the market level surged to 1.94 percentage points – a 40-year high. (The model is based on the average of three methodologies, summarized here.) The current average model estimate for the 10-year rate is 2.86% for last month — far below 4.80% level for October (as well as yesterday’s 4.44%).

Although the modeling shows that October’s spread isn’t unprecedented, history suggests such an extreme level doesn’t last long. As I noted in last month’s update (which still applies today): “The market is pricing the 10-year yield at what appears to be a lofty and arguably unsustainable level.”

Yesterday’s sharp slide in the 10-year rate may be the start of normalizing the spread. Catalysts include expectations that the Federal Reserve is done with rate hikes for this cycle.

“The market’s telling you they expect the Fed to start easing sooner rather than later,” says Charles Schwab chief fixed income strategist Kathy Jones. “I would guess early 2024.”

Yesterday’s “positive inflation news helps cement the case for a Fed pause on rate hikes,” advises Morningstar senior U.S. economist Preston Caldwell.

In turn, the case appears to be strengthening for expecting a narrowing spread between the current 10-year yield and the average model estimate shown in the chart above.

More By This Author:

Desperately Seeking Yield: Tuesday, Nov. 14Globally Diversified Portfolios On Track For Solid 2023 Gain

Book Bits: November 11, 2023

Disclosure: None.