10-Year Treasury Yield ‘Fair Value’ Estimate: Wednesday, March 15

US interest rates have been on a roller coaster lately, but there’s a case for considering the possibility that yields have peaked. The wild card is the Federal Reserve, of course.

The critical question: Will the Fed’s policy decisions over the next several months conflict or align with emerging signs that rates look set to more or less hold steady, if not decline, from current levels?

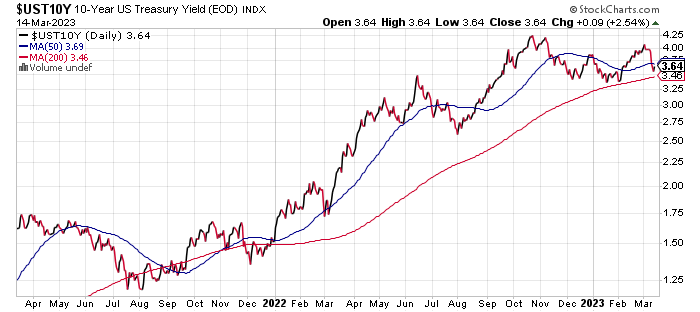

From a technical perspective, the benchmark 10-year US Treasury yield continues to trade in a range. The latest runup peaked at 4.08% on March 2, slightly below the previous top in October. The failure of the market to break out to new highs implies that we’ve seen the highs for this cycle.

The Fed, of course, can force rates higher and so caution is recommended as long as the central bank remains tentative on deciding how much progress it’s made in its efforts to tame inflation. In fact, yesterday’s consumer inflation report for February suggests that the pricing pressure continues to ease. The decline is weaker than the Fed would prefer, but for the moment the bias still points to the downside. To the extent that the downside bias endures, even weakly, there’s support for thinking that the 10-year rate has peaked.

That’s also the view based on CapitalSpectator.com’s fair-value model for the 10-year yield, which continues to reflect a lower estimate relative to the market yield.

Today’s update estimates the fair value for the 10-year rate at 2.77% for February, or well below the current market rate: 3.64% as of March 14. The model could be wrong, of course. In fact, it usually is. But the errors have a history of varying randomly around the actual 10-year rate, which implies that the current gap, which is unusually wide, will soon narrow. In turn, that suggests that the current market rate will fall, the model estimate will rise, or both, in the near term.

My view is that most of the spread narrowing will be borne by a lower market yield. This is based on the assumption that inflation will continue to ease and economic growth will remain relatively subdued at best.

More By This Author:

Nobody Expects A Banking Crisis, But…US Bonds Rise As Risk-Off Sentiment Strengthens

Median US GDP Estimate For Q1 Ticks Slightly Positive

Disclosure: None.