US Job Revisions Make An Even Stronger Case For Rate Cuts

Image Source: Pixabay

After benchmarking with state unemployment insurance tax records, the Bureau for Labor Statistics has acknowledged that it overestimated employment in the US by 911,000 in the 12M to March 2025. Thus, labour market momentum is being lost from an even weaker position than originally thought, reinforcing expectations of meaningful interest rate cuts.

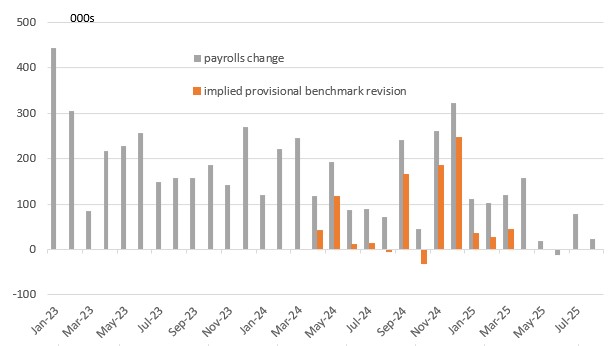

The Bureau for Labor Statistics has just published its preliminary benchmark revisions to US non-farm payrolls for the 12 months to March 2025 and they show that rather than adding 1.758mn jobs as originally reported, the US economy created only 847,000 – a 911,000 downward revision. This is a bigger error than the consensus expected (682k) and even larger than the 800k Treasury Secretary Scott Bessent talked of over the weekend. This means that rather than recording average monthly payrolls growth of 146,500 over that period, it is actually only 70,600 per month.

Implied payrolls numbers based on downward revisions (monthly change, 000s)

Source: Macrobond, BLS, ING

These new numbers come about after benchmarking the initially reported payrolls figures to employment data from the Quarterly Census of Employment and Wages (QCEW) that are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. Historically the error has been 0.2 percentage points, but this year’s error was 0.6pp coming after last year’s 0.5pp error that required a 818,000 downward revision.

For this year the most impacted sectors were leisure and hospitality (-176k jobs or 1.1pp) followed by retail trade (-126k or 0.8pp) and whole sale trade (-110k or 1.8pp). The biggest percentage error was in information at -2.3pp (or 67,000 jobs).

In the benchmarking process the BLS cite problems with response rates, which means data gaps, and response errors, whereby employers give them the wrong number relative to what are reported to tax authorities. They also highlight problems with other forecast errors that are attributable to the BLS themselves. The BLS has a good handle on what is going on amongst large employers, but has less visibility on the small business sector and has a “births-death” model.

In steady times, their assumptions are accurate, but at turning points in the cycle they can be significantly wrong – so in the early stages of a downturn they tend to overestimate the jobs created by new start-ups – “births” – and underestimate the number of jobs lost by the “death” of failing small businesses.

These revisions suggest that jobs momentum is being lost from an even weaker position than originally thought. It also reinforces the belief that even the poor numbers seen in 2025 are probably overstating the health of the employment market. So even if we get an upside surprise to US inflation on Thursday the Federal Reserve will very likely be cutting interest rates next week and follow up with 25bp moves in October and December.

More By This Author:

Hungarian Inflation Stagnates At Elevated LevelFX Daily: Swiss National Bank Seems More Comfortable With CHF Strength

Rates Spark: Not The End To France’s Problems

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more