US IP: May Was A Good Month And It Was Still ‘Manufacturing Recession’

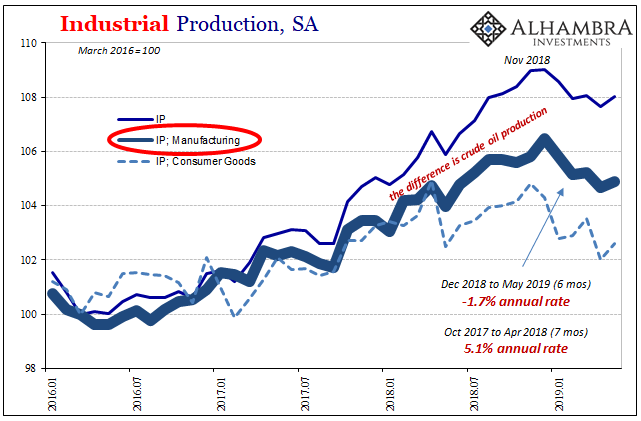

Whether or not a full-scale recession shows up in the US is an open question. There’s less of one in US industry. The “manufacturing recession” we last saw of Euro$ #3 is becoming clearer as a repeat property in Euro$ #4. According to the Federal Reserve, May was a relatively good month for industry – total output didn’t decline from April.

No matter in the big picture. The trajectory is becoming very well established. As is consistent with economic and market data from all over the world, “something” really went wrong around November 2018. Mainstream talk, when even admitting the possibility of weakness, continues to center on trade wars. The markets displayed the further decay of eurodollars.

It is the manufacturing sector which is leading the decline. While crude oil production continues to provide the only real boost, it isn’t enough to offset what is now six months, half a year of going the wrong way.

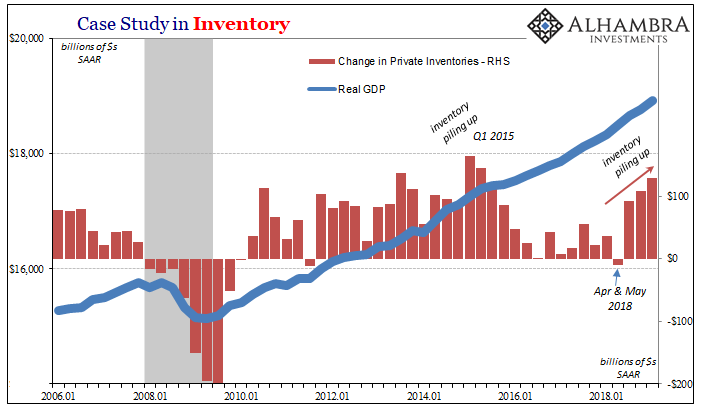

As the prior manufacturing recession, the production of consumer goods indicates the segment where imbalances are piling up. Consistent with GDP’s inventory estimates during the first quarter underlying the robust headline, the supply chain is starting to be pulled inward on itself. In days gone by, the classic recession pattern.

The Fed’s estimate for the production of consumer goods is falling at a sharp clip already, an annualized rate of more than 4% over these last six months.

The implications are pretty straightforward. Whereas retail sales are hanging in at around or a little less than 3% growth, that’s actually bad news if not yet recession news. As it had been in the past, it’s not nearly enough spending growth to keep the goods economy moving or even from contracting.

Increasingly negative production levels are the inevitable adjustment to first the falloff in consumer spending and then the manufacturing sector viewing that change as substantial or more than temporary. Most likely both.

Including recent labor market data, it is a volatile mix that if it gets worse would certainly lead to rate cuts. There’s way too much consistency here with a broad cross section of data.

To translate into a second half rebound, to make this all a temporary soft patch, what’s the catalyst for that? The Fed “pause?” The unemployment rate? It sure won’t be European strength nor is it China “stimulus.”

While the bond market initially sold off on the retail sales numbers, safety was actually bid once the IP figures came out. The spending estimates didn’t seem bad enough on their own at first, until the manufacturing recession in the Fed’s data put them into a more relevant and ultimately consistent if unfriendly context.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

If Powell wants to keep his job in the next administration he may have to tighten things up even though things are slowing. That would protect the integrity of the Fed, which is under attack by Trump, who would surely like to get rid of Powell if he gets reelected.

Likely true.