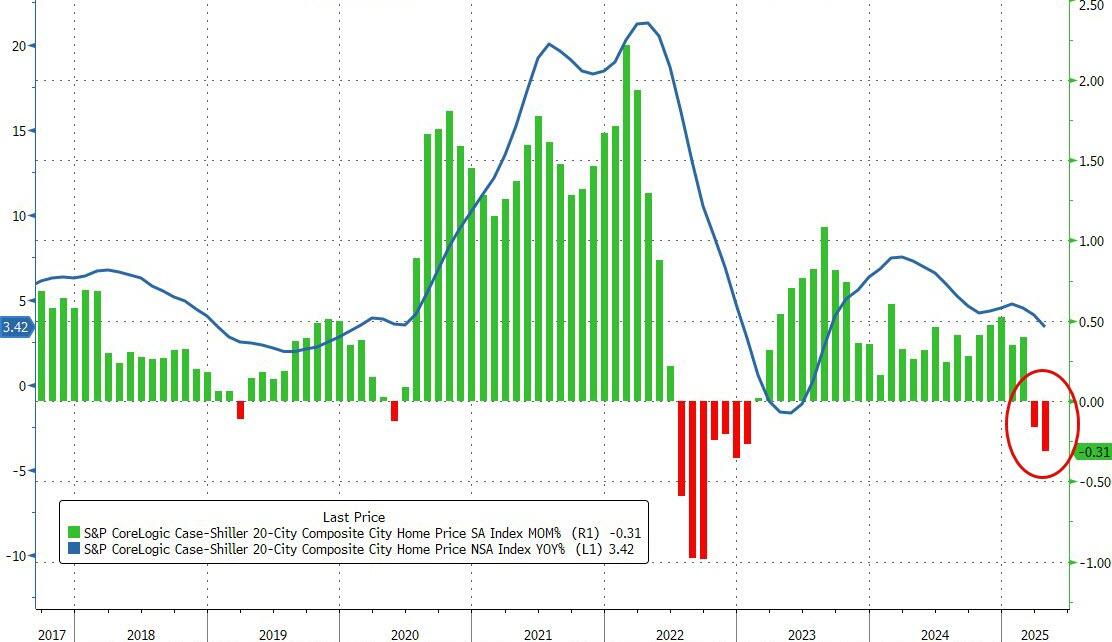

US Home Prices Plunged In April - Biggest Drop Since Dec 2022

After US home pries declined in March (the latest data) for the first time in over two years, this morning's Case-Shiller Home Price Index data was expected to show another drop in the cost of buying a home.

And the consensus was right but way off in magnitude as prices in April tumbled 0.31% MoM (-0.02% exp) - the biggest MoM drop since Dec 2022...

Source: Bloomberg

Prices are still up 3.4% YoY, but that is the slowest acceleration since Aug 2023.

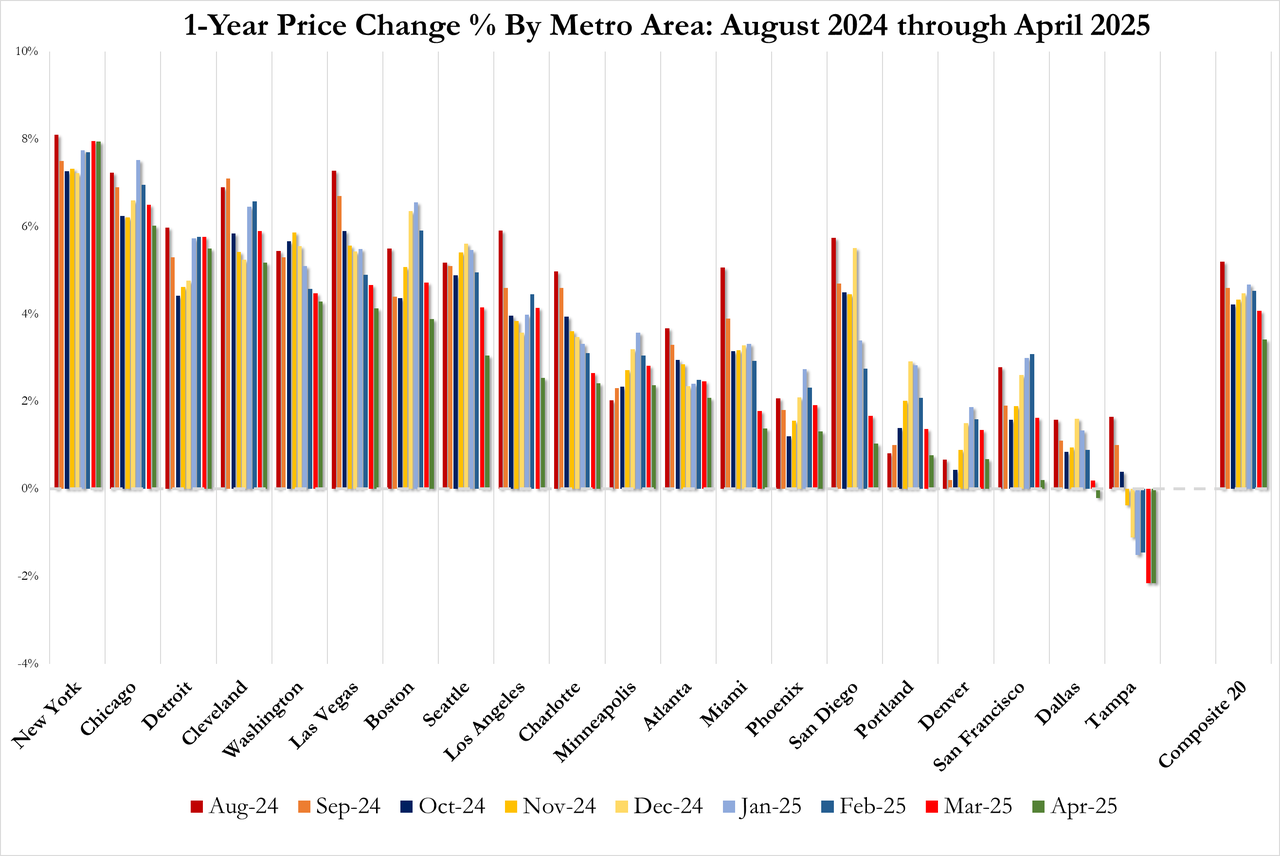

Tampa prices continue to lead the plunge...

Arguably, (lagged) mortgage rates dipped during that period (positive short-term for the highly smoothed and lagged Case Shiller series), but as is clear, the next couple of months do not bode well...

Source: Bloomberg

However, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag), which implies prices are going continue to lag for the next couple of months before re-accelerating once again...

Source: Bloomberg

So 100bps of rate-cuts prompted a re-acceleration in home prices... and now prices are tumbling again as you pause... Well played Fed!!

More By This Author:

Automotive Industry Imbalance Delays Trade Negotiations With JapanKey Events This Week: GDP, Core PCE, Durables, Powell And Fed Speakers Galore

US Existing Home Sales Print Weakest May Since 2009

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more