US Home Prices Drop For 5th Straight Month In July, Led By Tampa

Image Source: Pexels

With new home prices falling and median existing home prices rising in August (while average existing home prices rise, signaling 'expensive' homes are selling), this morning's (admittedly lagged and smoothed) Case-Shiller home price data was expected to decline (for July)... and it did, but ony marginally.

Home prices across the top 20 cities in the US fell by 0.07% MoM (less than the 0.2% decline expected) - the fifth straight monthly drop in prices. This pulled the YoY price appreciation down to 1.82%, the lowest since July 2023...

Source: Bloomberg

The US is coming off its weakest spring selling season in 13 years after high prices and mortgage rates sidelined many would-be buyers.

“July’s results reinforce that the housing market has downshifted to a much slower gear,” said Nicholas Godec, Head of Fixed Income Tradables & Commodities at S&P Dow Jones

Indices.

"In other words, U.S. home values have essentially stagnated after inflation, marking the third straight month of real housing wealth decline for homeowners. This reversal is striking: during the pandemic boom, home prices were climbing far faster than inflation, rapidly boosting homeowners’ real equity. Now, the situation has flipped – over the last year, owning a home yielded a modest nominal gain, but an inflation-adjusted loss. "

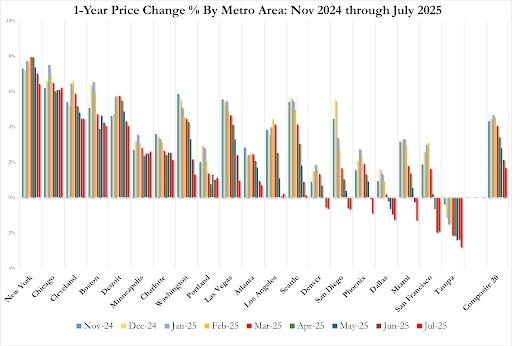

The geographic hierarchy of U.S. housing continues its dramatic shake-up, with 7 cities seeing outright price declines YoY...

-

Denver -0.6%

-

San Diego -0.7%

-

Phoenix -0.9%

-

Dallas -1.3%

-

Miami -1.3%

-

San Francisco -1.9%

-

Tampa -2.8%

However, given the decline mortgage rates, one could argue that home prices are set to re-accelerate soon (which fits with the slowdown in the price depreciation)...

Source: Bloomberg

On the bright side, declining home prices (and the follow through into PCE/CPI calculations for Shelter costs) could more than offset any tariff-driven anxiety over the next few months.

But, home price changes do seem to track very closely with bank reserves at The Fed (6mo lag), which implies home prices could rapidly decelerate in the new year (after a brief rebound)...

Source: Bloomberg

“Looking ahead, the housing market appears to be settling into a new, more measured equilibrium,” Godec concluded.

“The era of 15-20% annual home price jumps is behind us, and in its place we’re seeing growth rates closer to overall inflation – or even a bit below it. While that means homeowners aren’t gaining wealth at the breakneck pace of the recent past, it also signals a potentially healthier trajectory for housing in the long run.

The question remains, that after slashing rates by 100bps (last year), home prices have started to decline (with significant lag)... is that what The Fed wants this year too, now that the rate-cutting cycle has restarted?

More By This Author:

Key Events This Week: Payrolls, JOLTS, And ISM, But U.S. Govt Shutdown Is The Big OneMarijuana Stocks Jump On Trump's "Revolutionize Senior Healthcare" Video

Help Wanted: These Are The Most In-Demand Jobs Of The Next Decade

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more