US Growth With A Capital K

Image Source: Pexels

Net trade lifted US growth well above expectations

The delayed US third-quarter GDP report has come in at an eye-popping 4.3% annualised rate, a full percentage point above the consensus expectation. This was primarily due to a strong performance from net trade with exports rising 8.8% and imports falling 4.7%. This means that net trade contributed 1.6pp of the 4.3% headline growth rate. Other than that, consumer spending grew a robust 3.5% versus the 2.7% rate expected. Non-residential fixed investment was a little softer at 2.8%, while residential investment fell 5.1% for a second consecutive quarter. Rounding it out, government spending grew 2.2% while inventories subtracted 0.22pp.

So a fantastic outcome, but fourth-quarter GDP is likely to record growth that is considerably slower, thanks in part to the effects of the month-long government shutdown. We also can't see the net trade component continuing to make such a strong contribution while consumer spending is also set to slow. Expectations of cooling data probably explains the relatively muted market reaction with the 10Y Treasury yield only up 3bp on the day and Fed funds rate cut expectations for 2026 still holding above 50bp.

K-shaped consumer and K-shaped corporates

Looking at the details, the K-shaped economy is staring us right in the face. Notwithstanding today’s contribution from net trade, we’ve written a lot about the bifurcation in the household sector – the top 20% of households by income continue to spend strongly, boosted by high incomes and soaring wealth, while the bottom 60% are really struggling on concern about job security and the potential for tariff-induced price hikes. This goes a long way in explaining why spending is holding up yet confidence is so weak.

It is increasingly obvious in the corporate sector, too – not just in terms of the stock market's performance but also business capex. For four quarters in a row, business capex outside of tech has contracted – that is a recession-style performance. But investment in computing and software is up 18% year-on-year which means overall business capex continues to rise.

Non-residential private fixed investment growth (YoY%)

Source: Macrobond, ING

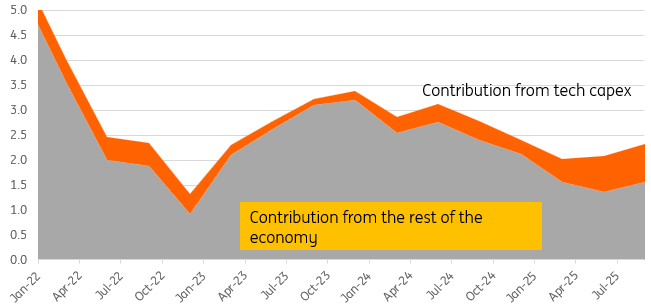

Moreover, the chart below shows how important tech capex is right now, with computing and software investment contributing a third of the 2.3% YoY GDP growth. This story is unlikely to change meaningfully in the near term, given both government and the corporate sector are aligned in striving for US 'victory' in the battle for AI dominance.

Tech investment contribution to YoY% GDP growth

Source: Macrobond, ING

High-income households and tech investment to remain key 2026 growth drivers

Neither of these trends (high-income household spending and tech capex) appear to be weakening and in all likelihood they are going to continue to propel growth in 2026. What could change that? Well, the most likely candidate would be a stock market wobble that hits the value of tech stocks hard. That would likely lead to a tightening of lending conditions which could squeeze capex and hurt those high-income households via negative wealth effects. Recall that Federal Reserve data shows the top 20% of US households by income own 70% of the wealth in America and right now, that style of financial hit would be the most likely event to lead to a change in their spending patterns.

More By This Author:

Czech Consumers Remain Upbeat Amid Gloomy Industrial OutlookPoland’s Retail Sales Disappoint But Growth Outlook Remains Robust

Further Bank Of Japan Hikes Are Expected, But Not Imminent

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more