US Dollar Index Price Forecast: Hovers Around 99.00, With A Persistent Bearish Bias

Image Source: Pixabay

- The US Dollar finds primary support at the lower boundary of the descending channel around 98.70.

- Technical analysis indicates a persistent bearish bias as the RSI stays below the 50 level.

- The nine-day EMA of 99.68 appears as the initial barrier, followed by the descending channel’s upper boundary around 100.00.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is retracing its recent losses from the previous session. The DXY is trading around 98.80 during the Asian hours on Tuesday.

On the daily chart, technical analysis suggested a persistent bearish bias, with the index moving downwards within a descending channel pattern. Additionally, the DXY remains below the nine-day Exponential Moving Average (EMA), indicating that short-term momentum is weaker. Additionally, the 14-day Relative Strength Index (RSI) stays below the 50 level, indicating reinforcement of the bearish bias.

On the downside, immediate support appears at the lower boundary of the descending channel around 98.70. A break below the channel would reinforce the bearish bias and put downward pressure on the US Dollar Index to navigate the area around 97.91 — the lowest level since March 2022, which was recorded on April 21.

To the upside, the US Dollar Index may target the initial barrier at the nine-day EMA of 99.68, followed by the descending channel’s upper boundary around 100.00. A break above this crucial resistance zone could cause the emergence of the bullish bias and support the DXY to test the 50-day EMA at the 101.20 level. A break above this level could strengthen the short-term price momentum and support the index to explore the area around the two-month high at 104.37, reached on April 1.

US Dollar Index: Daily Chart

US Dollar PRICE Today

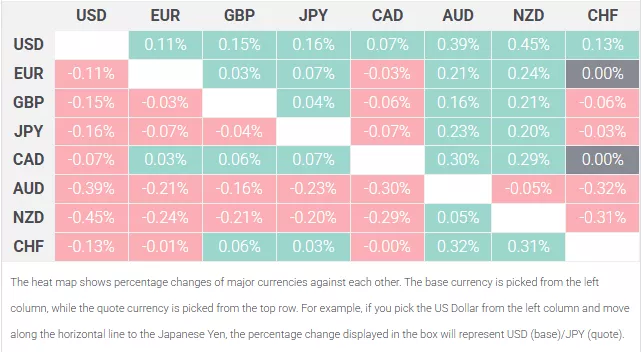

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

More By This Author:

USD/CAD Falls To Near 1.3700 As Traders Expect BoC To Hold Rates In JuneUS Dollar Index Falls Toward 99.50 As Trump’s One Big Beautiful Act Clears First Hurdle

Silver Price Forecast: XAG/USD Posts Monthly Highs Above $32.50 Due To Safe-Haven Demand

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more