US Big Banks Suffer Biggest Deposit Outflow Since April... Until The Fed 'Adjusted' Them

Image Source: Pexels

Money market funds saw yet another week of inflows (+$40BN), taking the total AUM to a new record high of $6.508 TN...

Source: Bloomberg

The inflow into MM comes as bank deposits (on a seasonally adjusted basis) dropped a modest $13BN to the week-ending 10/23...

Source: Bloomberg

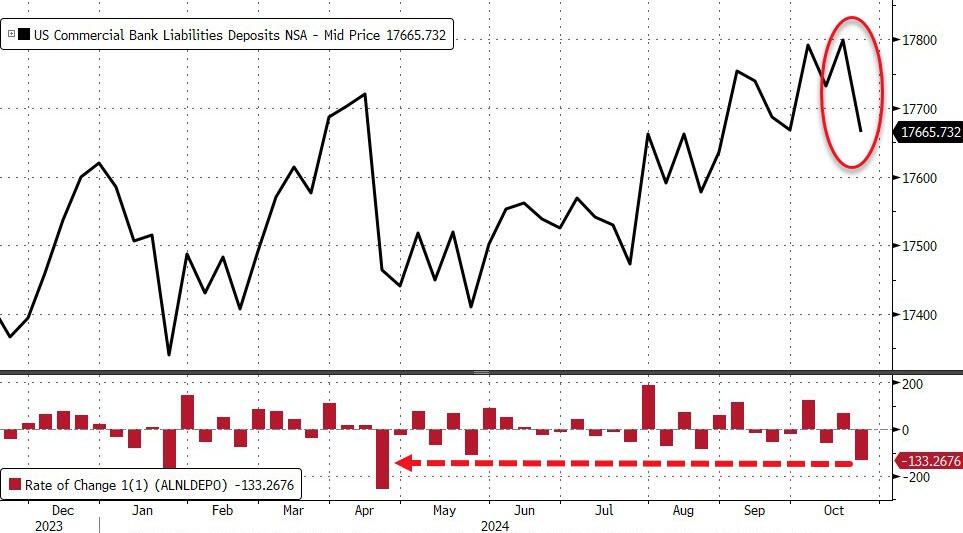

But, on a non-seasonally-adjusted basis, total deposits plunged $133BN (the biggest weekly decline since April)...

Source: Bloomberg

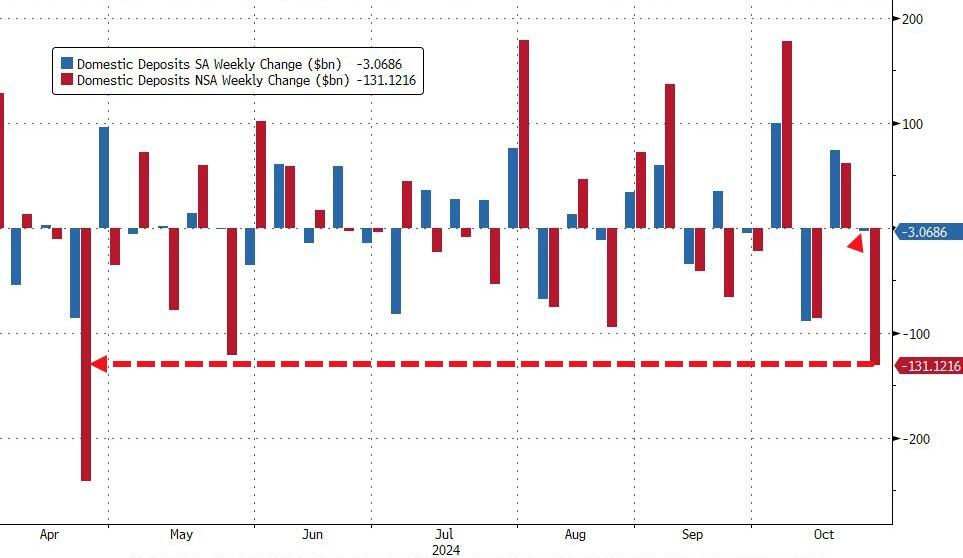

Excluding foreign deposits, it's even uglier. On an NSA basis, US deposits plunged $131BN - the biggest weekly drop since April (Large banks -$97BN, Small banks -$34BN). But, by the magic of The Fed's PhDs, the 'seasonal adjusted' domestic deposits fell just $3BN (Large banks +$8BN, Small banks -$11BN)...

Source: Bloomberg

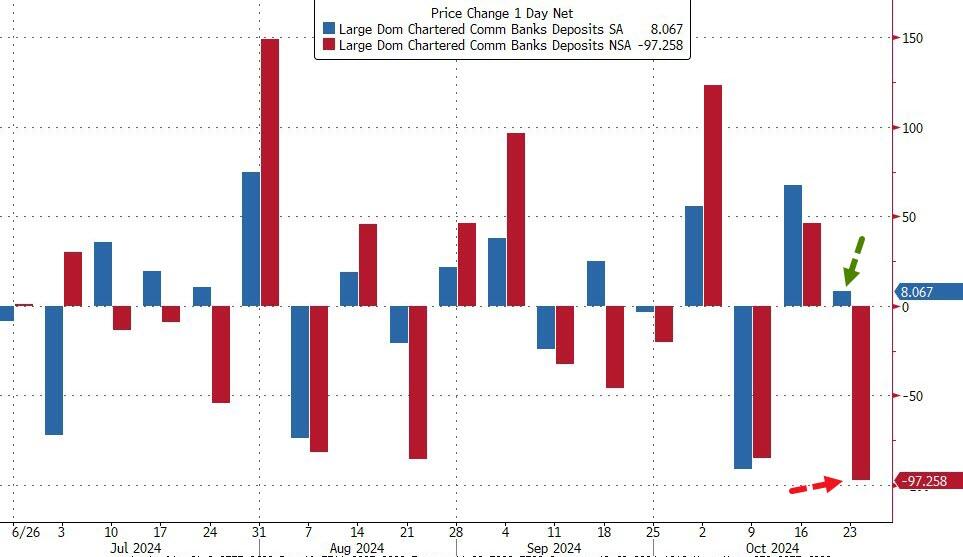

This is the biggest Large bank deposit drop since May...

Source: Bloomberg

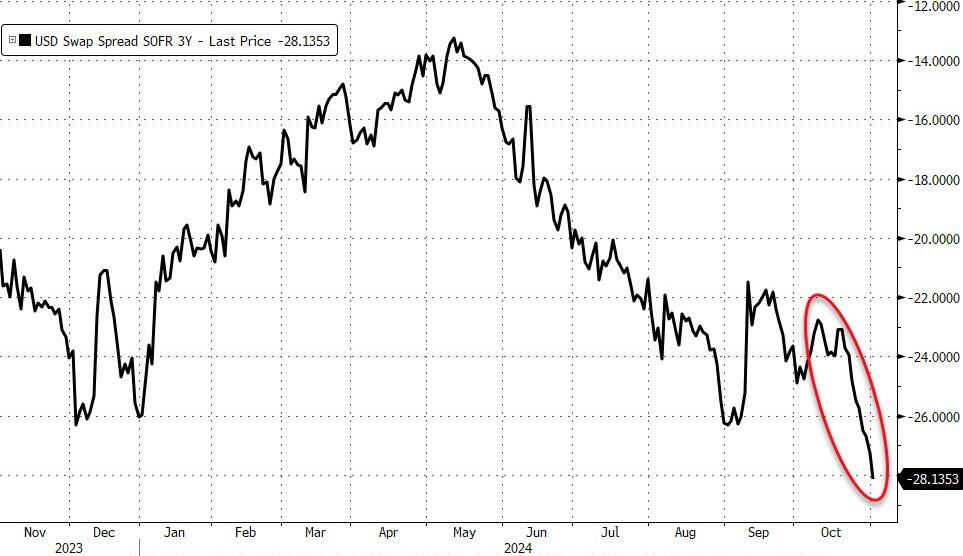

This should only be worrying if we see liquidity problems in the banking system starting to occur.

Wait, what?

Source: Bloomberg

...and reverse repo usage is collapsing (liquidity needs?)

Source: Bloomberg

Is that why USA sovereign risk is blowing out?

Source: Bloomberg

Are they holding back a banking crisis for Trump's victory?

More By This Author:

Nvidia To Replace Intel In The Dow Jones Industrial Average; Stock JumpsJobs Shock: October Payrolls Huge Miss As Private Jobs Drop For First Time Since 2020

China Urges Automakers To Stop Investment In EU Countries Amidst Trade War

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more