US Auto Sales Crash As Dealer Inventory Hits New Record Low

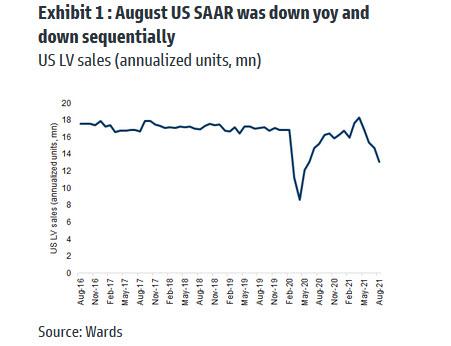

US light vehicle sales tumbled in August, sliding to just 13.1 million (SAAR) per both Wards and Motor Intelligence, down in the mid-teens percent range from about 15.3 million in August 2020 and down sharply from the July SAAR of about 14.6 million. As last month, the collapse in sales was widely attributed to the ongoing collapse in auto inventory levels.

Some more details from Goldman:

- Car sales were down about 18% yoy, SUV sales were down about 15% yoy, and pickup truck sales were down about 24% yoy. Pickups and SUVs as a percent of total units were 19% and 53%, respectively (vs. 20% and 51% in August 2020).

- Per Motor Intelligence, Ford sales were down about 33% yoy and GM sales were down about 39% yoy in August. Ford's market share in August declined yoy to 11% from 14%, and GM's market share declined yoy to 12% from 17%. We believe that Ford and GM have faced more difficult supply chain challenges than some of their competitors YTD.

But while legacy auto sales tumbled, EVs and hybrids continued their recent ascent, and in August EV sales were up about 39% yoy, and hybrid sales were up about 63% yoy, per Motor Intelligence. In part this was due in part to growing consumer demand for EVs and hybrids, in addition to more EV/HEV models on the market. It is worth noting that Tesla does not report monthly sales, and given its dominant EV market share in the US, the EV data has a greater degree of estimation than the other monthly datapoints.

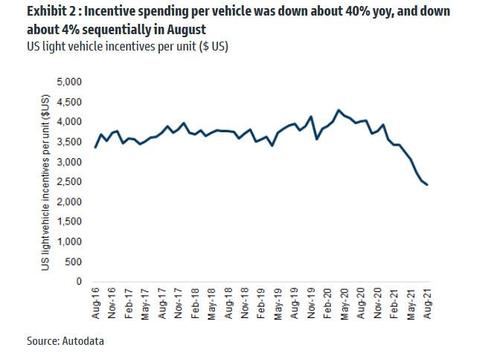

Next, looking at incentives, it is hardly a surprise that with cars flying off the lots,there were barely any. According to Motor Intelligence, August's industry incentive spending per vehicle was down about 40% yoy and down about 4% sequentially to about $2.4k per vehicle. Goldman expects industry pricing to remain strong as components shortages continue to weigh on production in the short term, and dealer inventory remains low.

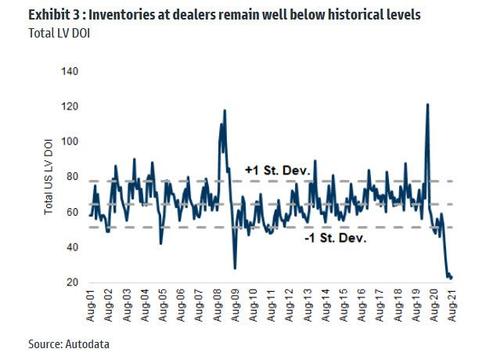

Finally, the elephant in the room remains the inventory level at dealer lots, or rather lack thereof: Inventory at US dealers, already all time low, declined even more and sank sequentially to below 1.0 mn from just above 1.0 mn in July 2021, and down from 2.5 mn in August 2020. Industry DOI came in at 23 days compared to 22 days in July 2021 and 50 days in August 2020. Pickup truck DOI was 32 days (vs. 31 in July 2021 and 50 in August 2020), SUV DOI was 21 days (vs. 20 in July 2021 and 48 in August 2020), and car DOI was 18 days (vs. 19 in July 2021 and 52 in August 2020).

Inventories at dealers continued to fall from already historically low levels, and according to Goldman, it will take time for inventory at dealers to return to normalized levels given the strong demand for vehicles coupled with ongoing supply chain challenges (particularly with semiconductor chip shortages, but also due to shipping constraints).

What are the implications? According to Goldman's auto analyst, "August sales results were well below our preview" as historically low inventory levels (below 1MM units vs. historically in the 3-4MM range) continued to weigh on industry sales but by more than even Goldman had expected. Goldman concludes that the August sales level, coupled with the reduced volumes in recent months and very low inventory, implies downside risk to its full-year CY21 SAAR view, driven by very limited supply "given that inventory declined by about ~50K units mom despite the weaker sales level."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more