Upgrades Based On Momentum, Not Fundamentals

“Davidson” submits:

4/4/2019: “DJ RPC Inc Raised to Overweight From Underweight by Morgan Stanley”

MS double upgrade on RPC Inc. (RES), shows that they waited for Momentum to build before analyst shifted rating-typical example how Wall Street has become permeated with short-term Momentum thinking. It is simply a measure of our time of how short-term result-oriented thinking has deteriorated our long-term understanding of markets and how economics and fundamentals work long-term.

No one is willing to make a longer-term recommendation for fear of being criticized the next couple hours should the price shift against them. Today, it is typical that we see analysts wait till shares have begun to shift in a particular direction before recommendations are shifted accordingly.

Same in news, politics and etc. It is the ‘Gotchya’ environment of elevating oneself at the expense of others. I call this ‘sociopathic thinking’ which has become so dominant on platforms like Twitter and etc. There is a certain segment of the population who seek power over others regardless of where the facts lay. Truth of whatever is present in a situation is lost by short-term thinking in the push to get one’s self ahead of everyone else.

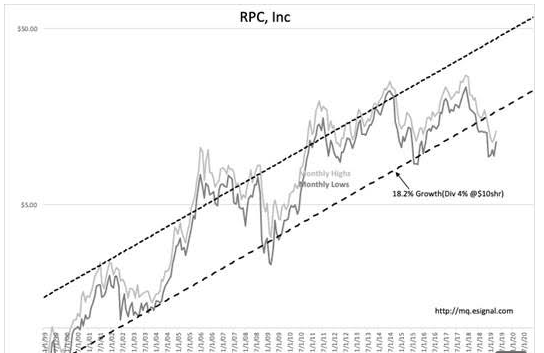

RES is one of my recommendations based on management’s long-term thinking/performance in servicing the oil E&P sector, the chart below. I began to buy mid-teens when it fell below the Monthly Lows Trend and added more at ~$10shr recently when we had the ’Great Depression’ panic last fall. I have a string of energy and industrial related recommendations from mid-2016 based on discounted prices with exceptional management skills similar to RES.

(Click on image to enlarge)

Short-term thinking impacts all institutional and endowment management because most Boards are looking quarter-to-quarter trying to avoid outside criticism which comes instantaneously from every corner and is posted on the Internet for all to see. In the chase for returns, short-term thinking causes even the most prestigious Boards to chase ‘fads of the moment’ turning their activity into Momentum Trading.

I have maintained long-term perspective with the focus on management skill sets. Even with markets becoming increasingly more short-term, the long-term performance of all indices is based on the pace of underlying economic and business fundamentals. It is companies such as RES which provide the performance of their indices long-term even when we have a significant portion of investors chasing FAANG issues.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

moreComments

No Thumbs up yet!

No Thumbs up yet!