Unemployment Rate Shockingly Falls To 8.4 Percent

Great August Jobs Report

Once again, the ADP report was too negative on job creation. In the past few months, it has been too negative, but at a lesser rate each time. At this pace, in the next few months it will re-couple with the BLS report. We won’t be discounting the ADP report next month as much as we did this month. Of course, it’s not like the August ADP report was weak like the initial July reading. Disappointment wasn’t nearly as shocking.

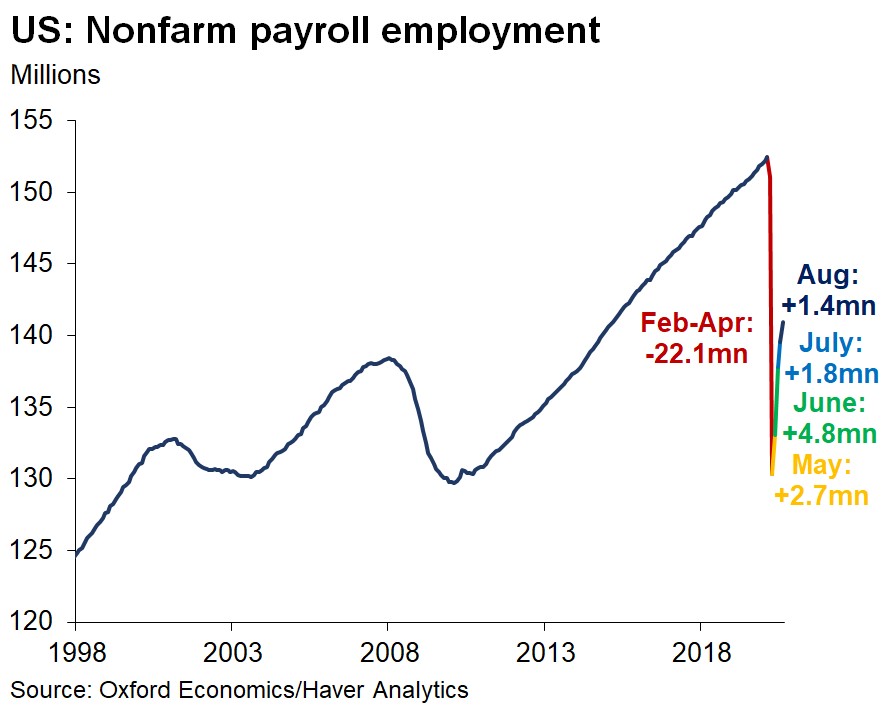

Specifically, there were 1.371 million jobs created in August, which slightly missed estimates for 1.4 million. This was down from 1.734 million. It’s not bad to see sequential declines because the easiest fruit has been picked. In this case, the easy fruit is the temporary job losses that turn back into employment.

As you can see from the chart above, 10.7 million jobs have been added back in the past four months. About 48% of the jobs have come back, which is a huge victory. It’s silly to focus on the 11.5 million shortfall (from before the recession). Obviously, there is still work to be done to fully recover from the recession.

However, recessions never gain all the jobs lost in four months. Secondly, COVID-19 isn’t fully gone. These results are much better than most people expected in April. There was a half V-shaped recovery in employment. Gains will moderate in the rest of the year, unless Abbott (ABT)’s tests allow the economy to get back to normal.

Big Drop In Unemployment Rate

Unemployment rate fell 1.8 % to 8.4%. When I initially saw the estimate for job creation and the unemployment rate, it seemed like the unemployment rate estimate was too high. Sure, the real rate is 0.7% higher because of misclassified workers, but there were misclassified workers last month as well. Further good news, the underemployment rate fell from 16.5% to 14.2%. That’s an even bigger 2.3% drop, which means 0.5% fewer people were marginally attached to the labor force.

Adding to the great news, the labor force participation rate increased. It’s perplexing how the unemployment rate fell much more than expected since job creation slightly missed estimates and the participation actually increased more than estimates. It rose from 61.4% to 61.7%, which was a tick above estimates.

Prime age labor force participation rate rose one tick to 81.4%. It’s below the previous expansion peak of 83.1%. All these great numbers make a fiscal stimulus less likely. That’s not a bad thing, though. It's better that people work than get help from the government. Getting paid more to stay home from work was always a temporary policy.

Where The Jobs Were

The worst part of the labor report was the fact that the government was responsible for the most job creation. It was confusing as to why estimates for government job creation were so low given the hiring for the census. The estimate was for 42,000 jobs created, but the government actually added 344,000 jobs as you can see from the chart below. That means private sector job creation was 1.027 million, which missed estimates for 1.358 million.

Retail trade was next with 248,900. COVID-19 isn’t spread as much in retail stores, so spending in them came back this summer. Leisure and hospitality added 174,000 jobs. This sector still needs to add the most jobs to get back to normal. It’s still being impacted by COVID-19.

A vaccine, treatment, or quick test would help this industry the most. Finally, information added 15,000 jobs, which beat the 1,000 lost shown in the ADP report. That's an important industry because these jobs pay the most.

Temporary Losses Versus Permanent

Share of permanent unemployed rose from 23% to 33% and the share of temporary unemployed fell from 56% to 46%.

We all knew this would happen, but it’s still great to see many of the temporarily unemployed get their jobs back. Remember, almost all the newly temporarily unemployed workers are going to either get laid off or will go back to work within the next few months.

The chart above shows there are 6.16 million temporarily unemployed people. That’s what’s left of the easy fruit to be picked in this labor market recovery. It’s good to see there is still some fruit left with the unemployment rate already in the 8's. A prediction that the unemployment rate would fall below 8% by the end of the year looks very promising.

There are now 3.411 million workers who have permanently been laid off. That’s much less than the peak of 6.818 million after the last recession. Labor market recovery is going to slow considerably when we need to rely on those people getting their jobs back to lower the unemployment rate.

At this recent pace, the permanently unemployed might get to near 5 million by the time the temporary unemployment gets back to normal. That means the unemployment rate might fall to around 7% when we start to see a slower recovery. That’s not terrible. A big variable is if Abbott’s new test causes a burst in economic activity that accelerates the recovery.

Wage Growth

Wage growth was strong as there were 15,000 information workers added. Yearly growth in average hourly earnings stayed at 4.7%, which met estimates. Generally, wage growth isn’t important in recessions and early in recoveries because fewer people are getting the wage growth. Wage growth could also be caused by lower income workers losing their jobs rather than anyone actually getting a pay hike.

Wage growth is starting to matter again as the labor market recovers. Length of the work week rose from 34.5 hours to 34.6 hours, which means weekly earnings growth was strong. Specifically, weekly earnings growth stayed at 5.3%. This strong wage growth and the overall nice spike in job creation caused the 10-year yield to spike 8.3 basis points. That could cause the sector rotation out of growth tech stocks to continue.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more