Ultimate Guide To The Short Strangle Strategy

A short straddle is an advanced options strategy used where a trader would sell a call and a put with the following conditions:

- Both options must use the same underlying stock

- Both options must have the same expiration

- Both call and put options are out of the money (OTM).

A short strangle is established for a net credit and profits if the underlying stock trades in a narrow range between the break-even points. The profit potential is limited to the total premium received minus commissions.

Since selling a short strangle involves selling both a call and a put, the trader gets to collect two premiums up-front, something that makes selling strangles appealing although, there are risks associated with this trade.

A short strangle can result in unlimited loss potential whenever a substantial move occurs so this strategy should be used with caution, particularly around significant market events like an earnings announcement.

Losses in the trade accumulate if the underlying stock makes a substantial move beyond the breakeven points to either the downside or the upside, which can result in unlimited losses.

Selling short strangles is a strategy generally used when the market is experiencing low volatility and no events are expected before the expiration date.

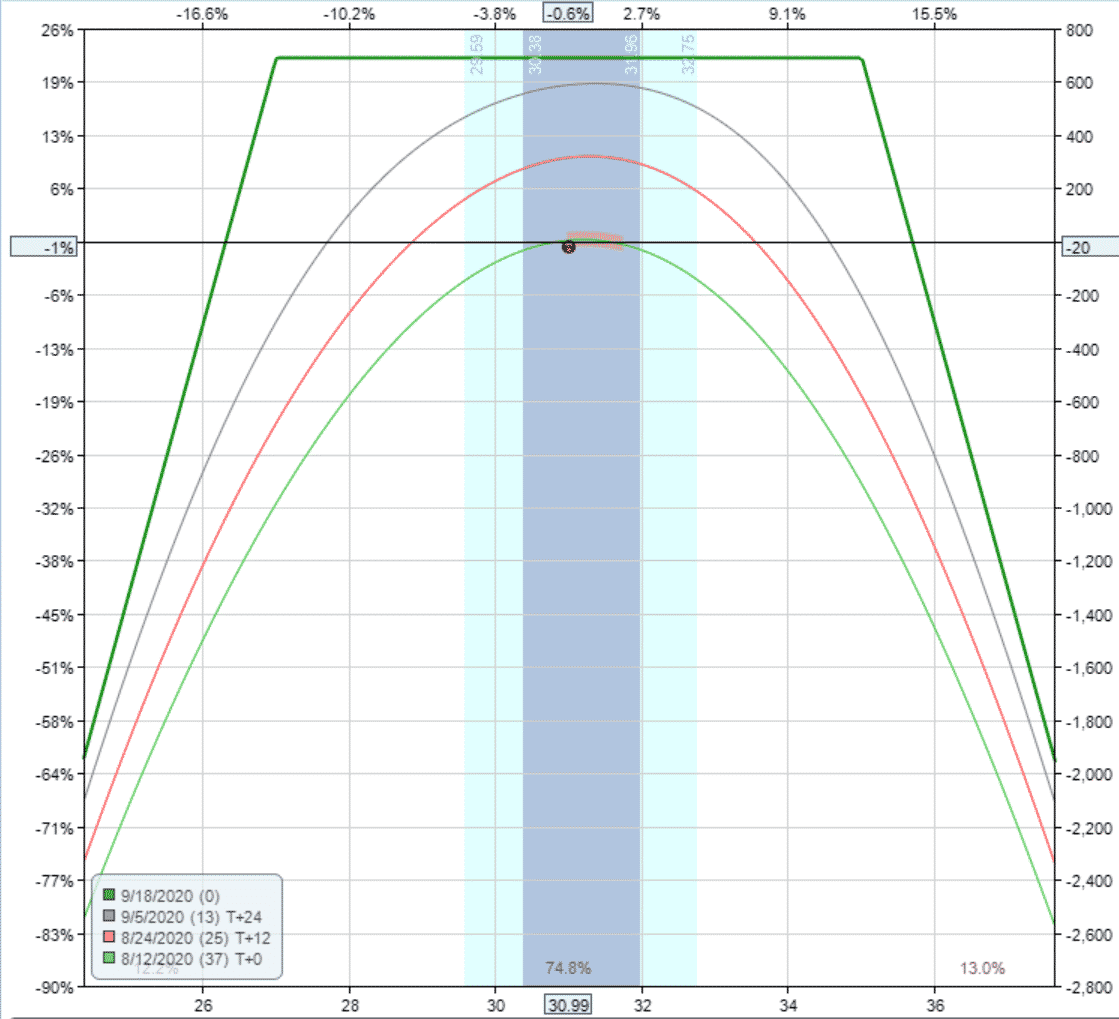

Below we illustrate an example of how a short strangle looks. We are going to use the example below in the next few sections.

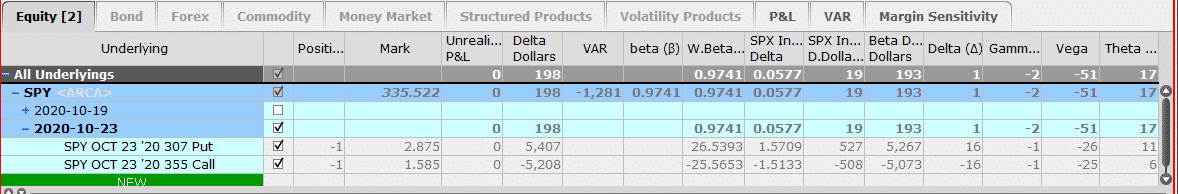

This is a SPY short strangle from September 18th, 2020:

Maximum Loss

Maximum loss is unlimited on the upside because the stock price can rise indefinitely. On the downside, the maximum loss is limited, but only to the extent that the stock price can only fall to zero.

Short strangles involve selling naked options and are not recommended for beginners.

In the example illustrated above, the trader received $446 in premium for selling the out-the-money call and out-the-money put.

Let us assume SPY drops 20%, SPY would trade at $268.50.

The 355 call would expire worthless and the 307 puts would be in-the-money and the loss on this leg would be (307-268.5) x 100 = $3850

Subtracting the credit received, we get a total potential loss on the downside of $3404.

As you can see when things go wrong with this strategy, they can go really wrong, so short strangles should be used with caution and a stop loss should be used.

The loss potential on the upside is theoretically unlimited. Wherever the stock finishes, take the ending price, less the call strike price x 100, and add back the premium.

Maximum Gain

The maximum gain occurs when the underlying stock price is trading between the strike prices of the put and call option when the expiration date is reached.

When this occurs, the call and put options will expire worthless and the gain is equal to the credit received when entering the position.

Using our SPY example, the maximum gain is $446 and would occur if SPY closed between $307 and $355 on expiration.

In reality, most traders will close out their position well before expiry.

We will talk about profit targets and stop losses in one of the sections below.

Breakeven Price

A short strangle has two breakeven prices, which can be found by applying the following formulas:

Upper Breakeven Price = Strike Price of the Short Call + Net Premium Paid

Lower Breakeven Price = Strike Price of the Short Put – Net Premium Paid

In our SPY example, we can calculate the breakeven prices as $302.54 and $359.5.46

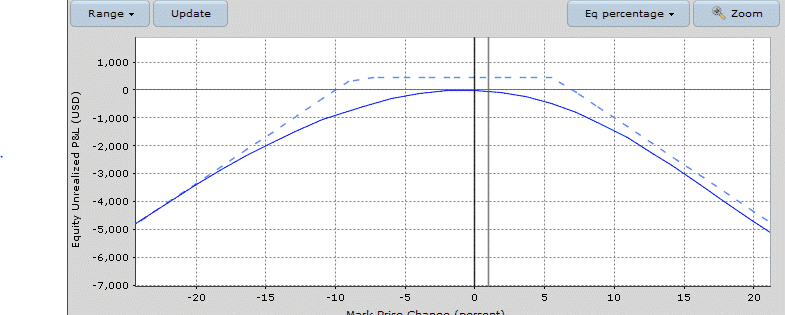

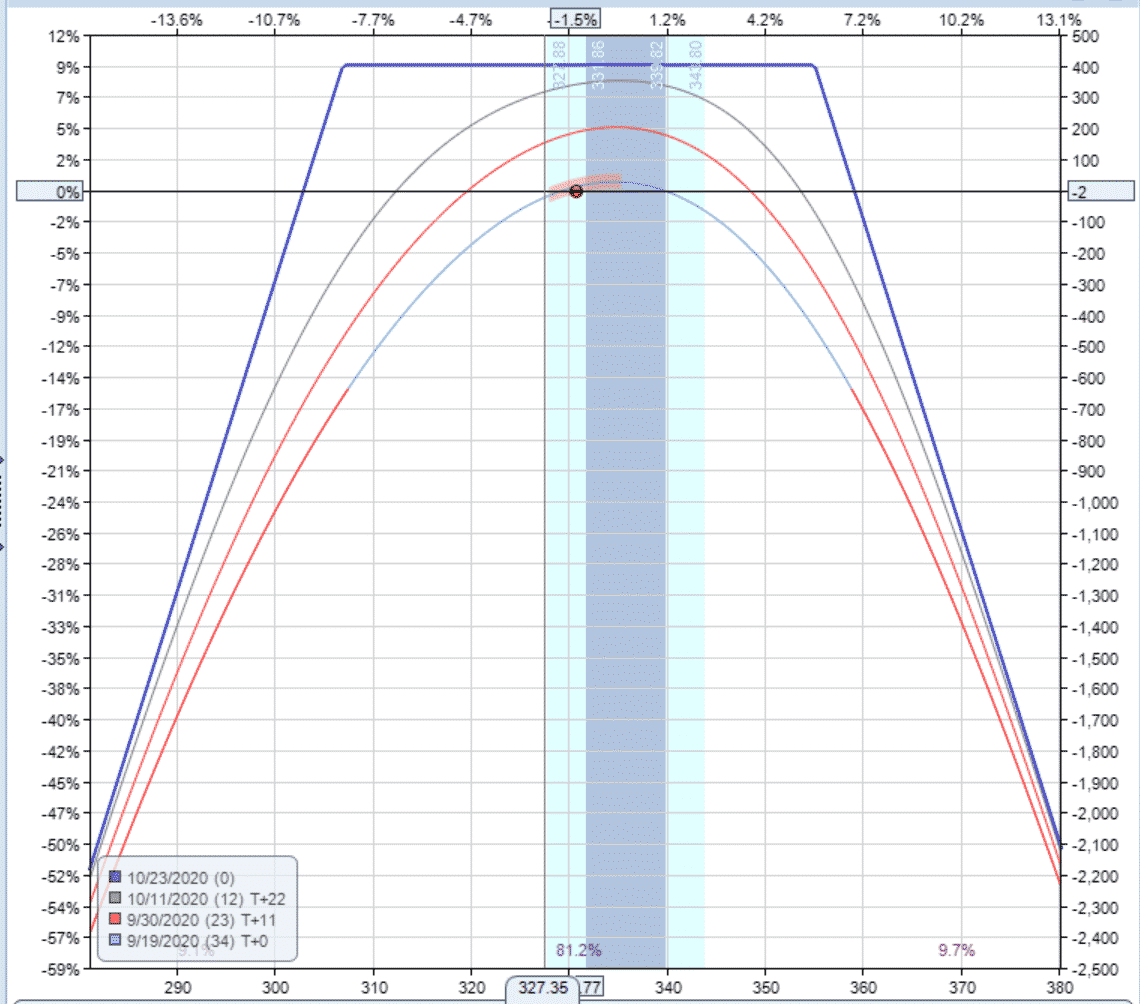

Payoff Diagram

Short strangles have a payoff diagram shown with a dashed line in the graph of the SPY trade. The trade has high gamma, particularly when it approaches expiration.

The ideal scenario for short strangles is when the price of the underlying stock trades in a narrow range between the breakeven points with decreasing volatility.

Below you can see how the trade progresses over time with the T+0, T+11, and T+22 lines shown.

Risk of Early Assignment

There is always a risk of early assignment when you trade American options (individual stocks or ETF). You can mitigate this risk by trading European options (Index options), but they are more expensive.

Usually, early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call to take ownership of the stock before the ex-date and receive the dividend.

For this reason, it is important to watch out for ex-dividend dates. Otherwise, make sure to close the trade if either of the options are significantly in-the-money and do not have much time value remaining.

How Volatility Impacts Short Strangles

Short strangles are short vega trades, so they benefit from falling volatility after the trade has been placed.

Volatility has a big impact on this style of trade.

Our SPY example has a vega of -51 compared to 17 theta and 1 delta, so vega is by far the biggest driver of the trade.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has negative vega, it gets hurt from rising volatility.

Looking at the SPY example above, the position starts with a vega of -51.

This means that for every 1% drop in implied volatility, the trade should gain $51.

The opposite is true if implied volatility rises by 1% – the position would lose $51.

How Theta Impacts Short Strangles

A short strangle is a positive theta trade, this means that it will make money with every day that passes, with all else being equal.

With short strangles, the trader is hoping that the stock does not change in price while time decay acts in his favour.

In our example, the SPY trade had theta of 17 meaning it will make around $17 per day, with all else being equal.

Theta will increase the closer the trade gets to expiry.

Other Greeks

Delta

A short strangle will generally start delta neutral or very close to neutral. Our SPY trade had a delta of 1.

The delta of the trade will change throughout the trade as the stock moves.

If the stock rallies, the spread will become negative delta as the trader wants the stock to move back towards the center of the profit graph.

If the stock falls, the spread will become positive delta as the trader wants the stock to move back towards the middle of the payoff graph.

Gamma

Short strangles are negative gamma meaning they will benefit from stable stock prices.

This also means that delta will become more negative as the stock rallies and more positive as the stock falls.

Gamma will be higher for shorter-dated options.

For this reason, the last week of an option life is referred to as “gamma week”. Many professional traders try to avoid being short gamma during the last week of an options life.

In our SPY example, the short strangle had gamma of -2.

Risks

Price risk and volatility risk are the main risks with short strangles. Big moves in the underlying stock will result in the stock moving out of the profit zone.

Naked options are very risky, and losses could be substantial.

As mentioned in the section on the greeks, a short strangle is a negative vega strategy, which means the position benefits from a fall in implied volatility.

If volatility rises after trade initiation, the position will likely suffer losses.

Changes in volatility are one of the main drivers in the trade and could have a big impact on P&L.

Short strangles held over earnings could result in big losses if the stock makes a big price move.

Although early assignment does not happen often it can theoretically happen at any point during the trade.

The risk is much higher when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low. E.g. a trader would generally not exercise his right to buy SPY at $300 when SPY is trading at $290 purely to receive a $0.50 dividend.

The risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that do not pay dividends or trade indexes that are European style and cannot be exercised early.

However, this should not be the primary factor when determining which underlying instrument to trade.

If you are worried about being assigned and not having enough on the account (margin call), think about closing your short strangle before the ex-dividend date if either of the strikes are close to being in-the-money.

Trade Management

Let’s look at some basic ideas on trade management.

It is important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

There are many things to consider here but let us look at some of the basics of how to manage short strangles.

Profit Target

It is important to have a profit target. That might be 30% of the potential profit or you may plan on holding to expiration provided the stock stays within the profit zone. That is the first decision.

One nice rule of thumb that some traders use is to close the trade if it has made 50% of the profit potential in less than 50% of the duration of the trade.

You may also want to think about including a time factor in your trading rules. How long do you plan on holding the trade if neither your profit target nor stop loss has been hit?

Stop Loss

Having a stop loss is very important, much more than having the profit target.

With short strangles, you can set a stop loss based on the premium received.

Some traders like to set a stop loss at 1.5x or 2x the premium received.

Whatever you decide, make sure it is written down and mapped out in your trading plan.

Short Strangle vs Short Straddle

The main difference between a short straddle and a short strangle is that in a short straddle you sell the call and the put at the same strike price.

However, in case of a strangle you sell the calls and puts out-of-the-money.

This results in less premium received but potential a greater margin for error if the stock does make a big move.

The combination of a short call and a short put at-the-money in a short straddle has more extrinsic value than the one we get after selling a strangle, but the profit range in a straddle is narrower

Some option sellers prefer short strangles over short straddles as it gives them a much larger safety zone.

Short Strangles vs Iron Condors

Short strangles and iron condors have quite similar payoff diagrams but there are some differences.

Short strangles are two-legged options trades with undefined risk, whereas iron condors are four-legged strategies with a known maximum profit and loss on entry.

The defined risk nature of the iron condor reduces the margin requirement compared to a strangle, but it also lowers the probability of profit on the strategy.

Iron condors have a lower theta decay and a less negative vega meaning falling volatility will be less benefit to an iron condor vs a short strangle.

Short-Term vs Long-Term Short Strangles

Long-term strangles have lower theta than short-term strangles, the further out in time the strangle is, the slower it decays.

Generally speaking, a volatility spike will impact shorter-term options much more than longer-term options.

When selling strangles traders should have a strong opinion that volatility will fall.

Short term strangles are more sensitive to gamma risk, in particular during the expiration week. The profit and loss can fluctuate very quickly in the last week.

Short term strangles will move very quickly compared to long term strangles.

Selecting Short Strangle Strikes

The selection of the short strangle strikes depends on factors like the volatility of the markets and the amount of premium the trader wants to collect from selling the short strangle.

There are three main ways to choose the short strikes when selling a strangle:

- Use delta. I.e. Sell 10 delta or 15 delta

- Use standard deviation. i.e. sell strikes 1 or 2 standard deviations away from the current price

- Use technical analysis (Bollinger bands or other technical indicators)

Using a combination of all three criteria makes sense, but you also do not want to overcomplicate things. It is fine to just sell 15 delta strangles. This method takes into account any market fluctuation leading to an increase in the volatility.

Short Strangle Example

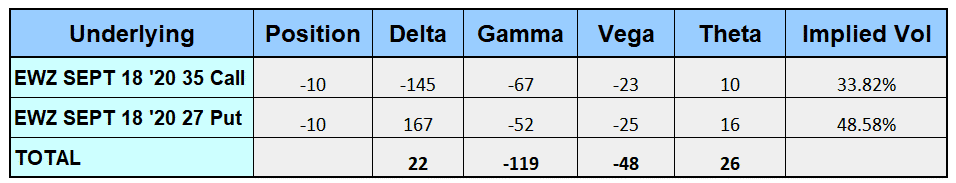

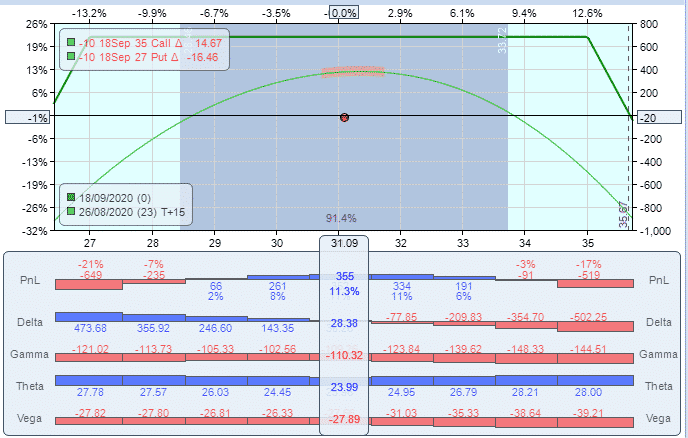

Let’s go through an example of a short strangle and see how the position progressed throughout the trade.

This trade was on EWZ (Brazilian ETF) and was entered on August 11th of 2020.

Date: August 11, 2020

Current Price: $30.99

Trade Set Up:

Sell 10 EWZ September 18th, 35 call @ $0.24

Sell 10 EWZ September 18th, 27 put @ $0.46

Premium: $700 Net Credit

By August 26th, the profit has risen to $355 and it was time to close out the trade. This is a nice easy example. Things don’t always work out this well.

Notice that the EWZ price did not change too much during the trade. On August 26th, the stock was trading at $31.13

It was possible to close the position earlier because vega collapsed from -48.51 to -27.89.

Summary

Short strangles are popular among theta traders due to the high level of time decay. However, traders need to weigh up that benefit with the risk of the stock making a big move.

This trade strategy has high gamma which means that big moves in the price of the underlying will have a significant negative impact on P&L.

When it comes to short strangles, a good rule of thumb for taking profits is if 50% of the premium has been made in less than 50% of the time.

Stop losses should be set at around 1.5x to 2x the premium received.

This options strategy is not recommended for traders with less than 12 months of experience trading real capital.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more