Trump: How You Like Me Know?

Market Wrap

It’s often said that the market like to buy the rumor and sell the news and yesterday was a textbook example of the first part of this. Major broad equity indexes were up across the board with small caps leading the way as the Russell 2000 rose 1.65%. Technology played into overall results as the Dow added 0.56%, the S&P 500 gained 0.67%, and the Nasdaq Composite closed 0.87% higher. Sectors were also higher except for Consumer Staples which saw gains in staples retailers like Costco Wholesale (COST), Walmart (WMT) and Target (TGT) edged out by losses in staples producers like Altria Group (MO), Mondelez International (MDLZ) and Proctor & Gamble (PG). The remaining sectors saw results ranging from 0.14% (Energy) to 1.90% (Consumer Discretionary), with Industrials following, rising 0.94%.

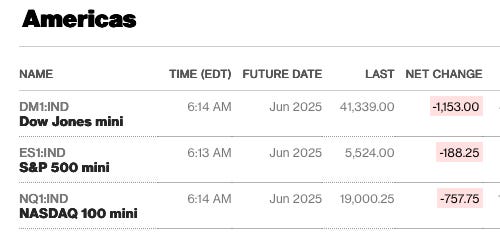

While technically not part of the official trading day, aftermarket futures had a pretty definitive reaction to “LiberationDay” as eMini futures fell 1.81% (Dow), 3.24% (S&P 500), and 4.00% (Nasdaq 100) by the 6:00 pm trading resumption following the daily maintenance break. If there was ever a “morning after the night before”, this might be it.

Source: Bloomberg, April 3, 2025

Market volatility edged lower by the close but remained elevated as the Cboe Market Volatility Index (VIX) fell to 21.51. Gold buyers did not ease off the “Buy” button, pushing the traditional hedge to $3,133.70/oz.

The Tematica Select Model Suite had an overall positive day except for Luxury Buying Boom which saw luxury shoe producers drag their heels during yesterday’s session. Leadership came from Space Economy, Safety & Security, and Rebuilding America. A reminder that it is not lost on us that Market Hedge still sits on top of the YTD leaderboard. If tariff economic impact expectations coupled with broad market index futures trading (June contract quoted) are any indication, we expect this trend to remain in place for at least the short term if not longer.

Trump: How You Like Me Now?

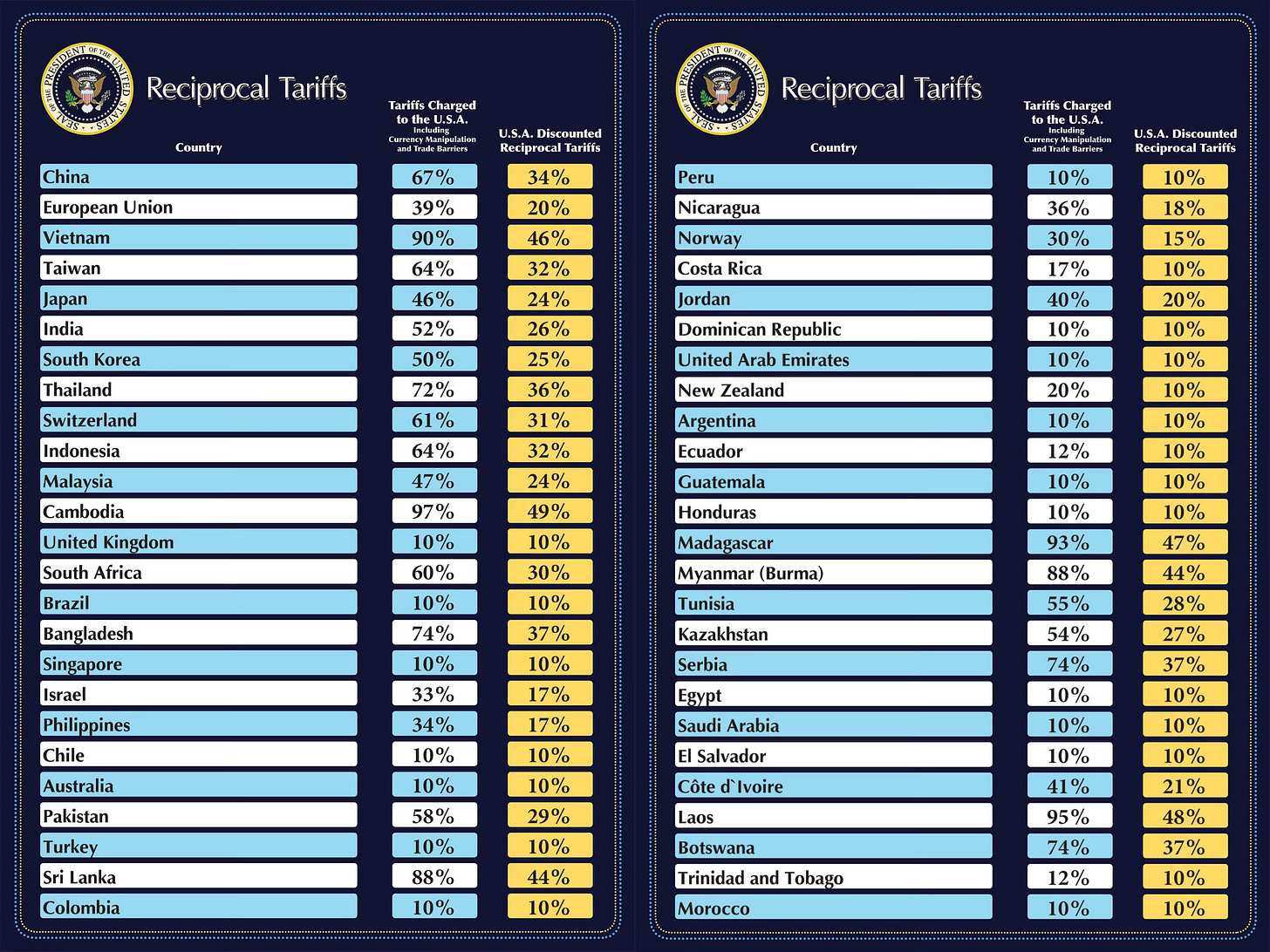

Global markets are reacting to arguably larger-than-expected Trump reciprocal tariffs announced yesterday and the start of tariffs on autos and auto parts. While markets are absorbing yesterday’s announcement, our concern remains focused on potential responses from tariff-slapped countries and companies as well as the reformulation of earnings expectations by market participants. In full, over 180 countries and territories are subject to Trump tariffs announced yesterday, with reciprocal rates on ~90 countries set to become effective on April 9 while a baseline across-the-board tax of 10% to all imports to the US begins on April 5.

Early this morning, we are already seeing responses being formulated. Volvo CEO Håkan Samuelsson shared the company “will have to increase the number of cars we build in the US and surely move another model to that factory”. Mercedes Benz Group AG is considering shifting the production of another vehicle model to the US and is also reportedly considering cutting sales of lower-margin imports. After being hit with 30% tariffs, South Africa is reportedly seeking to negotiate a new “bilateral and mutually beneficial trade agreement”, and India’s Department of Commerce is also “carefully examining the implications”. Prime Minister Keir Starmer of Britain said negotiations toward a trade deal with the U.S. would continue and did not suggest any immediate retaliation.

Others, however, are at least verbally pushing back on Trump’s tariffs and our thinking is the coming days could either lead to new trade deals or actions that could escalate a trade war. Prime Minister Pedro Sánchez of Spain has challenged the Trump administration’s argument that the latest tariffs are “reciprocal”. Denmark’s industry minister, Morten Bodskov, said the country was ready to “stand firm” in response to Trump’s tariffs. Taiwan’s government condemned the tariffs as unreasonable and said it would lodge a strong protest with the U.S. trade representative. European Commission President Ursula von der Leyen responded to the tariffs announcements by saying the European Union is preparing further countermeasures against US tariffs if negotiations fail.

We’ve discussed in recent days how all this uncertainty along with slowing consumer spending, business uncertainty, and other factors are poised to weigh on June quarter guidance. Developments in the last 24 hours haven’t changed that, more likely they have raised the likelihood companies take an even more conservative approach. If you think this sounds like more market volatility ahead, we are inclined to agree with you.

The question to ponder then is what could lead the market to rebound in a sustained manner.

As of now, we see three possibilities:

- Trump and other countries negotiate trade deals that render yesterday’s reciprocal tariffs mute. Possible.

- The Fed cuts interest rates, but the odds of that are at least questionable given recent inflation data and the potential for tariffs to stoke those figures higher. UBS is out with the following - "Simple back-of-envelope calculations suggest a permanent implementation of the full set of proposed tariffs would see inflation rise to around 5% as prices adjust to the higher costs of imports." Directionally not good for rate cuts.

- Trump delivers on tax cuts. TBD.

We’ll continue to follow those scenarios and identify others that could rescue the market, but gaming it out, the market could recover some from extremely oversold levels in the coming days, but we’re not out of the woods.

Next items to watch include today’s March ISM Services PMI report, tomorrow’s March Employment Report, and comments from Fed Chair Powell late tomorrow morning.

More By This Author:

Tariff Clarity? Earnings Pre- Announcements?Trump Auto Tariffs, Fed Speakers, CoreWeave’s IPO

Trump And April Tariffs - Will He Or Won’t He?

Disclosure: None.