Treasuries: Thoughts On The Lousy 10-Year Auction And What It Means For Yields

Image source: Pixabay

We’ve had a crazy few trading days (though tension was building up over the past three weeks), growing worries over economic growth, wild FX moves, and a 10-year yield that touched 3.66% early Monday morning and was at 3.93% just before this week’s 10-year auction. One would have thought that the sale would do just fine with that backdrop but no, the auction was terrible.

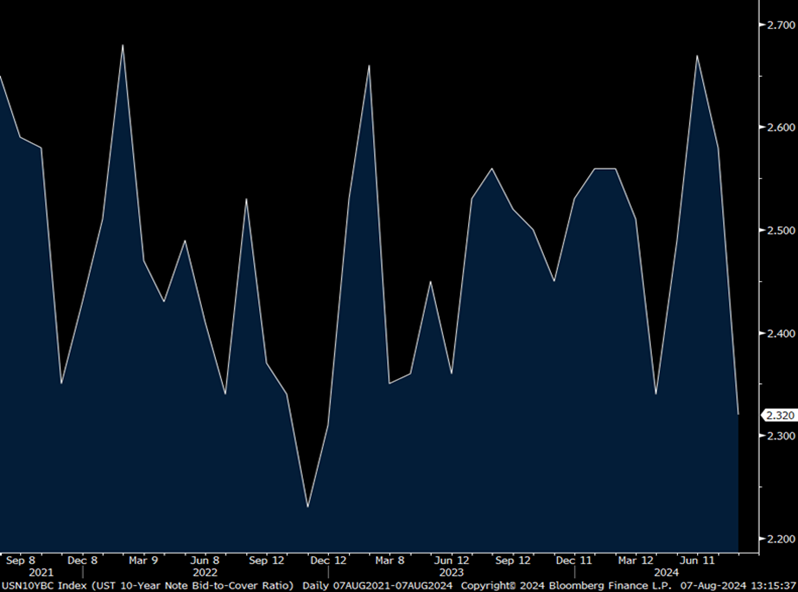

The yield of 3.96% was well above the when-issued of 3.93%. The bid-to-cover ratio of 2.32 was well below the 1-year average of 2.52 and the weakest since December 2022. Dealers were also left with 82% of the auction, the second-highest since last October.

10-Year Bid-to-Cover Ratio

There is the simple trade of buying duration when inflation moderates and worries grow that the economy will slow. But maybe it’s just not that easy.

Maybe these wild FX moves are dissuading foreigners from buying US Treasuries?

Maybe the Federal Reserve is not going to cut 50 bps in September as policymakers have more faith in the US economy?

Maybe debts and deficits really do matter this time and if the economy rolls over and the unemployment rate rises, the US government will collect less in tax receipts? And that $2 trillion deficit becomes $3 trillion and that 6% budget deficit as a percent of GDP will be 10%? That would entail a lot more bond supply.

I believe that 3.66% Monday morning yield will stick for a while as the low. I also still think there is a good chance that long-term rates stay higher for a while (and for not all good reasons, aka debts and deficits finally matter and foreigners are not much of a help anymore).

I get the economic bull case for longer term Treasuries. But as I said, maybe it’s just not that easy as the bond bull market of 40 years is over.

More By This Author:

Eli Lilly: A Pharmaceutical Juggernaut That Just Crushed Earnings EstimatesDespite Selloff, This Stock Market Still Has These 3 Things Going For It

Buy & Hold Forever: Farmers & Merchants Bancorp

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more