Top 3 Investment Themes To Watch In 2022

Investment themes to watch in 2022: central banks to tolerate higher inflation, the green transition, and bullish TIPS.

With only two trading days left in the year, investors have already made their plans for 2022. With so many variables to consider due to the COVID-19 pandemic, planning is more difficult than it used to be.

The pandemic has hit the Northern hemisphere economies again. Once winter settled, the infection rate jumped as people spend more time indoors, and a new variant, called omicron, spreads faster than the previous ones.

Yet, pandemic or not, the world moves ahead, and financial market participants prepare for a new year living with covid. And, most likely, with higher inflation.

Here are the top three investment themes to watch in 2022: central banks to tolerate higher inflation, the green transition, and bullish TIPS.

(Click on image to enlarge)

Central banks to tolerate higher inflation

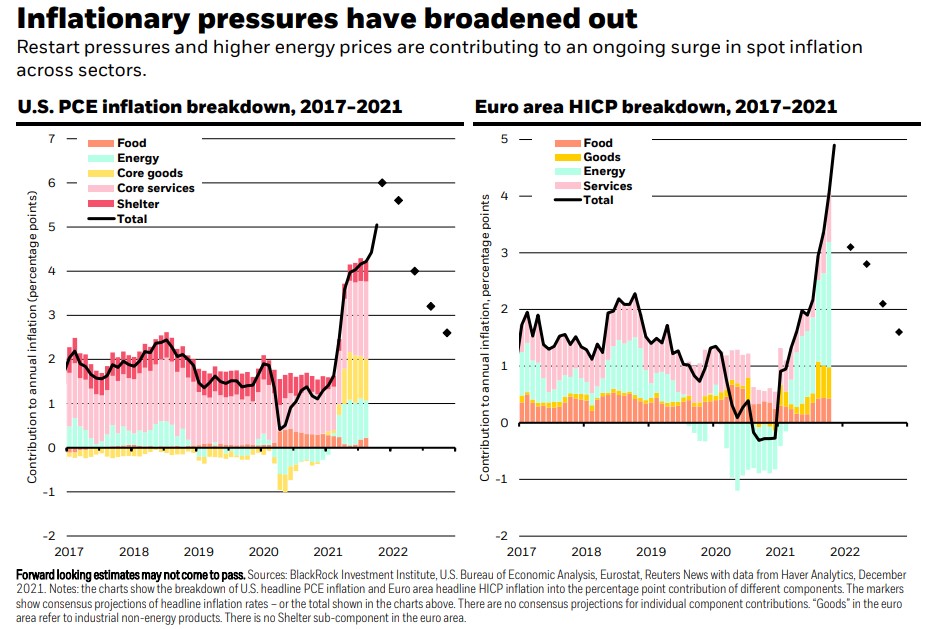

One of the surprises in the last part of the trading year was the Federal Reserve of the United States admitting that inflation is not “transitory” anymore. Inflationary pressures have broadened up in the two major economies in the world, the United States and the Euro area.

While the Fed is forecast to raise the rates next year, the ECB is in no hurry to do so, regardless of the fact that inflation is much higher than the target. In other words, central banks will tolerate higher inflation, and market participants need to adjust their strategies accordingly.

The green transition

Developed nations have intensified their efforts to meet the net-zero emissions goals. As such, the green transition is closely monitored because it is viewed as a decades-long supply shock.

Things have already started to move. In Europe, Spain has just received EUR10 billion from the Next Generation EU funds and a big part of the amount goes into developing and supporting green projects.

Bullish TIPS

TIPS are Treasury Inflation-Protected Securities designed to provide protection against inflation. Because of higher medium-term inflation expectations, the flows into TIPS are likely to accelerate at least in the first part of the year.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more