Top 10 Big-Dividend Energy Stocks (6% To 14% Yields)

Summary

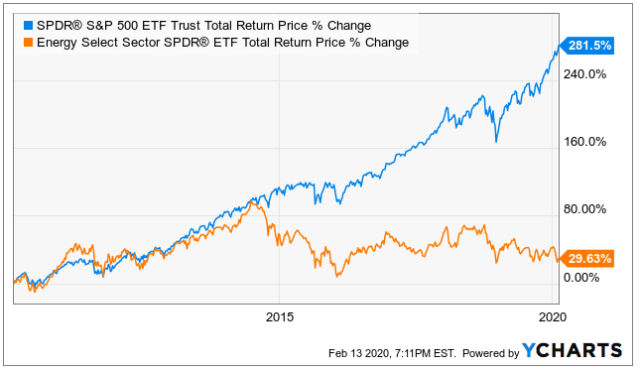

- The energy sector has lagged the market significantly.

- Low commodity prices is one big obvious reason, ESG divestment is another cause of significant selling pressure.

- Despite the low prices, some energy stocks remain powerful cash flow machines, and offer big attractive dividend yields. We rank our Top 10.

There are two big reasons energy stocks are down, and they are both creating some very attractive big-dividend investment opportunities. First, new technologies (such as hydraulic fracturing) have increased supply, and brought energy prices sharply lower in the past half-decade. And second, the massive wave of so-called “sustainable” and “ESG” investors (ESG stands for Environmental, Social and Governance) have put truly massive selling pressure on “fossil fuel” stocks. However interestingly, as ultra-billionaire Bill Gates recently explained (fairly accurately):

”Divestment, to date, probably has reduced about zero tonnes of emissions. It’s not like you’ve capital-starved [the] people making steel and gasoline.”

It seems the point Gates is trying to make is that even though the massive divestment wave can have a very negative impact on share prices, it has had very little (practically negligible) impact on the businesses—which means many of them still have plenty of wherewithal to keep paying and growing those big dividend payments to shareholders. And their yields are unusually and attractively high (a compelling characteristic if you are an income-focused investor).

In this report, we highlight our Top 10 Big-Dividend Energy Stocks. All of them currently offer attractive prices (i.e. they’re oversold because the market has either fearfully overreacted to low energy prices, or ESG investors have forced the share prices lower for non-financial reasons), and they all offer very attractive big dividend payments to investors.

Opportunity Overview:

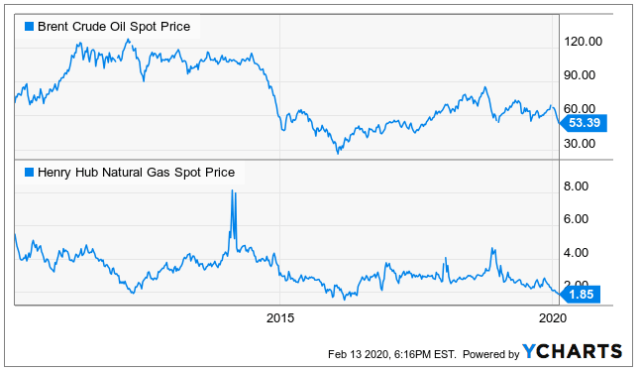

Before we get into the specific names, it’s worth sharing some data on the two big themes (i.e. lower energy prices and ESG selling pressure). Regarding energy prices, the analysis is fairly straight forward. There is a high correlation between the profitability of these companies (they all have different “break even energy prices), their share prices, and energy prices. And here is a look at what’s happened to energy prices over the last decade:

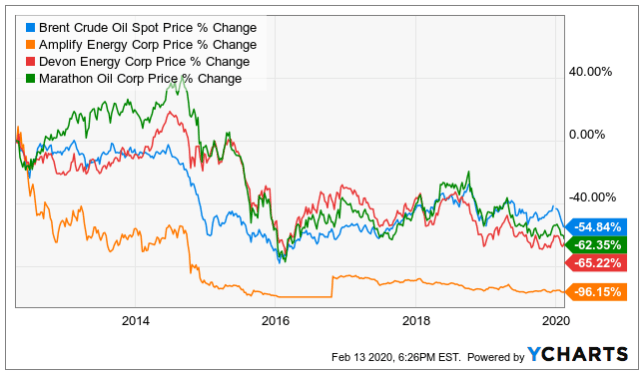

And even though all energy companies are not the same (in fact, they are vastly different based on their businesses, their management teams, their financial strengths, their break even prices and much more), they have most all been impacted by energy prices. Fore perspective, here is a look at how closely the stock prices of major energy exploration and production companies follow the price of oil (as oil prices crashed in 2014, so did these share prices):

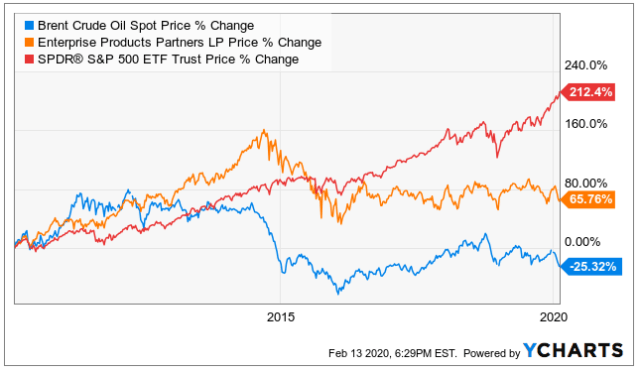

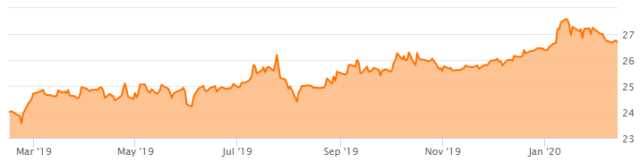

And even though some energy company’s prices shouldn’t follow oil prices too closely, they do. For example, Energy Products Partners (EPD) (a company we just wrote about in great detail) shouldn’t in the short term so much because its business is based on long-term midstream contracts, but it does as you can see in the following chart:

ESG Selling Pressure:

Regarding “ESG divestors’” impact on energy stock prices, it is arguably enormous. For example, according to Wikipedia (emphasis ours):

“Fossil fuel divestment campaigns emerged on campuses in the United States in 2010 with students urging their administrations to turn endowment investments in the fossil fuel industry into investments in clean energy and communities most impacted by climate change. By 2015, fossil fuel divestment was reportedly the fastest growing divestment movement in history. By December 2019, a total of 1,200 institutions and over 58,000 individuals representing $12 trillion in assets worldwide had been divested from fossil fuels.”

That alone has created enormous selling pressure that, according to Bill Gates, “probably has reduced about zero tonnes of emissions.” Said differently, it may be impacting their share prices, but not their ability to pay dividends. Of course, not all $12 trillion of those assets were invested in energy stocks to begin with, but considering energy and fossil fuel companies makes up a significant portion of the total global publicly-traded equity market cap (total global equity market cap is around $90 trillion), the selling pressure is very real.

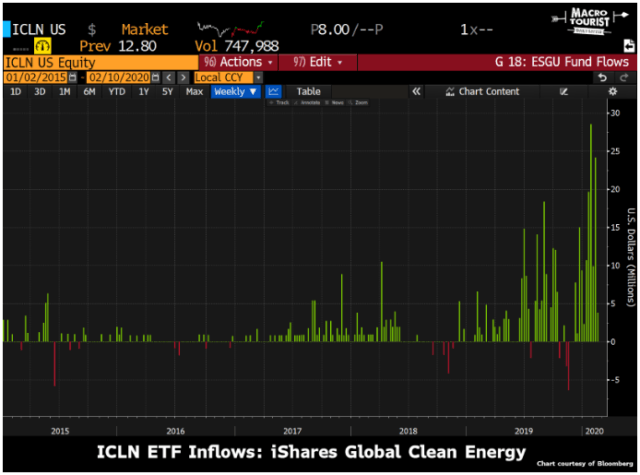

To add a little more near-term perspective on ESG investing, here is a look at inflows to the iShares Global Clean Energy ETF in recenty years (courtesy of The Macro Tourist).

These inflow are dramatic, and it is consistent with other ESG Funds The Macro Tourist also shares in his article. In fact, he explains about ESG investing:

“Money has poured in over the last quarter. This is the hottest investment theme out there bar none.”

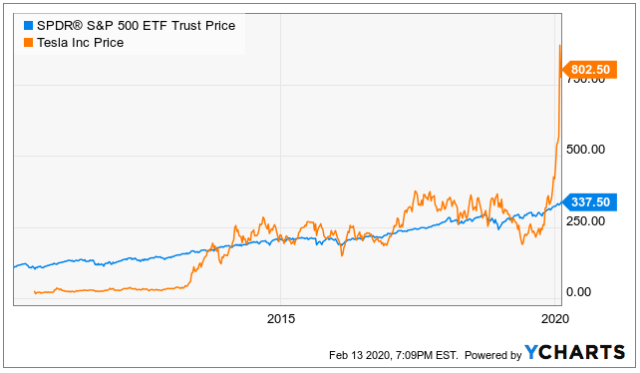

Entertainingly, the same article suggests part of the reason Tesla (TSLA) stock has done so well is because just about every ESG fund in the world MUST own this alternative energy car company. “How can a portfolio manager run an E.S.G mandate without owning Tesla?”

However, the flip side of all this clean energy / ESG investing theme is that money does NOT pour into the shares of traditional energy companies on a massive scale, and that is a huge contributor to the inappropriately low share prices and very high dividend yields of SOME energy stocks.

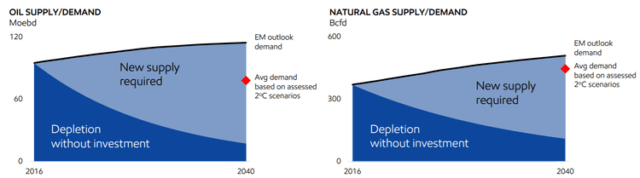

Fossil Fuel Demand Will Remain Robust

In reality, the world is extremely unlikely to transition dramatically to alternate sources of energy for decades. For example, the International Energy Agency (“IEA”) estimates approximately $21 trillion of oil and natural gas investment will be needed by 2040. For example, the chart below indicates that oil & natural gas demand will continue to remain robust even in 2040. This means a lot of big oil businesses will continue to be cash cows and will remain so in the future as global demand persists.

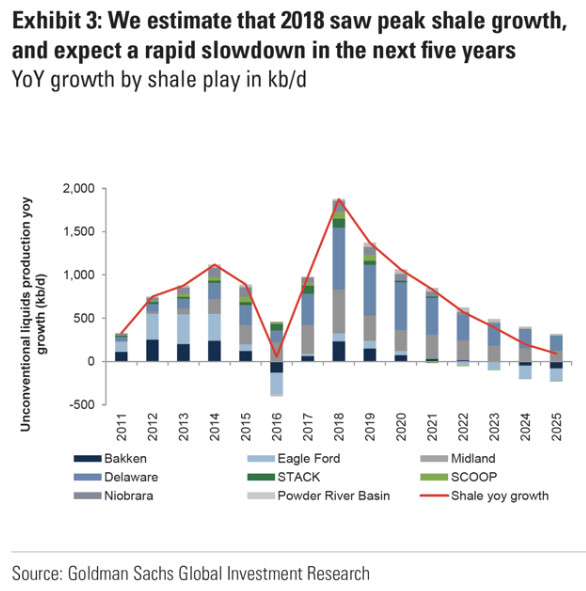

Further, some analysts expect a dramatic slowdown in shale production (i.e. new technology we mentioned earlier), which was a major driver of energy price declines, and could therefore provide more strength to prices going forward—a good thing for the fossil fuel industry.

Our Top 10 Big-Dividend Energy Stocks

And given the current industry dynamics, we’ve scoured the traditional energy space, and completed detailed reports on our Top 10 Big-Dividend Energy Stocks, all of which have powerful cash flow to support their dividends. And without further ado, here is our ranking countdown from #10 to #1…

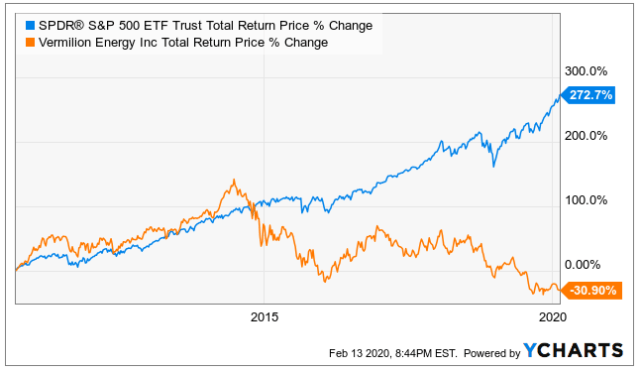

10. Vermilion Energy (VET),Yield: 14.4% (Paid Monthly)

With a yield this big, it’s bound to have some warts on it, but it made our list for its attractive cash flow power and the sharply discounted price. If you don’t know, Vermilion is a Canada based, global oil and gas producer with operations in North America, Europe and Australia. The company’s stock trades both in Canada as well as the US.

For your consideration, we’ve highlighted important risks and rewards in our recent full Vermilion report.

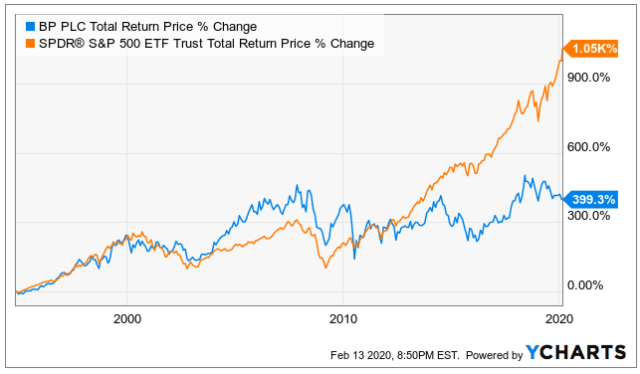

9. BP Plc (BP), Yield 6.8%

BP has had a target on its back since the deep water horizon oil spill and it continues to pay penalties for that to this day. However, the upside is that it is a dramatically safer and well run business. It also pays a very large and very safe dividend, and trades at an attractively discounted price.

You can access our recent full report on BP here.

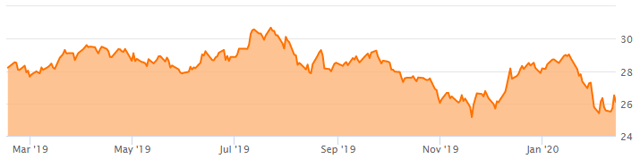

8. GasLog Partners Preferred (GLOP), Yield 9.0%

GasLog Partners (GLOP) just announced all time high revenue, EBITDA and distributable cash flow, not to mention a solid 1.2x distribution coverage ratio. The company also raised its distribution in 2019 and bought back a significant amount of its common units. Further still, during the latest earnings call, management explained they remain very confident in the company’s long-term outlook. This all sounds like a very attractive business, but the units plummeted about 49% after the earnings announcement because management dramatically reduced the upcoming distribution payment to unitholders, explaining they are “moving to a strategy that prioritizes the strengthening of our balance sheet through debt reductions.” In our view, these actions make the company’s preferred units significantly more attractive (because it frees up more cash flow to support them), yet the preferreds were dragged lower in sympathy with the common, thereby creating an increasingly attractive buying opportunity in GasLog’s 9.0% yield preferred units.

You can access our recent full report on GLOP.PA here.

7b. Enterprise Product Partners (EPD), Yield: 6.7%

Enterprise Products Partners L.P. is a best-in-class American oil and natural gas midstream service provider with its headquarters in Houston, Texas.

In the following report, we analyze the company’s business model, income, growth, distribution prospects and our opinion on why EPD offers such an attractive balance between risks and rewards. EPD Full Report.

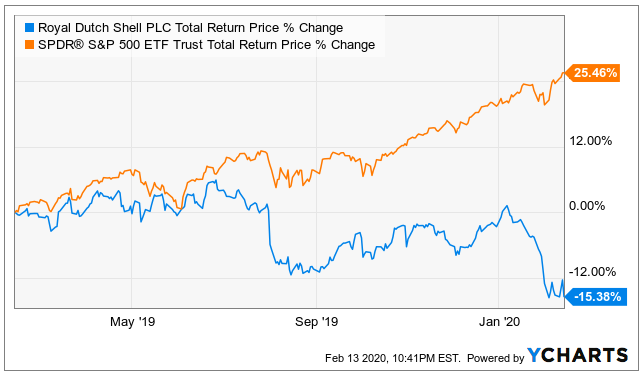

7a. Royal Dutch Shell (RDS-B), Yield: 7.0%

The dividend of this integrated oil and gas company is very safe, yet the yield has ballooned to 7% as inappropriate selling pressure has driven down the share price.

Given the health of the business, the shares are a buy, and you can access our previous RDS full report here.

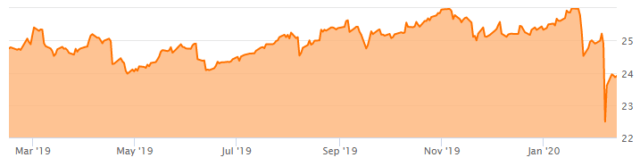

6. Seaspan Preferred (SSW.PI), Yield: 7.5%

If it’s steady high-income you’re looking for, Seaspan’s series I preferred shares (SSW.PI) are worth considering. You shouldn’t expect any price appreciation for these shares (they’ll continue to hover right around $25), but the big quarterly dividend payments are supported by a strong growing business (Seaspan’s fleet has grown dramatically while simultaneously increasing operational efficiency), strong financials (access to cash on favorable terms) and favorable industry dynamics (demand for Seaspan’s differentiated fleet). Further, the 7.8% dividend yield will go a lot farther than most other income investments, and it’ll do so with considerably less volatility risk and stress.

You can access our previous Seaspan Full Report here.

The remainder of this article (i.e. Our Top 5 Big-Dividend Energy Stocks) is reserved for Big Dividends ...

more