Three Things I Think – New Years Edition

Image Source: Pexels

Here are some things I think I am thinking about.

1) Book update.

Please excuse the radio silence in recent weeks. I wrapped up my new book this week and I am just putting the finishing touches on it, but I’ve been burning the midnight oil every night for the last two months.

I am very excited about this one. It’s been ten years since I published Pragmatic Capitalism and I have to laugh looking back at that one because this new book is infinitely better in my opinion. Granted, I am much smarter and more handsome than I was back then, but that book was dense and academic at times, intentionally so, and even though it’s an educational read, I don’t consider it a fun read. This one is a very different animal.

In this book, I review a whole bunch of investment strategies and approaches with the goal of helping people understand and find their perfect portfolio. It’s written in my voice with my lame humor. But I also think you’ll learn a lot from reading it. It turned out long (300 pages, oops), but each chapter is its own historical and educational look at a popular strategy so it’s not something you have to read sequentially.

I ended up signing with Harriman House to publish so we still have to go through the editing and design process, but I can’t wait to get this one out to the public.

2) No Recession in Sight.

My general theory in the last few years has been simple – the economy is reverting from the pandemic and that would be a bumpy ride. And as we’ve been undergoing that process the Fed had to aggressively raise rates to help curb inflation. That process isn’t exactly over, but it’s mostly over as inflation has fallen very significantly, even if it’s not below the Fed’s 2% target just yet.

My baseline has been for lower, but positive growth with the outside risk of a shock to the economy if the Fed overtightened. That obviously hasn’t transpired and if anything the US economy has been more robust than I expected. Interestingly, the global economy has been weak and the impact of rate hikes has been much clearer there. However, the USA appears to be experiencing a unique artificial intelligence boom that is helping to bolster the economy. This is most obvious in US capital markets where tech has held everything up. But outside of tech, the markets have been pretty bleh.

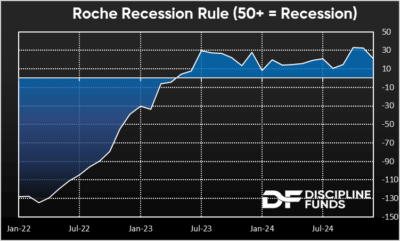

That said, it continues to be a super strange environment and it’s likely to get even stranger when Trump takes over. My recession rule is still well below 50 (the level at which a recession is virtually certain) and has actually been turned down with Friday’s labor market data. But the markets aren’t the economy and you’ve got this softness and potential for more mean reversion in the economy combined with very optimistic market expectations where virtually everyone views the USA and especially US tech as the only game in town. If that sentiment were to shift it would make for a very wild ride in the markets.

I really don’t know what 2025 has in store for us all. My baseline view on Trump is that he’s good for stocks and business. The outside risk is that these tariffs and cuts to the government end up being counterproductive in the near term, perhaps significantly. But for now things look pretty good and we’ll have to see how much of this tariff talk is Trump just being loud….

3) Happy New Year.

I just wanted to wish you all a happy 2025. The year isn’t off to a great start, at least for those of us in Southern CA. The fires in Los Angeles are beyond tragic. I just can’t imagine waking up one morning and dealing with your house being gone. And the worst part about it all is that all I see is people pointing fingers. Look, I’ll be the first person to tell you that CA politics is sideways in a lot of ways, but those of us living in CA also know how crazy this weather has been. We’ve had zero rain for 9 months. And then we got a 100MPH Santa Ana windstorm. You’re talking about the perfect recipe for wildfires that no amount of water and fire prep is stopping.

Anyhow, I wish the narrative was more about how to help all these people rather than finger-pointing. But I guess that’s the state of the country these days. We don’t seem to look at each other so much as countrymen and instead view everything through the lens of blue vs red (even though we’re mostly purple). But hey, if you do want to help here’s a great charity to contribute to that gives directly to wildfire victims in need.

I hope 2025 is a great year for you all, regardless of your politics. I am having a blast with my daughters even though I am still looking for the man who gave them their red hair. I can’t believe they’re 3 and 4 years old already. Everyone tells you the time flies, but it’s flying faster than they told me. I am working on a way to bottle them up and stop them from growing. I can do it. But until I figure that out I am just trying to enjoy every second.

More By This Author:

Global Diversification Is Still WorkingStrategic Reserves And Stuff

Weekend Reading – BBB Edition

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more