Three Things – Weekend Reading: Saturday, Aug 10

Image Source: Pexels

Here are some things I think I am thinking about this weekend:

1) The Panicky Emotions of Short-Termism

What a wild week for the market. After closing down 2.5% on Monday following the panicky response to the previous Friday’s job report, the market ended the week…flat. If you’d been on vacation all week and just looked at your account balances you’d have thought that nothing even happened.

It’s a good reminder to be careful about short-termism. Trying to predict the movements of a manic market like this is like trying to predict what a schizophrenic will think over the next week. We. Do. Not. Know.

But I always enjoy the back-and-forth banter from bulls and bears during weeks like this because it’s all so noisy. In my Defined Duration methodology the stock market is a 19-year instrument at present. It is an instrument that, if you hold it for 19 years, you can have a very high probability of earning 6-7% real returns. But you have to be incredibly patient to let corporations accrue the profits that ultimately drive their public market returns. This doesn’t happen quickly and the lifetime of a corporation can be incredibly long. Despite this, people often treat the stock market like it’s an instrument that you can trade over a day, week, or even a year. This is something I fundamentally disagree with and the irrationality of it all comes out in weeks like this.

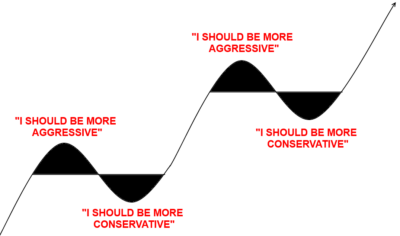

The attached graphic shows how this always works in the long run. The stock market is very likely to go up in the long run and during the course of this rise, you’ll constantly be tested and tempted. During the bears, you’ll regret being aggressive and during the bulls, you’ll regret being conservative. This is why diversification and balance work. You just accept that you can’t predict all the short-term twists and turns of the market and create a balanced enough allocation that you can’t be emotionally disturbed during all the ups and downs.

2) Is Housing Toast for the Next Decade?

I made a rather big prediction on Twitter this week when I said that residential real estate might be one of the worst-performing asset classes over the coming 10 years. My basic thinking is three-pronged:

- The huge returns in housing during COVID pulled future returns into the present and made buying vastly less affordable relative to renting. It will take many years and perhaps a decade for this differential to converge.

- There is a nationwide movement to build and help resolve the supply issue that has become so persistent in recent years.

- Demographics and inequality will reinforce the affordability issue and drive the convergence in prices mentioned above.

All of this is exacerbated by the recent high inflation and rising taxes. Residential real estate is an enormously expensive asset when viewed thru the lens of real, real returns. That is, after the costs of taxes, fees and maintenance a house ends up being a relatively low return instrument. These real costs are only getting worse.

This doesn’t mean I am bearish about housing. I don’t think housing prices will fall in the next 10 years. But I wouldn’t be one bit surprised if residential real estate underperforms a 10-year T-Note yielding 4% over the coming decade.

3) FOMO vs FEAR

Something I’ve been thinking a lot about lately is FOMO vs fear. Which one is more powerful?

We typically think of fear as the panic that sets in during bear markets, but the other type of fear is perhaps just as important – the fear of missing out. After all, fear of some sort is what drives all the bad decisions that derail portfolios. When the bull market is raging the fear of missing out will lead people to chase stock returns and when the bear market rages fear will drive people to abandon their stock exposure. But which is the more powerful emotion?

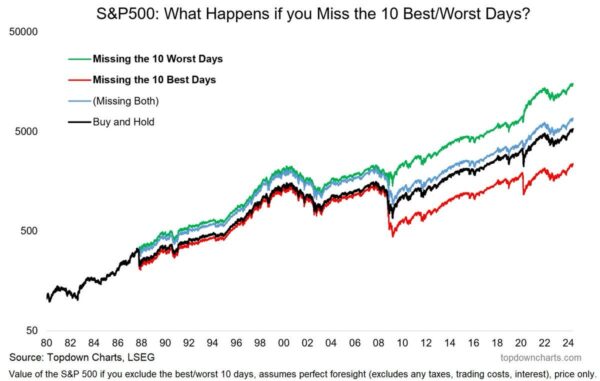

The classic research on this topic by Kahneman shows that people always fear losing what they already have and this creates a disproportionate worry about losses. This would seem to be confirmed by the attached chart showing the dispersion in returns by missing the 10 best/worst days (from Topdown Charts). But I think it’s more complex than this.

My general view is that FOMO is much more relevant when you’re young and accumulating assets while fear of losses is the bigger driver of behavioral biases when you’re older. Said differently, young accumulators will regret not being more aggressive when they can afford to be aggressive (because they have the runway to incur large losses and be patient) while older investors with a short time horizon will fear losses more because they don’t have the time to make up for large principal declines.

That’s all for this weekend. Next week is a big week with PPI, CPI, retail sales and many important retail earnings reports. It should be an important glimpse into the state of the US consumer. Speaking of consumption – I was out at breakfast last weekend and look who came up to me looking to consume some of my food. Those black swans are out there and I regret to inform you that this particular black swan was with his/her mate and they had 3 young black swans of their own….

I hope you have a great weekend.

More By This Author:

Is The Economic Plane Stalling?From Soft Landing To Emergency Landing?

Three Things – Commodities, Bitcoin & Stocks

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more