These Were The Best And Worst Performing Assets In October And YTD

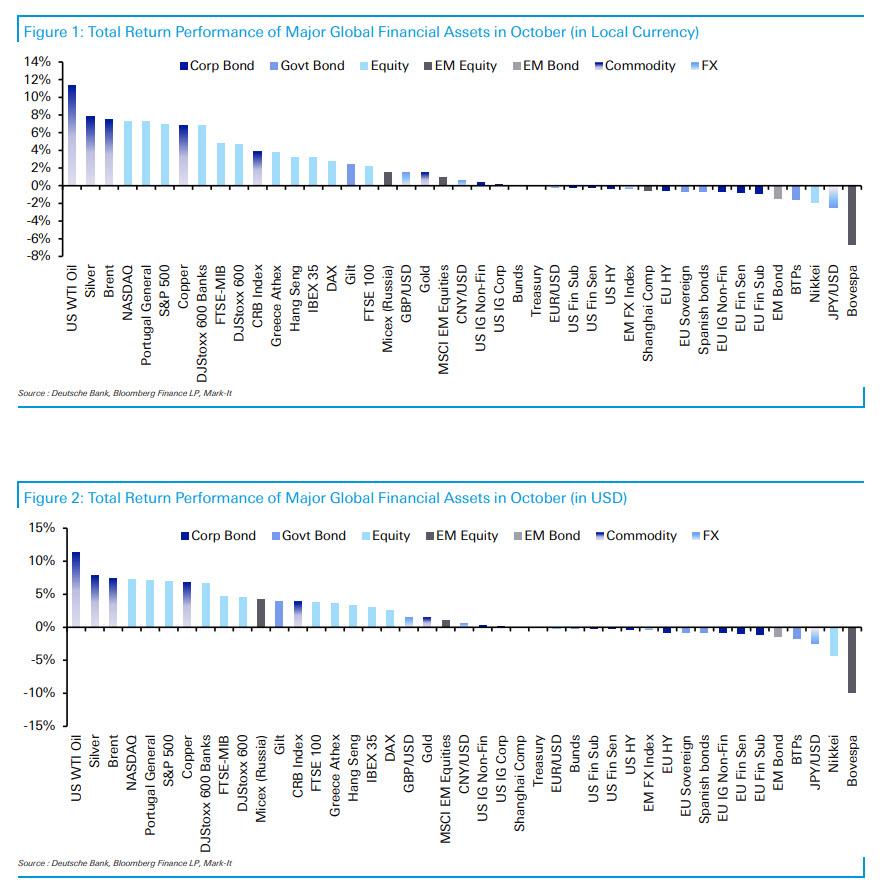

Despite stocks closing at new all-time highs amid a ferocious global melt-up (predicted correctly by Goldman), it was a mixed month for financial markets in October, with 22 of the 38 non-currency assets in Deutsche Bank's sample in positive territory.

Commodities put in another strong performance, with WTI oil prices leading our sample yet again, whilst equities also rebounded from their losses in September. However, fresh signs of inflation put more significant pressure on sovereign bonds, whilst other assets including HY credit and EM debt lost ground as well.

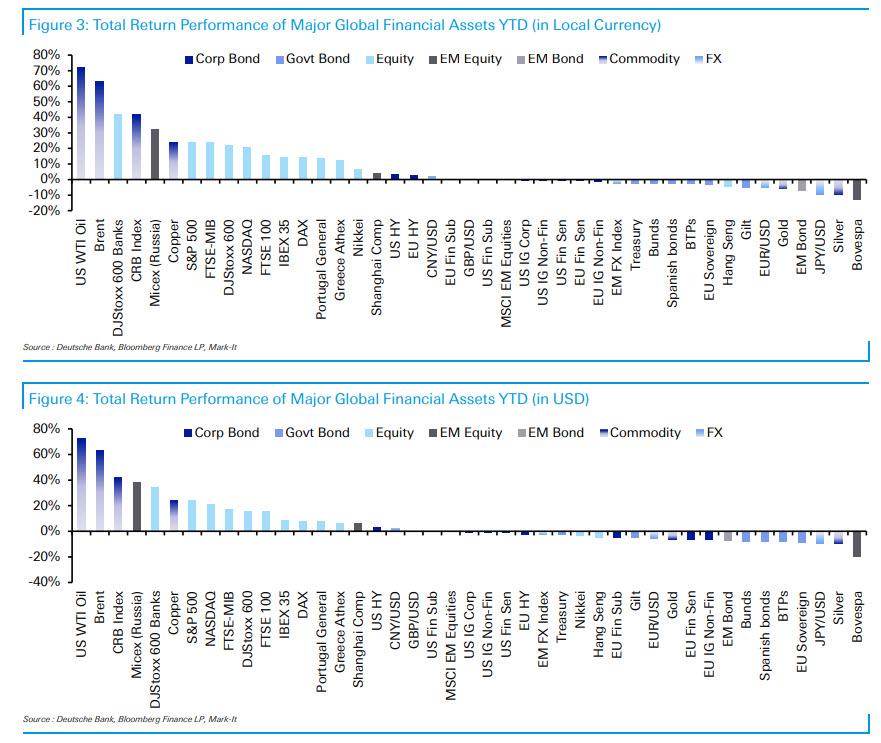

It’s been a familiar story throughout this year, but energy prices were once again at the top of our sample in October, with WTI oil (+11.4%) leading the way, whilst Brent Crude (+7.5%) wasn’t far behind in third place (Deutsche Bank still does not track cryptos and bitcoin/ethereum but that will change; if it did, it would find another epic month for the crypto space). That extends their YTD gains to +72.2% and +62.9% respectively, with the latest rise coming in part thanks to the surge in natural gas prices over recent months that’s boosted demand for petroleum. This is already having a significant impact on the cost of living for consumers, and here in the UK petrol prices stand at their highest levels in years.

That said, there was some respite right at the end of the month, with natural gas prices falling back strongly in Europe (-33.7%) after Russian President Putin ordered Gazprom to begin refilling its storage facilities in Europe from November 8 (however subsequently Russia cut off all gas deliveries via Yamal, so don't expect this drop to last). Staying on commodities, October saw further price rises more broadly that have added further fuel to inflationary pressures throughout the world. The key industrial bellwether of copper (+6.8%) had its best month since April, whilst precious metals including gold (+1.5%) and silver (+7.8%) similarly advanced. Meanwhile, there were further rises in agricultural prices, with wheat futures (+6.5%) up for a 5th successive month as they closed back in on their peak back in early May, whilst corn futures were up +5.9%.

Those inflationary pressures hampered sovereign bonds in October: Yields on 10yr US Treasuries were up +6bps in October to 1.55%, but that move was entirely driven by higher inflation breakevens, which were up +21bps over the month to 2.59%. That meant that Treasuries fell -0.1% on a total returns basis over the month, while Euro sovereigns overall (-0.6%) moved lower as well. The one outperformer was gilts (+2.4%), which saw big gains after the UK government cut its planned gilt issuance this year by more than expected.

And speaking of crypto assets, now that Goldman showed that the crypto class is a great inflation hedge, with inflation very much in the picture crypto-assets had a great month, although this also came as the first Bitcoin-linked ETF began trading on the New York Stock Exchange. By the end of the month, Bitcoin (+40.4%) had surged back, closing the month at $60,976. That’s actually slightly beneath its levels reached earlier in the month, when it hit an all-time intraday high of $66,976, exceeding its previous high back in April. Other cryptocurrencies put in a strong performance too, including Ethereum (+43.6%), Litecoin (+26.6%), and XRP (+17.1%).

Elsewhere, equities rebounded from their September losses, with the S&P 500 up +7.0% in total return terms to end the month at an all-time high. That was also its best monthly performance so far this year and takes the index’s gains for the year to +24.0%. In Europe, the STOXX 600 was also up +4.7%, taking its own gains for the year to +22.4%. Meanwhile, banks continued to be one of the top performers on a YTD basis, with the STOXX 600 Banks up +6.8% in October to have now risen +42.4% over the year as a whole.

Putting all that together, here are the best performing assets in October...

(Click on image to enlarge)

... and YTD.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more