Theory Versus Practice In Target Date Funds And Lifepaths

- Most TDFs are far riskier near retirement than the theory that they say they follow.

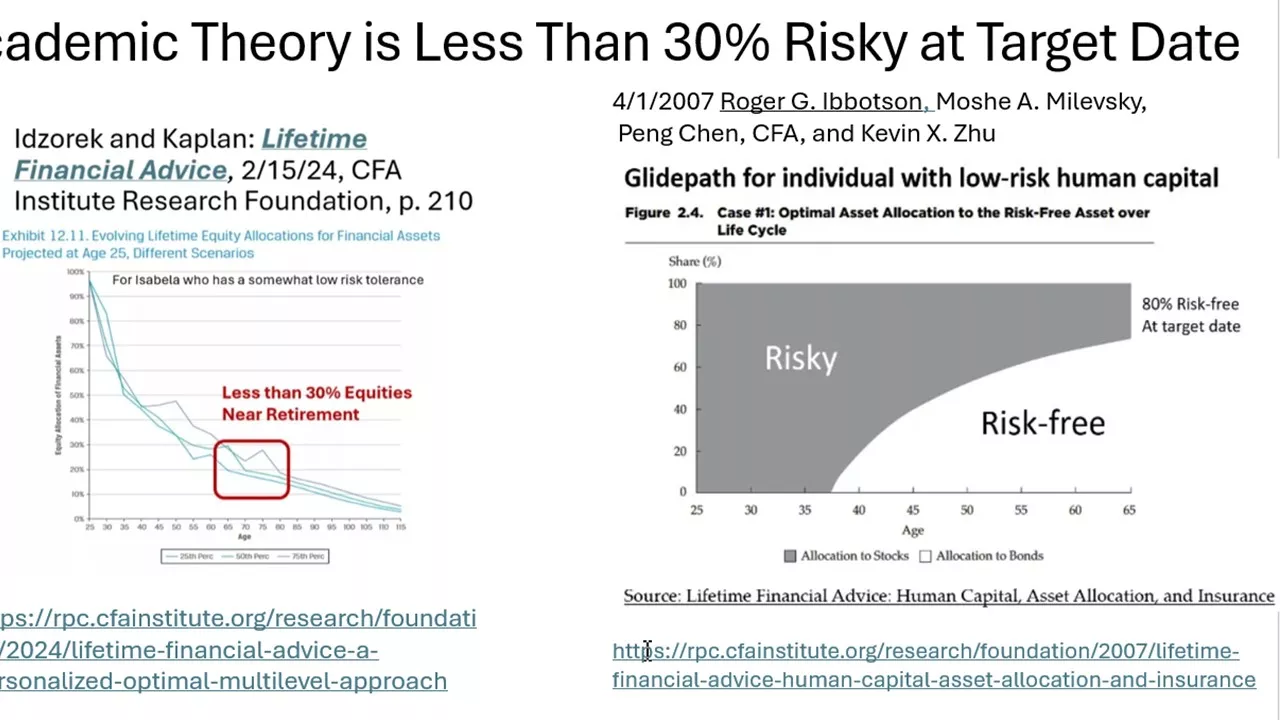

- Both Efficient Frontier and Human-Financial frameworks advocate for less than 30% in risky assets near retirement.

- TDF practices are 90% in risky assets near retirement.

- Baby boomers in TDFs are near retirement and should scrutinize their risk exposure NOW.

Two distinct academic theories lead to similar conclusions regarding the appropriate level of risk for people near retirement. One theory moves people along the Efficient Investment Frontier as they age, and the second theory integrates Human capital with Financial capital. Both theories have very low risk near retirement for the typical risk averse investor.

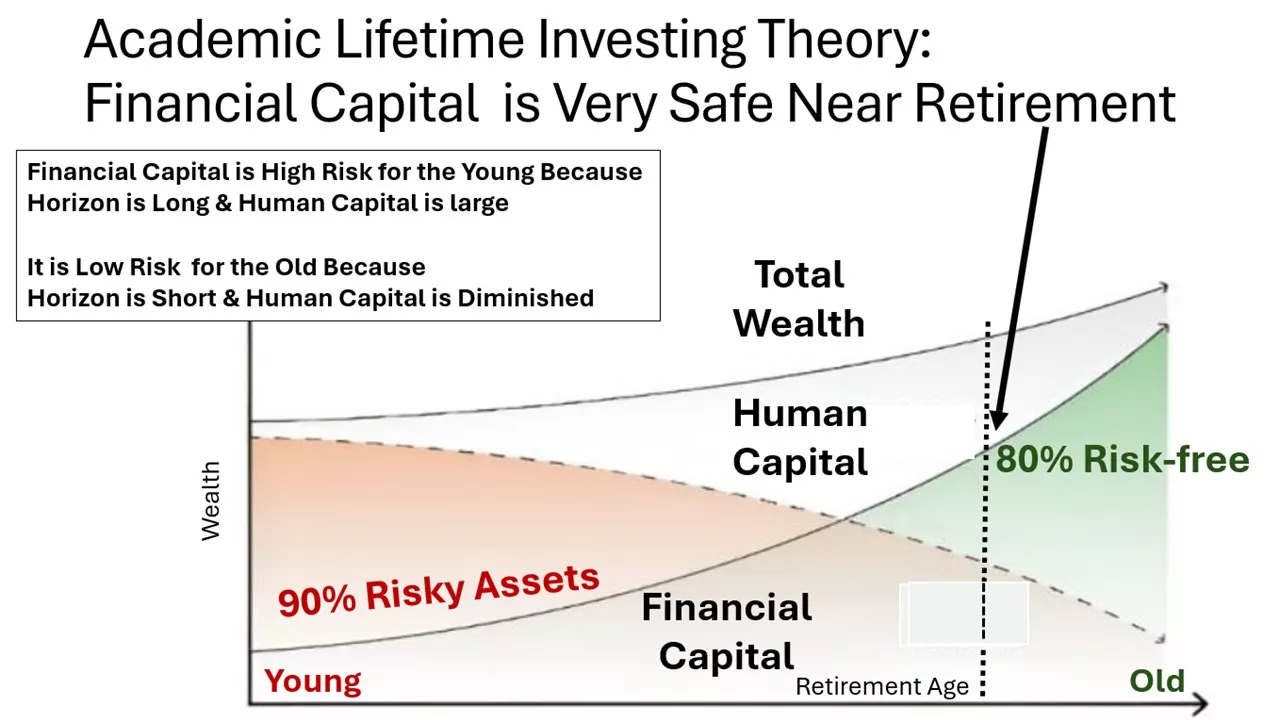

But common practice is far riskier than these two theories, despite the fact that most TDFs say they use Human-Financial Capital theory, even showing a graph like the one in the following. You could argue that their glidepaths are for people who are not risk averse, but that’s not many.

Here is the theory and the practice.

Human-Financial Capital Lifepath Theory

Here are the two studies that use the Human-Financial Capital framework:

Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance, 4/1/2007, Roger G. Ibbotson, PhD, Moshe A. Milevsky, Peng Chen, CFA, and Kevin X. Zhu

Lifetime Financial Advice: A Personalized Optimal Multilevel Approach, 2/15/2024, Thomas M. Idzorek, CFA and Paul D. Kaplan, CFA

Both studies use the following framework:

(Click on image to enlarge)

As our human capital depletes, we become increasingly dependent on our investments, so theory says that our investments can be risky when we’re young, but we should become less risky as we age. As we are near retirement, theory says very low risk, as shown in the following:

(Click on image to enlarge)

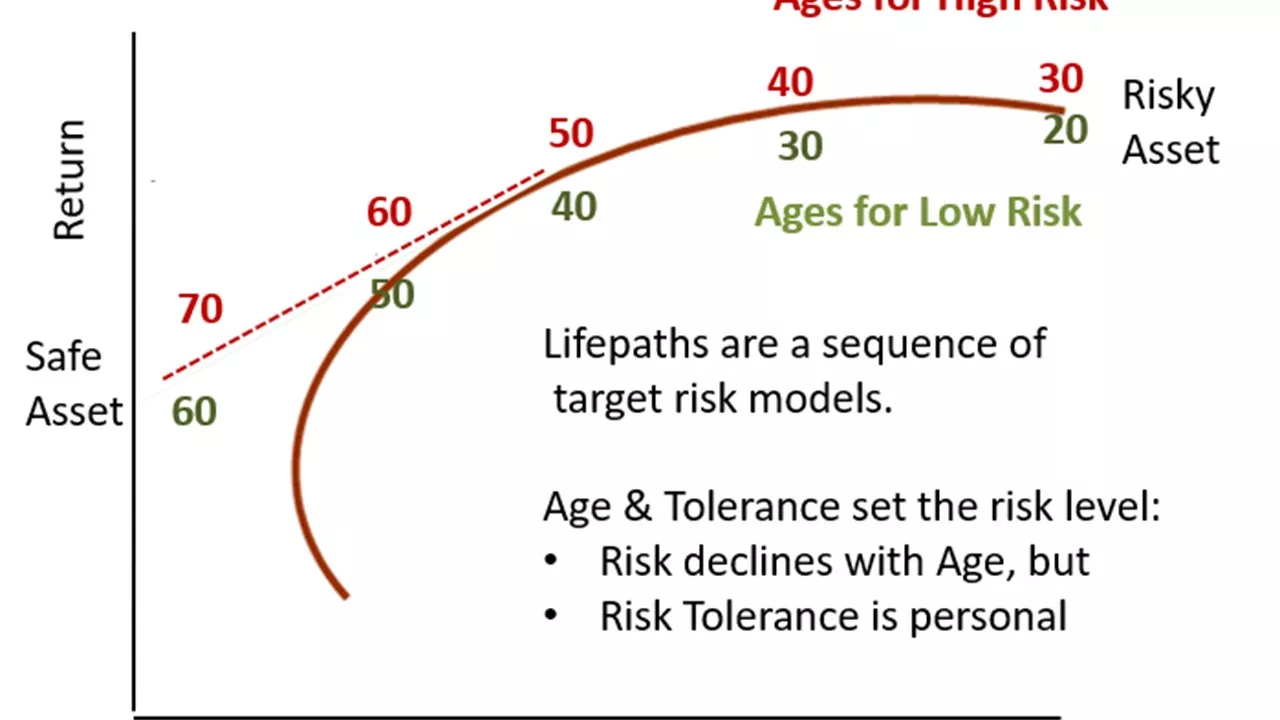

Efficient Investment Frontier Lifepath Theory

This approach uses a sequence of target risk models along the efficient investment frontier where your position on the frontier is a function of your age and your risk tolerance, as shown in the following:

(Click on image to enlarge)

We all have our personal feelings about risk that creates our risk preferences. Behavioral scientists tell us that we are risk averse-- we don’t like risk. But some people are risk takers, and they want their money to work really hard. Efficient frontier theory sets the standard for the risk averse majority, but an individual can override theory. Hence the red ages in the efficient frontier graph above.

This theory brings us up to retirement, at which time I point to a different theory for investing in retirement.

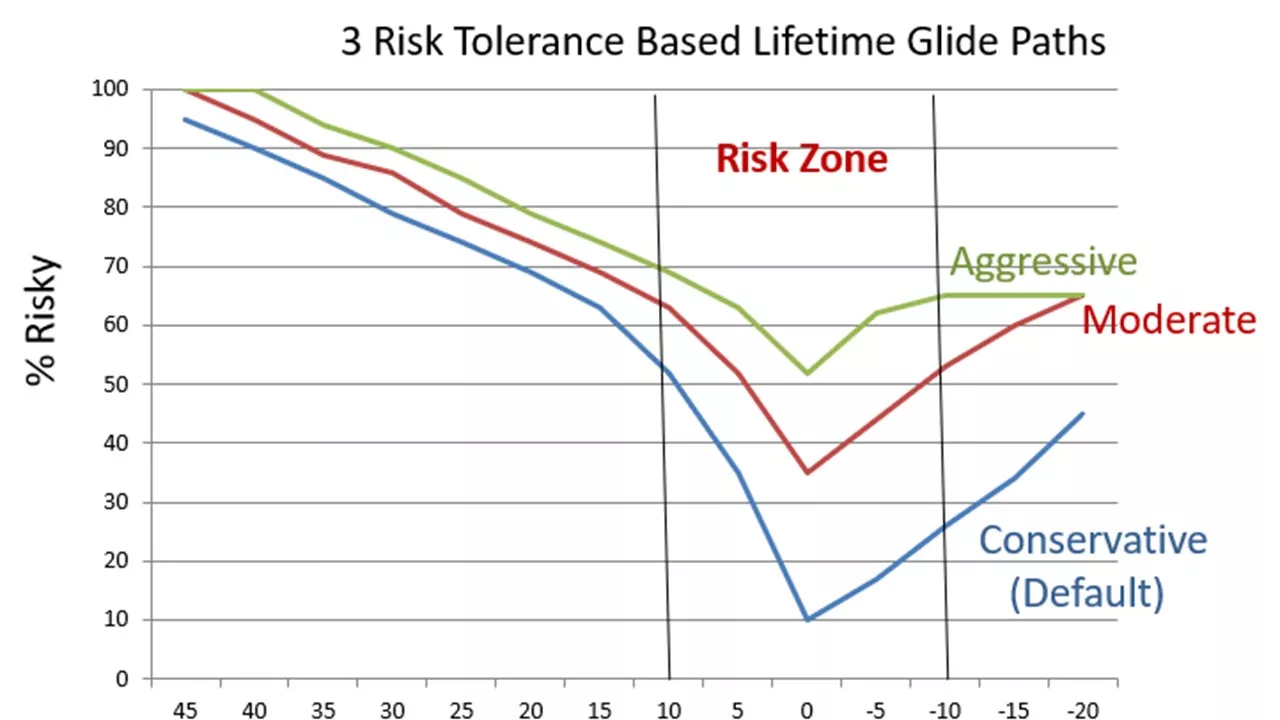

The academic theory for investing in retirement was introduced in Kitces and Pfau’s 2013 paper on Reducing Retirement Risk with a Rising Equity Glide-Path.Kitces & Pfau make a very persuasive case for entering retirement with low risk and then re-risking in retirement. We all pass through 3 stages of investing where the second stage of transitioningfrom working life to retirement should be very safely invested.

Connecting with pre-retirement theory, the pre-retirement glidepath needs to end safe to connect with a post-retirement path that starts safe, creating a U shape.

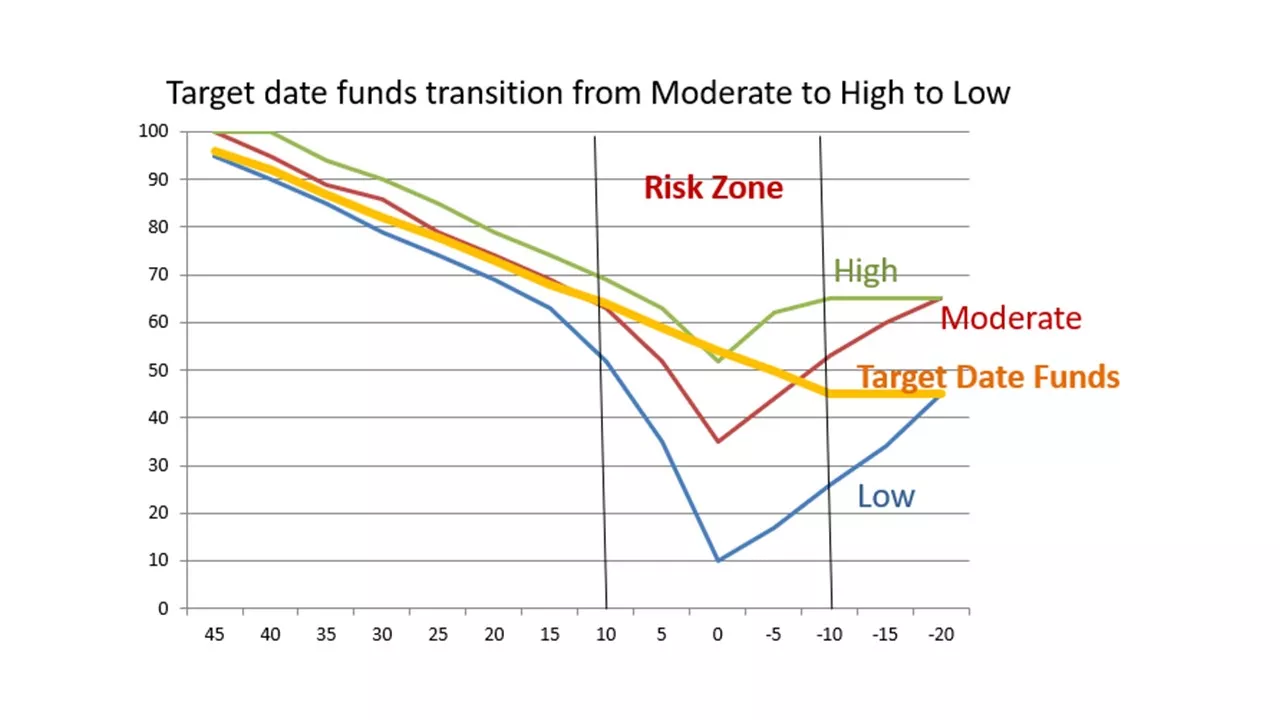

Acknowledging different levels of risk tolerance requires several lifetime glidepaths as shown in the following:

(Click on image to enlarge)

Investors can blend these glidepaths and they can change their risk tolerance at will. And there you have an Efficient Frontier framework.

Practice is Much Riskier Than Theory

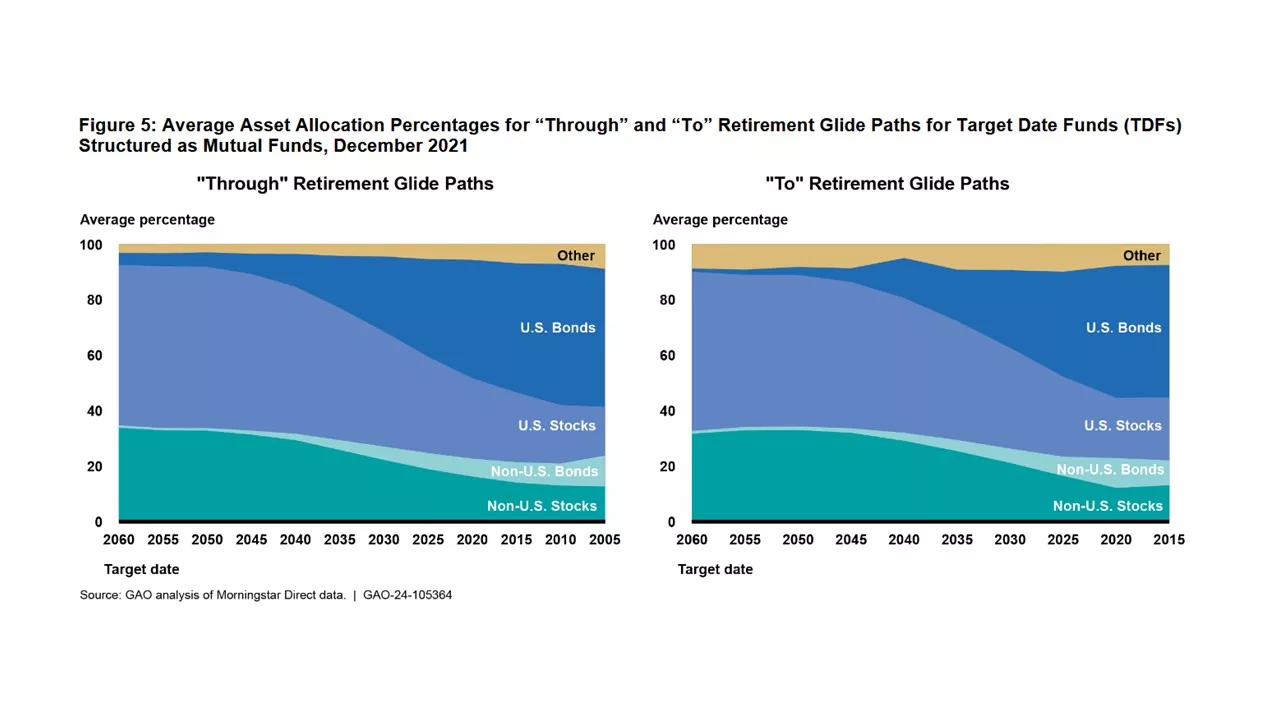

The Government Accountability Office (GAO) issued the following report that summarizes the glidepaths of “To” funds and “Through” funds: 401(k) RETIREMENT PLANS: Department of Labor Should Update Guidance on Target Date Funds.

(Click on image to enlarge)

Actual practice is risky near retirement with 90% in risky assets – 50% equities plus 40% in long-term bonds -- far more than the 20-30% recommended by academic theory.

Viewed another way, TDFs take moderate risk until they reach the Risk Zone when they become high risk, and then in retirement they become low risk. Note that participants in the Risk Zone are taking high risk. They don’t know it, but they will when the stock market crashes. A crash will be a “good” thing because it will expose this high risk, opening the door for improvements. Substantive prudence will morph into procedural prudence.

(Click on image to enlarge)

Conclusion

Albert Einstein said that everything should be as simple as possible, but no simpler. Here is a simple universal investmentframework. Please use it.

Readers of this publication expect an action step. How should you use this article? Please feel free to contact me. I have tools you can use. But if you’d rather not contact me, here’s what you can do:

- Think about your risk tolerance. Most of us have low risk tolerance, but you might be different.

- Find your risk tolerance path (low, middle or high risk) in the last graph above and locate yourself on the horizontal axis by finding the number of years that you are away from retirement and then look diagonally to your left for an allocation to your diversified risky portfolio.

- Act.

- Is the answer near your current portfolio? This will either confirm or question what you’re currently doing.

- If you’re invested in a target date fund, how close is your answer to a TDF? If it’s not close, consider getting out of your TDF, especially if it’s riskier than your answer.

More By This Author:

Peer Into The 2026 Market Forecast Crystal Ball

100 Year Perspective Provides Prospective

Short Term Interest Rates Could Decline Another 100 Basis Points