The Roadmap Into Year-End

Image Source: Unsplash

As we enter the holiday season into year-end, there will be less data to move markets, and seasonality historically plays a significant role. Next week, the NYSE and Nasdaq are closed for Thanksgiving on Thursday, Nov. 24, and there is a half day on Friday, Nov. 25.

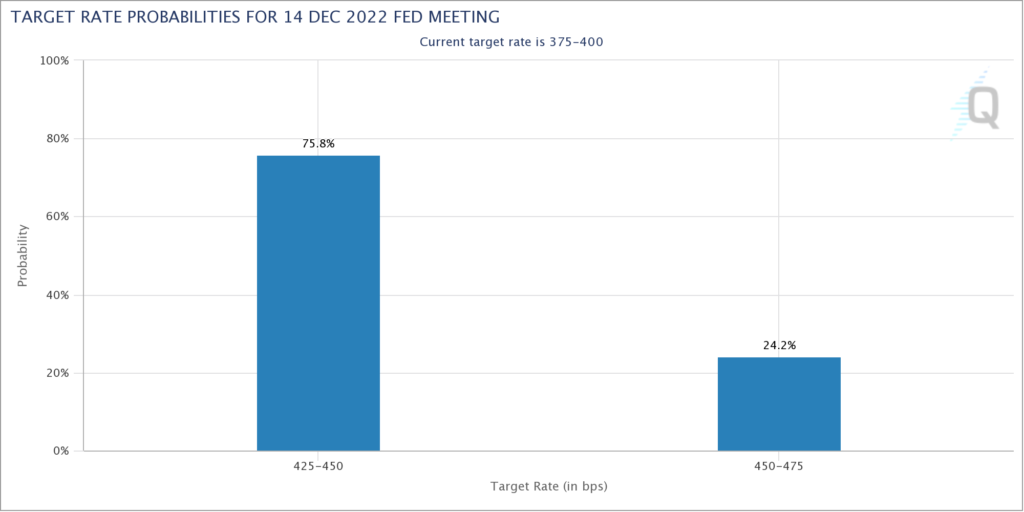

There isn’t much on the calendar until the November CPI Report on Tuesday, Dec. 13 at 8:30 a.m. EST. As long as it’s below 8%, I expect the Fed to raise 50 basis points the following day while jawboning the markets about how it’s not a pivot. If all goes as expected, I don’t foresee a big market reaction.

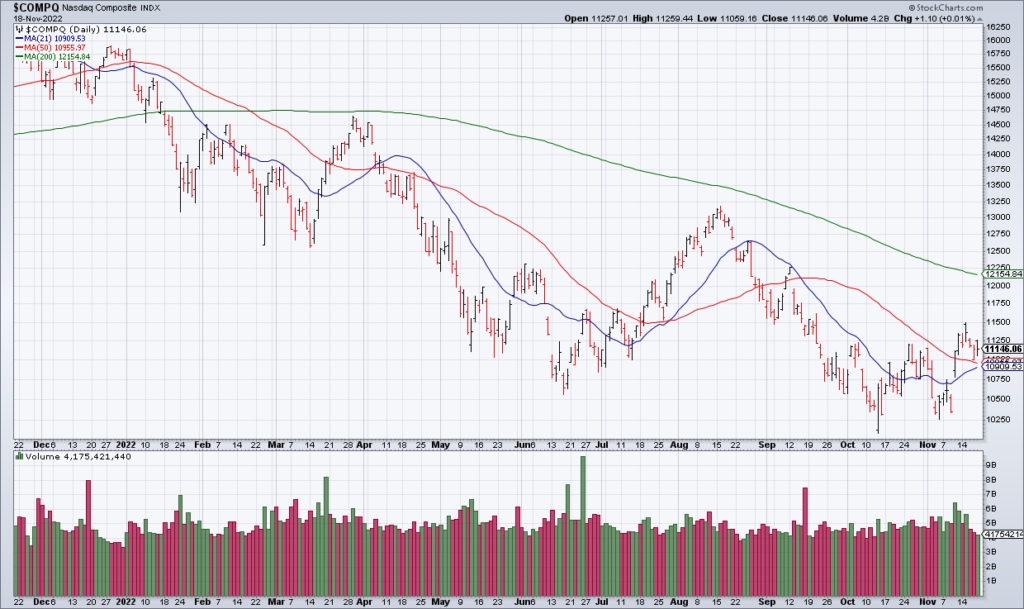

Historically, markets have experienced a Santa Claus Rally at the end of the year. While I don’t see a lot of upside from current levels, my bias for the rest of the year is an upward drift. If I had to guess, I’d say the Nasdaq may close 2022 at around 11,500.

The NYSE and Nasdaq close again for Christmas on Monday, Dec. 26, and Tuesday, Dec. 27 is a half day.

At the end of 2021, I correctly forecast that inflation would define markets in 2022. In 2023, I expect it to be recession that defines markets. Use the calmer trading conditions during the last six weeks of the year to position your portfolio appropriately.

More By This Author:

Interpreting TGT Vs. WMT EarningsLong WMT, Short HD, Value In IAC

The Flaw In The Bull Case