The Relative Weakness

Image Source: Unsplash

I do not want you, or me, to lose sight of the big picture, in spite of the carnival which happened on Friday. I was away from my screens most of the day, and seeing the raw quotes and reading the breathless headlines, I figured it was the end of the world for the one or two bears left on the planet. The moment I got back to see my screens, I saw nothing had changed. The /ES was still as wrecked as it was before.

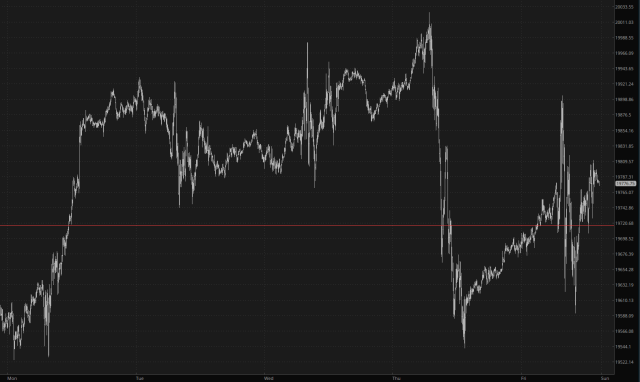

Looking closer, you can see that Friday’s high didn’t even muster the strength to beat Thursday’s high, which was before Powell went 'full pivot.' That’s a big deal.

So, too, with the Nasdaq. The recovery has been explosive, but we’re far afield from lifetime highs. Additionally, there is nothing, absolutely nothing, about this chart which suggests a bullish setup. Quite the opposite.

If we look closer once more, we can see how relatively feeble the /NQ rally was, considering the magnitude of the news.

And this is reflected just as plainly in the daily charts, as well as the intraday. I’ve been doing this whole “charting” thing for a while, and the 'Powell Pivot' will be remembered, months from now, as a crucial turning point.

More By This Author:

I tilt to the bearish side. Slope of Hope is not, and has never been, a provider of investment advice. So I take absolutely no responsibility for the losses – – or any credit ...

more