The Pricing War Among Asset Managers Heads To Zero

The U.S. financial market has undergone a gradual change over time as the financial markets have seen a higher influx of e-brokers. These e-brokers have several advantages over traditional brokers. However, they also face a few challenges, which means they face strong competition.

Broadly, e-brokers offer a better value proposition and provide a lot of business to asset managers. Having said that, e-brokers are reaching the top of the rising rates, andthe circumstances make it harder for them to make money in a highly competitive environment.

On the other hand, if brokers and asset managers work together and enter into self-indexing at low price points, the competition can effectively be dealt with. It will give both asset managers and brokers the upper hand over index providers.

Sneak peek into the new launches by JPMorgan and Fidelity and the implications

JPMorgan e-Broker launch

JPMorgan is launching a new e-broker service that is priced very competitively. Customers will get 100 free trades the first year, and those whose balance remains higher than $15,000 will have free trades available to them in the second year as well. The e-broker service offers a low trading commission rate of $2.95 and also supports automatic portfolio building.

This new launch will make the market all the more competitive. Other brokers like Schwab may also lower their commission rates. This will make the environment more difficult for the already-competitive e-broker market, and making a profit is expected to become riskier.

Fidelity Zero-Fee Index Fund launch

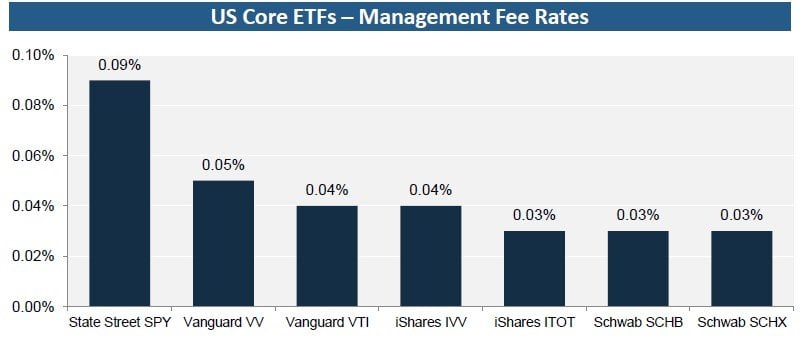

Meanwhile, Fidelity has also launched two zero-fee index mutual funds. These are the United States’ first zero-fee funds. Fidelity has also lowered its expense ratio on numerous other funds, pushing the average management fee for its funds down 35%.

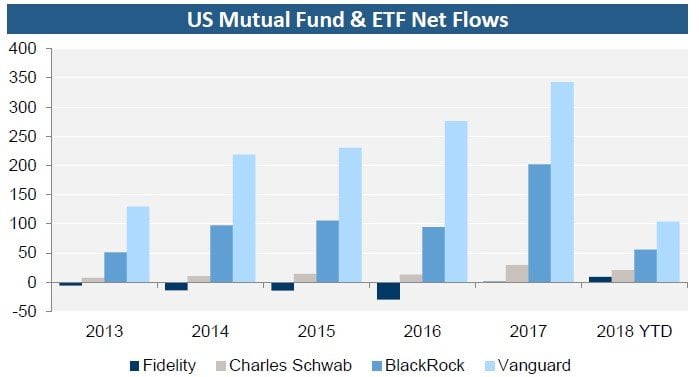

The zero-fee index funds are being marketed as mutual funds and are only available through Fidelity’s brokerage platform. It plans to offset the loss from not charging a fee for those funds by increasing its securities lending revenue. However, competitors like BlackRock and Vanguard do not have the option to compensate for losses through alternative sources of income.

Overall, the zero-fee fund launch is expected to lead to organic growth for Fidelity and will also benefit partners like BlackRock, which has a substantial share on its platform. However, the move may lead to more challenges for competitors like Schwab.

Will large players budge on pricing?

It is critical to understand how these moves of comparatively small players in the e-broker market will impact larger and more significant players like TD Ameritrade and E*Trade. The larger players do not offer competitive pricing as of now, and this may affect the influx of net new assets.

On one hand, TD Ameritrade is financially quite sturdy and has a solid foundation. It could bear the weight of competition and continue its current high commission rates. On the other, Schwab may not be able to survive and could give in to the war over commission rates.

Self-indexing could be the solution

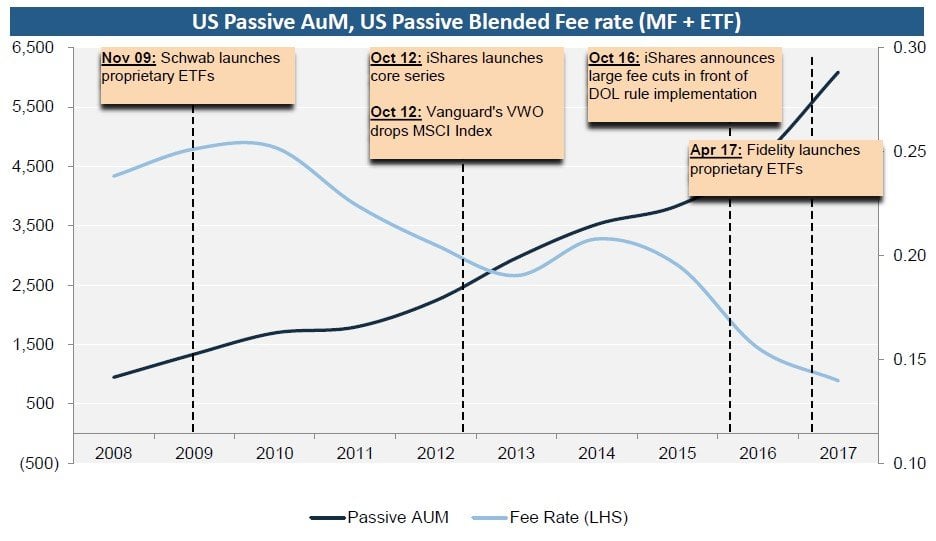

Self-indexing was quite tricky in the past, but with the SEC’s easier norms and the ETF rule approval, it has become a more feasible option for almost all brokers and asset managers.

Therefore, it is possible for e-brokers and asset managers to duck the pricing war and try to increase their profitability and earnings through self-indexing. Overall, institutional investors still prefer brand-name indexes, but there is no such bias in the field of fixed-income investing. Self-indexing holds a broader scope in the fixed-income space.

Thus, it is possible for less competitive asset managers and brokers to turn to the self-indexing space to create more value for themselves instead of getting into the low-price race.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more