The Price Of Rent Surged 27 Straight Months. Is Relief Finally Coming?

Image source: Pixabay

The CPI report is on Tuesday. Reports suggest rent concessions from landlords. We’ve heard this story before. Is this time the real deal?

Concessions From Landlords

The Wall Street Journal reports Renters Are Starting to Get Concessions From Landlords Again, emphasis mine.

After suffering through a three-year period when rents jumped by 30% or more in many U.S. cities, renters are now starting to enjoy small breaks like this. Rents still aren’t falling by much. But thanks largely to an unusual surge in new building supply, more landlords are offering other enticements to fill up their properties, from a month of free rent to a reduction in fees and deposits.

The deepest discounting is happening in the South and other Sunbelt markets, in cities such as Charlotte, N.C., and Dallas, where there has been more construction than in the rest of the country. Mid-America Apartment Communities, a publicly traded company focused on Sunbelt cities, said in an October earnings call that widespread use of concessions by developers was weighing on how much rent it could charge.

Concessions don’t always reflect a great deal. Some landlords might offer discounts only on rent that was unusually high to begin with. Landlords dangling concessions also often ask tenants to sign 18-month leases. That means units leased in fall or winter months come up for renewal in the spring or summer, when landlords tend to have more pricing power. Tenants could end up paying much higher rents down the line.

The concession trend might also prove short-lived. Permits for new buildings are falling, amid a financing crunch that makes it difficult for developers to put stakes in the ground.

And a for-sale market that remains inaccessible to so many could also prop up rents long term and cut into all the freebies. Coats, the Virginia Beach renter, was readying to buy a home until interest rates shot up last year and prices hovered near record highs.

Is This the Real Deal?

I have doubted every one of these falling rent stories for two years. This one seems a little more solid.

Rather than saying I doubt it. I will change my tune to I just don’t know.

For sure, a half percent on average for 27 straight months doesn’t seem sustainable, but many have been yapping about 1 year lags for about two years.

Seasonality in Play

The Journal caught one key idea with “units leased in fall or winter months come up for renewal in the spring or summer, when landlords tend to have more pricing power. Tenants could end up paying much higher rents down the line.“

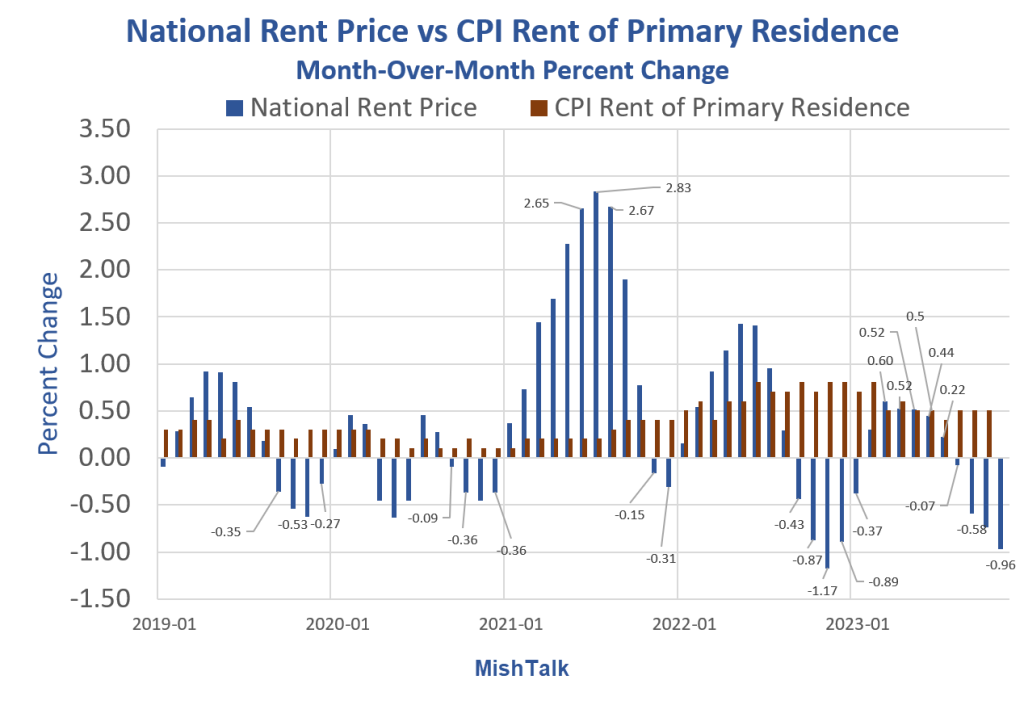

National Rent Price vs CPI Rent of Primary Residence

Is the Fourth Time a Charm?

The “falling rent” stories to date have all been wrong due to a combination of factors.

First, they ignored seasonality. Second, they have primarily been based on new leases not renewals.

New leases only account for 15 percent of the market according to census data. Judging from the above chart, one might have expected the price of rent to fall at the beginning of 2021, 2022, and 2023.

Many did. Look what happened.

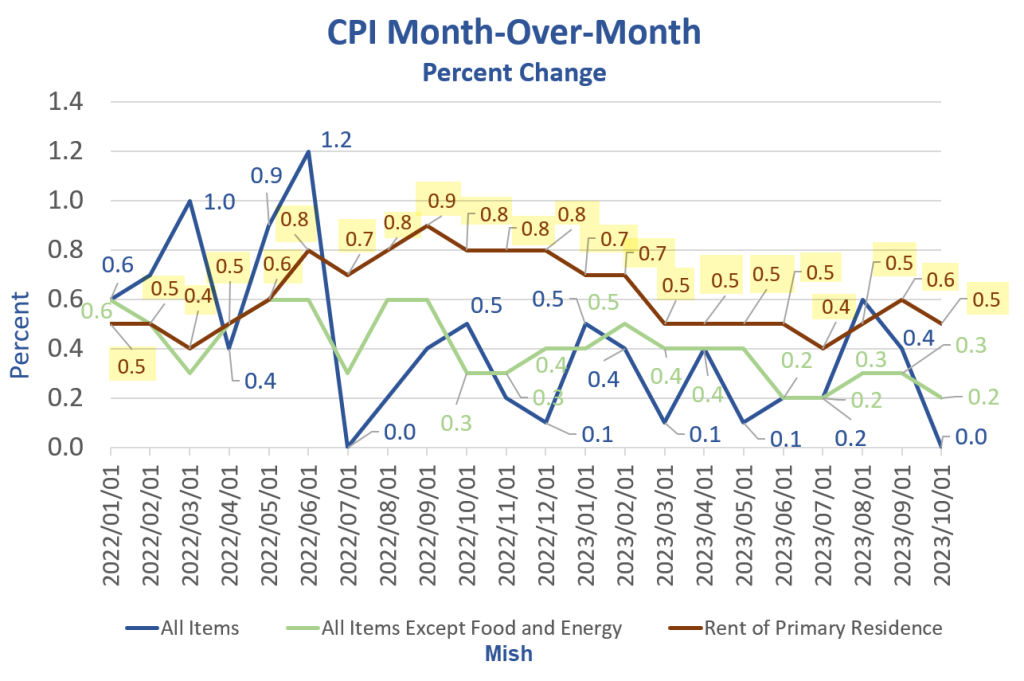

CPI Rent

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.5 percent in October.

CPI month-over-month data from the BLS, chart by Mish

People kept telling me rent is falling. I keep saying it isn’t (and the data proves it).

For discussion, please see Falling Rent is Extremely Rare, Yet Economists Keep Expecting That

Rent of primary residence has gone up at least 0.4 percent for 27 consecutive months although the widely believed lag is 12 months!

Let’s assume rent reverses for a while due to a combination of strong seasonality, finished apartments, and increased competition for new leases.

It’s possible. And if it does, then on Tuesday we could easily see a negative CPI print.

But if rent just slows to 0.2 percent or less, reported inflation will head towards the Fed’s 2 percent annual target.

Is the BLS Is Overstating Rent and Exaggerating Inflation?

On December 7, I investigated A Curious Claim that the BLS Is Overstating Rent and Exaggerating Inflation

I provide solid evidence that the BLS has been doing no such thing.

Nonetheless, assume inflation slows along with rent. At some point, it’s bound to happen.

The key question then becomes: Was inflation transitory or is it the easing that’s transitory?

Please see the above link for my take on inflationary pressures and how long they might last.

More By This Author:

California Has A $68 Billion Budget Deficit With Only $30 Billion In Reserves

Biden Pressures The Allegedly Independent Fed To Stop Rate Hikes

How Much Did The Huge 412,000 Birth-Death Adjustment Impact October’s Job Report?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more