The King Of Tech ETFs Still Has Its Weaknesses

The Invesco QQQ ETF (QQQ) is a strong and proven choice as a fundamental building block of a technology equity portfolio. At its size, design, and liquidity it avoids any serious ETF structural worries and offers a diversified and broad sampling of the technology market through being pegged to the NASDAQ 100 index. However it suffers from being heavily weighted towards large cap technology behemoths and to even just a few among those. Furthermore, with the technology sector's immense variety of sub-sectors the QQQ ETF's particular mix may underweight, overweight, or even entirely leave out certain distinct sub-sectors that a technology investor may be interested in.

A Tech ETF That Has Risen With The Tech Sector

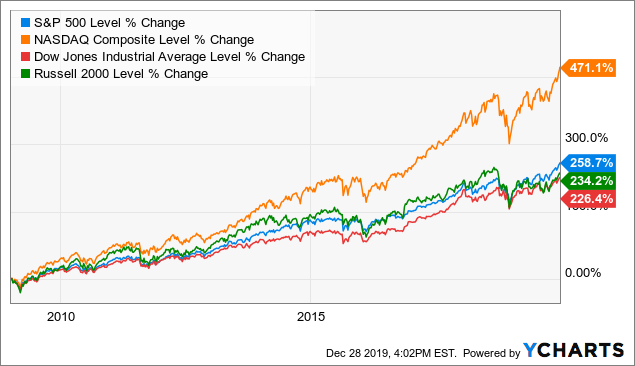

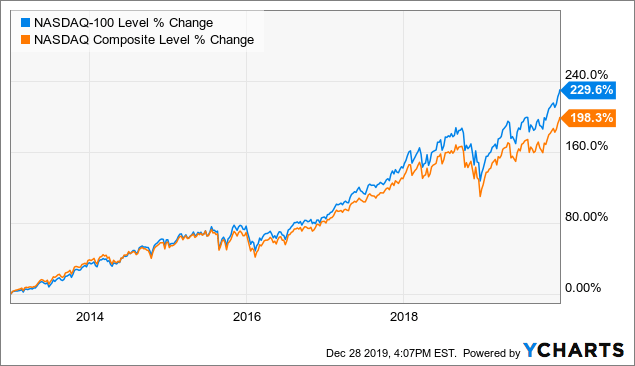

As shown above, since January 1st 2009 the NASDAQ composite has posted significantly higher returns than the Dow Jones, the S&P 500, and the Russell 2000. The NASDAQ composite however has been outpaced by the NASDAQ 100, which is a market-capitalization weighted index composed of about 103 of the largest non-financial NASDAQ-listed companies and the index the QQQ ETF is pegged to. Essentially, this means that growth in recent years has been primarily geared most towards large-cap technology companies as compared to nearly all other major categorizations.

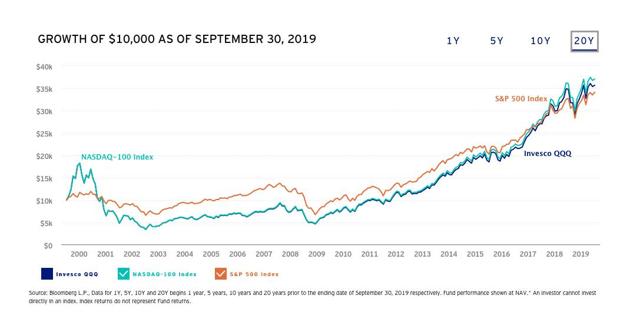

The QQQ ETF is designed to track the NASDAQ 100. Since QQQ's release in 1999 it has done so with quite close accuracy.

(Source: Invesco)

Structurally Sound But With Little Choice

From a structural standpoint the QQQ ETF is remarkably stable. It is one of the oldest ETFs and also one of the largest, whether by assets under management (currently about $87 billion) or by trading volume. It has robust liquidity and an expansive options market. It features low fees, with a total expense ratio of about 0.20%.

QQQ's negatives primarily seem to be less in any design of the ETF but rather those common to ETFs in general and the NASDAQ 100 in particular. While QQQ is insulated from the primary worry of ETFs in terms of structural risks nonetheless it still will have the occasional slight deviation from index that even an ETF pegged directly to an index may experience over time.

The weaknesses of investing in the NASDAQ 100 are more worth considering. As the QQQ's holdings demonstrate, it is focused heavily on large cap companies with its September 30, 2019 fact sheet showing an average weighted market capitalization of over $455 billion. The technology sector often sees many companies go public in the small cap to mid cap range that may be worth considering to invest in and the QQQ ETF, as a reflection of the NASDAQ 100, does not truly allow one to participate in that vibrant segment of the technology market. However a caveat to this is, as shown in the charts at the beginning of the article, that large-cap tech growth has outpaced general tech growth in recent years.

Another weakness of investing in the NASDAQ 100 comes with the mix of companies the index is composed of. The QQQ ETF is broken down technology-wise into about 15.65% software, 13.71% Interactive Media & Services, 12.17% Semiconductors & Semiconductor Equipment, 11.72% Internet & Direct Marketing Retail, 11.32% Technology Hardware, Storage, & Peripherals, 5.20% Biotechnology, 4.33% Media, 4.18% IT Services, 2.68% Beverages, and 2.64% Entertainment.

Essentially the QQQ ETF and its associated NASDAQ 100 index is quite well-balanced between a lot of different technology sub-sectors, even if it is slightly weighted more towards certain kinds as a result of those companies being more prominent. However this level of diversification may not be the exact mix one wants to distribute one's assets in, such as if one wants greater biotechnology investment. Furthermore, there are sectors that are not as easily represented in the sector mix and in part also due to the smaller sizes of some companies in more specific sub-sectors. For example, if one wanted greater cyber-security focus in one's investments then QQQ leaves one out of luck.

Additionally, the QQQ ETF and its associated index has the same diversification problems on the company level. As of the September 30, 2019 fact sheet the company had as its largest investments 11.49% in Microsoft, 10.95% in Apple, and 9.29% in Amazon, amounting with these three companies to already 31.73% of the ETF's holdings. If one doesn't like this particular focus on these specific large companies then the ETF doesn't leave one with much choice.

Conclusion

The QQQ ETF appears to be better served as a foundational cornerstone of a technology portfolio or if one is comfortable with riding the general large-cap technology wave with one's investments.

As shown above, the QQQ ETF is as structurally well-designed as an ETF can be with its low fees, highly accurate tracking, immense assets, superb liquidity, and robust derivatives markets.

However the ETF's strengths as a "catch-all" for the NASDAQ 100 are also in many ways its weaknesses. The ETF is extremely oriented towards large cap technology companies and just a certain few amid those. It embraces a particular technology sub-sector mix that may leave out certain sub-sectors entirely or not weight as much as one would hope in certain areas.

QQQ has been successful, both in growing its assets under management as an ETF over the decades as well as posting solid returns, because it mirrors the immense rise of large cap technology companies in that time as well.

For those seeking a core, lower-risk base for your portfolio's equity needs QQQ seems to serve that purpose well. However as also shown it may be worth then adding some extra "spices" to the mix in the form of other more specific and focused investments to make up for QQQ's generic characteristics.

Disclaimer: These are only my opinions and do not constitute investment advice.