The Inventory Cycle – Correctly Predicted The Markets In May 2021. This Is What Is Saying Now.

- Business makes inventory decisions as economic conditions change.

- Business must adjust production levels to maintain inventory levels consistent with sales growth.

- These inventory decisions have a major impact on the economy, financial markets, and stock selection.

My latest article on the inventory cycle was published on 5/18/2021. At that time, the economy was strong, and the business cycle was on an upswing. At that time, the dynamics of the inventory cycle pointed correctly to the following takeaways.

- The trends reviewed in my article of November 24, 2020 are still in place.

- The inventory to sales ratio keeps declining, pointing to continued strength in manufacturing.

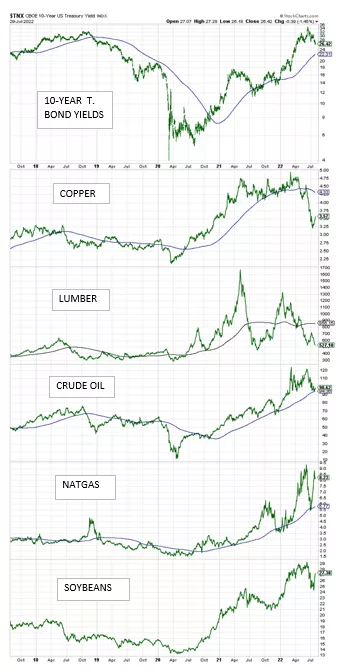

- The implication is commodities and interest rates are likely to rise as long as the inventory to sales ratio is declining, indicating sales outstripping inventory accumulation, and the business cycle indicator is rising.

- Commodities and interest rates will peak when the inventory to sales ratio starts rising, indicating inventories rising faster than sales, and the business cycle indicator declines.

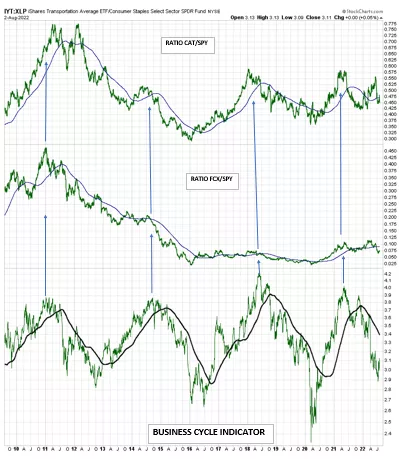

- Commodity sensitive stocks such as CAT and FCX will continue to outperform the market as long as the inventory to sales ratio declines and the business cycle rises.

- A rise in the inventory to sales ratio and a decline in the business cycle indicator will suggest a change in portfolio asset allocation from cyclical to defensive sectors.

The inventory cycle continued to support the above conclusions. Now, however, important changes have occurred. Let me explain.

The business cycle goes through four main phases. Each phase has major implications on investment trends and is driven by how business decision-makers react to economic conditions.

In Phase 1 business experiences low inventories and stronger demand. Consumers’ optimism increases as income after inflation improves thanks to declining inflation and interest rates. Business responds to increased sales by raising production targets and building up inventories.

Increasing production implies more demand for raw materials and employment, and increased borrowing to improve and increase capacity. The outcome is commodities and interest rates bottom, and employment increases in this phase.

The positive loop of more income, more sales, more employment, more production takes the business cycle into Phase 2. This is the time the economy strengthens above its historical average pace. Production is now rising rapidly and places upward pressure on commodities, wages, interest rates, and overall inflation. Labor costs increase with inflation. Consumers’ optimism (Univ. of Michigan) declines because of the decline in purchasing power caused by higher inflation.

Toward the end of Phase 2 these trends become a concerning development. The economy is overheating and the increase in inflation causes a slowdown in real demand. The economy now enters Phase 3.

In Phase 3 business does not recognize consumers’ purchasing power is decreasing. Manufacturers keep producing to keep unit costs down and plants operating at full capacity.

There is a time in Phase 3, however, when sales grow at a pace slower than inventories causing costs to rise more than anticipated, negatively impacting earnings. Business decides then to cut production to protect earnings. The outcome is declines in orders for raw materials, declines in borrowing, and layoffs. Inflation, however, keeps rising, further reducing consumers’ purchasing power.

The business cycle is now in Phase 4, the most important phase for investors because of the risk of large drawdowns in equity prices. This is the time full-scale bear markets are rampant and all the excesses created in the previous phases are removed.

The business cycle is in Phase 4. It will last as long as:

- Inventory growth declines and is brought in line with that of sales. Inventory growth will have to decline to about 3% after inflation according to recent history.

- Commodities and interest rates decline as business reduces the purchase of raw materials and borrowing because of the attempt to cut inventory growth.

- Inflation and labor costs finally decline. This is a major development accompanied by rising consumer optimism due to the increase in purchasing power and improvement in earnings.

The business cycle will transition in Phase 1 following the above developments.

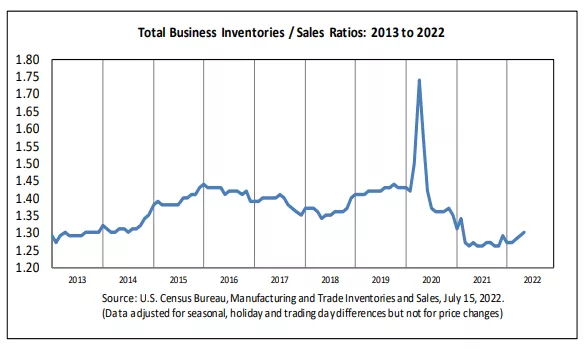

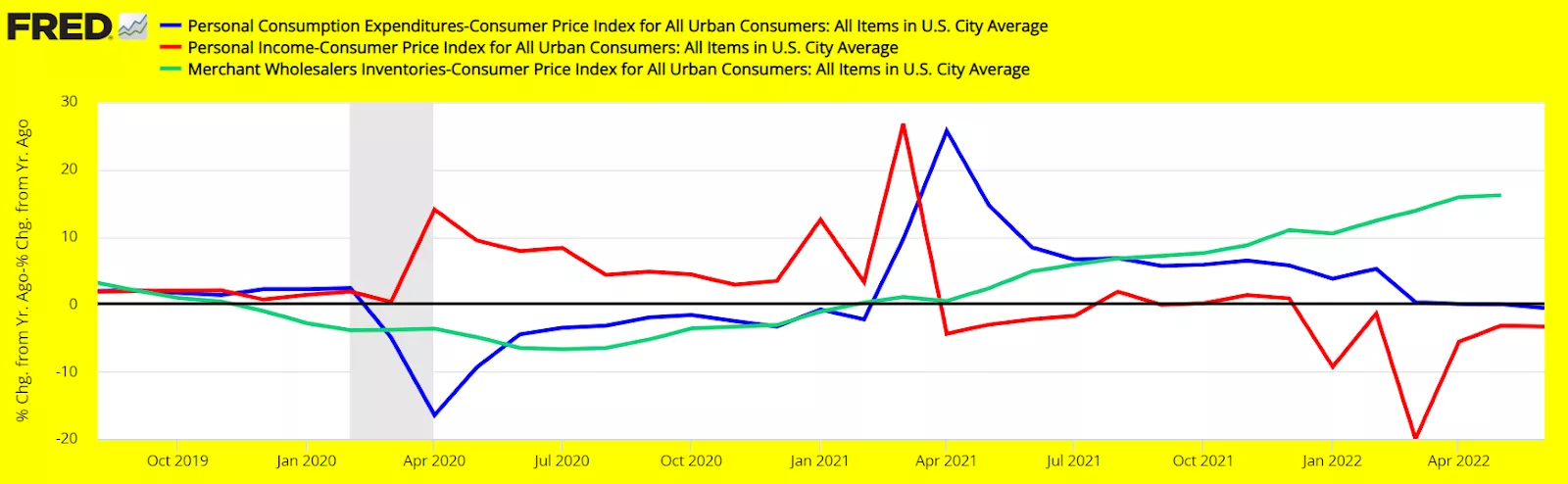

The above graph shows the inventory-to-sales ratio as of May 2022 (published July 15, 2022, by the Bureau of Labor Statistics). The ratio is rising, reflecting inventories growing more rapidly than sales. As of this writing, for instance, wholesalers’ inventories are soaring at a +16.2% y/y pace after inflation. Retail sales after inflation, meanwhile, have declined -0.6% y/y, and personal income is down -3.3% y/y after inflation.

(Click on image to enlarge)

Inventories will be cut aggressively because they are impacting earnings in a major way. Production will be reduced enough to bring inventory growth in the 2%-4% range after inflation.

In the meantime, commodities and long-term interest rates will continue to decline to reflect lower growth in business activity caused by the decline in production and inventories (see above chart).

More By This Author:

The Business Cycle Now And Its Impact On The Financial Markets

A Winning Investment Strategy For Recessions And Bear Markets

Bad News For Stocks, Commodities, Good News For Bonds

Subscribe to The Peter Dag Portfolio Newsletter by clicking here.