The Fed’s Set For A 25bp Cut, But It’s A Close Call

The US Fed has made it clear that monetary policy is going to be eased meaningfully from next week onwards. We had favoured a 50bp cut, but the latest job and inflation numbers suggest officials will more likely vote in favour of 25bp. Nonetheless, they will leave the door open to potentially more aggressive action down the line.

Rate cut expectations built over the summer

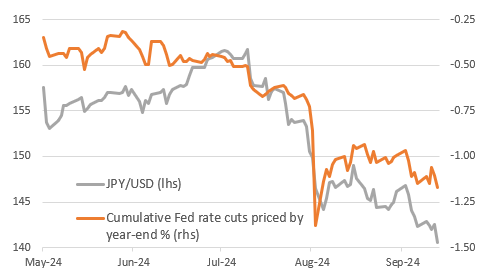

It has been an eventful summer with the combination of a Bank of Japan rate hike on 30 July, which caught many in the market off guard, and the Fed pivoting to put less emphasis on inflation and more on the jobs situation at the 31 July FOMC meeting, triggering some major market moves. This was compounded by a weak US labour report on 2 August. With the yen surging, creating concerns about potential financial market dislocations, the market moved to price for a potential inter-meeting Fed rate cut. At one point 60bp of easing was priced by the September FOMC meeting and a cumulative 138bp priced by year-end.

Market pricing of Fed rate cuts by end 2024 (%) and USD/JPY

Source: Macrobond, ING

Fed rhetoric acknowledges priorities have changed

Soothing words from central bankers and some better US numbers helped stabilise the situation, but it was clear that the odds of meaningful Fed policy easing had increased. It turned out that the minutes of the July FOMC meeting showed a surprise rate cut had been considered, with “several” Fed members suggesting the data flow had “provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision”. Inflation concerns were moderating with nervousness about the prospects for jobs increasing.

Ultimately, they decided to wait for more data, but “the vast majority” of members felt it would “likely be appropriate to ease policy at the next meeting”. Then, on 23 August, Fed Chair Jerome Powell was as clear as you can be that “the time has come for policy to adjust; the direction of travel is clear”. It subsequently turned out that the Chicago and NY Fed banks had voted in favour of a 25bp cut to the discount rate, the interest rate the Fed lends to financial institutions, which is another signal of intent to loosen broader monetary policy.

50bp was our call, but we now see 25bp as more likely

It was then a question of whether it would be a 25bp or 50bp rate cut. We favoured a larger move as an insurance policy against the prospect of more significant job weakness in the future, but the most recent jobs report was not as weak as feared, and August core CPI came in hotter than hoped at 0.3% MoM. Given this backdrop, we have to admit that 25bp looks like the most probable outcome. The market was also sensing this with 30bp priced in the wake of CPI – effectively a 25bp is baked in with a 20% chance that the Fed goes for a 50bp cut. Yet, as of Friday morning, a flurry of wagers on a larger move has seen the pricing shift to 36.5bp - basically a 46% chance of a 50bp cut.

The door will be left open for larger moves

We believe it is indeed a close call, and there will be members of the FOMC who will vote for a 50bp cut. We agree there is plenty to justify such a move. Business surveys paint a gloomy picture of slowing activity and hiring. Meanwhile, the Fed’s own Beige Book suggests that only three Fed regions of the US experienced “slight” growth in the previous eight weeks – The Fed’s Boston, Chicago and Dallas Fed banks – while the other nine reported flat or declining output. However, the composition of FOMC members who are voting and a certain degree of fear amongst those members that inflation may remain sticky will probably see a narrow majority opting for 25bp. Nonetheless, if they do go for that, we think Chair Jerome Powell will take a relatively dovish stance in the press conference and leave the door open to a larger move at some point should the data deteriorate.

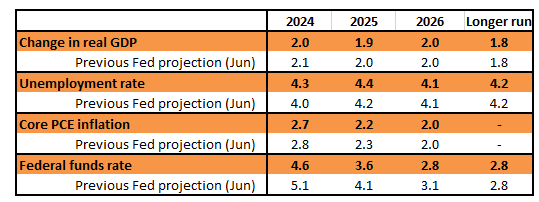

ING's expectations for what the Fed will forecast

Source: ING, Federal Reserve

Fed projections to point to 200bp+ of cuts

We will soon get an update on the Fed’s economic projections. There are likely to be some substantial revisions, given their June forecasts for growth and unemployment, which looked too optimistic even then. We think they will converge on the consensus numbers that suggest three 25bp rate cuts this year with a further 125bp next year.

A willingness to be flexible

This is less than the 100bp for 2024 and 150bp for 2025 currently priced by financial markets, but we strongly suspect the Fed will emphasise the uncertainty over the macro outlook and a willingness to be flexible – they can do more if the data justifies it. We suspect the Fed will maintain its long-run forecast for the Fed funds at 2.8%, having raised it to that level in June.

Our view is 100bp of cuts this year with another 100bp next year. So if they do a 25bp cut next week, that implies a 50bp move at either the November or the December FOMC meetings with 25bp of cuts at the first four FOMC meetings of 2025, leaving the Fed funds upper bound at 3.5%. We believe the Fed will end up front-loading the easing given deteriorating business surveys and a meaningful slowdown in labour hiring, which in combination will help dampen price pressures more quickly than the Fed is currently assuming.

Bonds risk a “sell-the-fact” psychology, even if it's only transitory

History shows that anticipation and subsequent delivery of a series of rate cuts tend to coincide with falls in the 10yr Treasury yield. There's more on that here. The anticipatory phase has been upon us since June, with the 10yr yield lower by some 100bp. The delivery phase is ahead of us. The big question surrounds capacity for the 10yr yield to fall some more. It’s now in the 3.65% area. For some time, we’ve been talking about a path to 3.5%, or slightly through. But anything lower would tend to look extreme against a future market discount for the funds rate to settle in the 3% area.

Two reasons to be cautious

We assert directional caution for two reasons. First, on the way down, the 10yr yield does not tend to hit the lows that the funds rate gets to. Second, a 10yr Treasury yield at around 3.5% or slightly lower is consistent with a 10yr SOFR rate of around 3%. That’s flat to the discounted future funds rate bottom, which, in effect, should act as a floor. Of course, this floor is a moving variable, as it can shift lower. But based on where we are now, longer-tenor SOFR rates really should not be trading below the implied floor for the funds rate.

So, as we face into the first cut of the cycle, there is a path for even lower longer-tenor rates. But to then get materially lower, the market would need to start thinking about a more significant easing than is currently discounted. We expect that the Fed broadly gets down towards the levels as currently discounted but will more likely settle slightly above than below. That should limit the downside for 10yr rates.

Finally, bear in mind that delivery of a first rate cut does not guarantee a coincident fall in the 10yr Treasury yield. The mid-1990s rate-cutting phase provides an example where the 10-year yield rose as the Fed began to cut. The 10yr yield subsequently fell back to a new low, but not before it had risen by some 50bp. Heading into this first rate cut, there is a “sell-the-fact” argument for a reactionary rise in the 10yr yield. But if that happens, we’d expect a multi-week reversal as yields ultimately revert lower.

Fed event risk unlikely to break the soft dollar trend

The DXY dollar index is down around 5% from its early July peak. In that time, two-year US Treasury yields have fallen close to 100bp, and the curve has bull-steepened. These moves look entirely consistent, and the big FX question for the upcoming FOMC meeting is whether the dollar needs to sell off anymore.

Powell now has more reasons to be dovish

If we do only get a 25bp Fed cut on 18 September and Dot Plots are less dovish than markets are currently pricing, it would all make it tempting to argue in favour of a counter-trend dollar rally. That may be the case, and if it is, we expect it to prove short-lived. Chair Powell’s press conferences have tended to be quite dovish this year, and he has several more reasons to be dovish now than he did earlier in the year.

Equally, discretionary rather than forced rate cuts from the Fed – consistent with a soft landing – should ultimately prove negative for the dollar. This would be consistent with risk assets staying relatively supported and the dollar starting to sit in the more bearish sweet spot of the dollar smile curve.

Expect FX traders to continue to express the softer US rate story through USD/JPY. This pair is one of the most sensitive to US rates, and the yen is helped by lower oil prices and the prospect of BoJ hikes. It also serves as a hedge should US equities re-price for a weaker growth outlook. And we favour a broadly weaker dollar into November’s US election, beyond which scenario analysis takes over.

More By This Author:

Poland’s Current Account Balance Significantly Worsens In JulyBank Of England To Keep Rates On Hold, But Faster Cuts Are Coming

Asia Morning Bites For Friday, Sept 13

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more