The Cryptocurrency Market Sinks After People's Bank Of China Ban

Yesterday will be remembered in the financial markets as the day when the cryptocurrency market almost completely collapsed, causing strong generalized declines that reached 30% in Bitcoin and 40% in Ethereum. This was after the People's Bank of China announced the prohibition of payments with Bitcoin in their country, thus closing the door to millions of users in their country, which caused a massive sale of such products around the world.

In recent weeks, we have seen how the cryptocurrency market is undergoing strong movements, not only due to the implicit volatility of this sector, but also to the different tweets and comments by Elon Musk for or against the payment method. The Tesla CEO has made various announcements over social media regarding whether or not the company will accept Bitcoins as a means of payment.

These comments and this volatility have attracted many new investors over the last few months, causing an impressive bullish rally in Bitcoin that led it to hit all-time highs at $ 64,778 on April 14, just 4 months after the Bitcoin exceeded $ 20,000 on December 16, 2020.

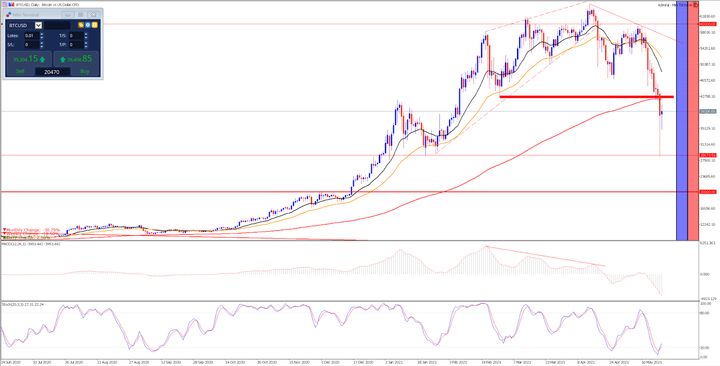

Yesterday, Bitcoin lost 30% of its value, although it finally managed to recover part of the lost ground and closed with a decrease of 14.40% at 36,720, 50 dollars. It, therefore, continued with the correction that began after marking all-time highs and breaking down the triangular formation, thus complying with the negative divergence that we could observe between the price and its MACD indicator. Such decreases have erased a large part of the annual benefits, establishing, for the moment, the annual increases at 37.9%.

Technically speaking, if we look at the daily chart, we can see that these strong falls have caused the price to break down the important average of 200 sessions. This acted as its main support in the coinciding area of the red band, which joins the previous lows until reaching the next lows where the recovery began.

Volatility is expected to remain in the coming sessions, so we must pay close attention to the price evolution and see if it is capable of recovering and breaking up against its average of 200 and its previous level of support that is currently acting as the main resistance. As long as this level does not recover, we could see further falls.

Source: Admiral Markets MetaTrader 5. BTCUSD daily chart. Data range: June 24, 2020 to May 20, 2021. Prepared on May 20, 2021 at 11:35 AM CEST. Keep in mind that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 302.3%

- 2019: 94%

- 2018: -73.2%

- 2017: 1337.7%

- 2016: 124.1%

If we look at the daily chart of ETHUSD, we can see that this pair also fell sharply to its 200-session average, although it eventually managed to close above its 61.8% Fibonacci retracement level of the previous bullish momentum, which currently acts as the main support level.

The BTCUSD pair is in a strong correction from its historical highs that reached last May 12 at $4,366.10, so we must pay attention to the next sessions and see if it is capable of recovering the supports lost in the last hours, as well as maintaining the level of 61.8% of Fibonacci, since the loss of this could open the doors to a greater correction.

Source: Admiral Markets MetaTrader 5. ETHUSD daily chart. Data range: June 24, 2020 to May 20, 2021. Prepared on May 20, 2021 at 11:40 AM CEST. Keep in mind that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 469.58%

- 2019: -2.04%

- 2018: -82.10%

- 2017: 9109.63%

- 2016: -29.89%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more

China has been actively working on its state-backed digital Yuan. Therefore, it does not come as a surprise that the nation may move to crush other public cryptocurrencies. $BTC.X $Bitcomp.

Check out this little bit from Investing....

charts.stocktwits.com/.../original_332885144.png

Meanwhile they are freely trading it Beijing!!