The Bigger Picture For Housing Affordability In The U.S.

What can you discover when you chart median new home sale prices against median household income?

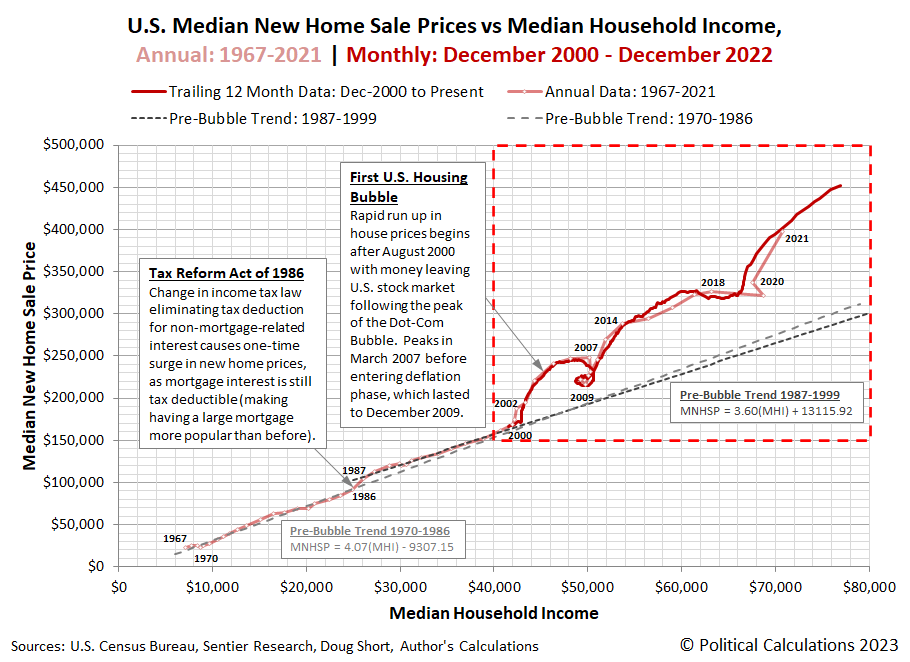

Here's the visualized beginning of the answer to that question, using annual data from 1967 through 2021 and monthly data from December 2000 through December 2022!

What you first see is there are some long-running and often linear relationships between these two variables. And what you find is that when you get to 2000, bubbles begin inflating that break down those relationships. We've highlighted that region with the red-dashed lines in the chart, so let's zoom in on it in the next chart.

The second chart answers the question of what the relationship between median new home sale prices and household income would have looked like had 2020's coronavirus pandemic not messed up the U.S. Census Bureau's collection of income data for 2019!

Going back to the first chart, you also get the answer to another question: How inflated are house prices today compared to how they were prices before the housing bubbles? As of December 2022, At just over $450,000, the trailing twelve-month average median new home sale price costs around 50% more than what they would had if the relationships that existed before 2000 continued to the present day.

Going to most observers, there have been two major housing bubbles in the 21st Century. The inflation phase for the first housing bubble had its origins in August 2000 and peaked in March 2007. Its deflation phase then lasted until December 2009. What we would consider the second housing bubble took off in July 2012. This more recent bubble has had several phases, but using the measure of median new home sale prices, has only begun to deflate in the last several months. That development is only starting to show up in the twelve-month moving averages we've presented in these charts.

These bigger pictures provide a little different, but very useful way to look at the underlying data for assessing how affordable housing is within the U.S. We're looking forward to seeing how they evolve during the course of this year.

References

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Population. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 27 January 2023. Accessed: 27 January 2023.

U.S. Bureau of Economic Analysis. Table 2.6. Personal Income and Its Disposition, Monthly, Personal Income and Outlays, Not Seasonally Adjusted, Monthly, Middle of Month. Compensation of Employees, Received: Wage and Salary Disbursements. [Online Database (via Federal Reserve Economic Data)]. Last Updated: 27 January 2023. Accessed: 27 January 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 January 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 January 2023.

More By This Author:

Relative Affordability Of U.S. New Homes Holds Near Record LowS&P 500 Adapts To Shifting Expectations For Rate Hikes

Dividends By The Numbers In January 2023

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more