The Bank Of Korea Lowers Rates, With Odds Favoring More Cuts

Image Source: Pixabay

The Bank of Korea resumed easing as the FX market stabilized amid weak growth concerns

The Bank of Korea lowered short-term rates by 25bp to 2.75%, as expected. The central bank’s rate-cut statement highlighted growing uncertainty from political developments at home and abroad, adding to downside risks and leaving the BoK open to further easing. With inflation seen staying below 2%, the main focus is on supporting growth. However, the pace and extent of easing moves depend on the government’s fiscal policy steps, currency moves and household debt levels.

Looking ahead three months, two out of six BoK members are open to a rate cut. Yet all agree that monetary policy remains on an easing path. We tend to downplay the forward guidance, as it can swing quickly, especially in times of great uncertainty. Also, Governor Rhee noted that the BoK's current assumptions on monetary policy aren’t all that different from the market's view of two to three cuts, including today's, this year. If growth proves slower than the currently expected 1.5%, policy coordination with the government will be needed.

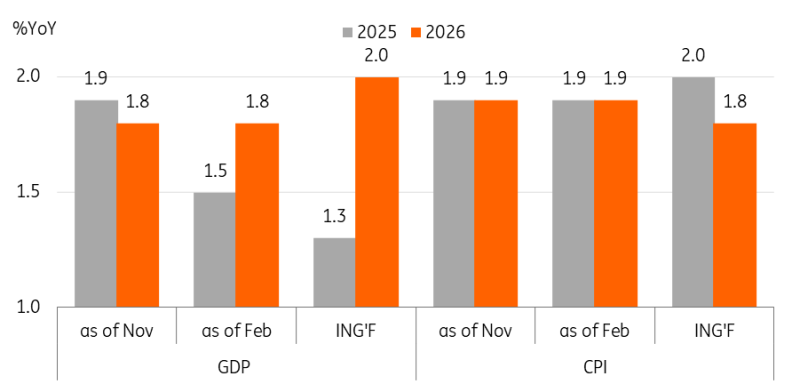

BoK revised downward its GDP forecast for 2025

Source: CEIC

FX market will remain volatile throughout 1H25

On the FX front, the USDKRW recently fell to the 1,430 level. But it’s expected to rise again once tariff risks intensify. One big area of uncertainty is the Constitutional court’s decision on whether to remove President Yoon from office, expected in the next two-to-three weeks. The USDKRW is likely to strengthen, but only briefly.

We figure that President Trump’s tariffs on Korean manufacturers will get tougher once the political situation in Seoul becomes clearer. This could trigger some USDKRW weakness. We expect the USDKRW to peak in the second quarter before stabilising in the second half.

BoK watch

We expect the BoK to ease three more times in 2025, once per quarter, as a lower-than-neutral rate is needed to support growth. This is 25bp lower than the BoK's current assumption and the market consensus. As we learn more about the government’s supplementary budget, we expect both monetary and fiscal policy to be accommodative to maximise the impact.

In terms of growth, we expect GDP to expand 1.3% year on year in 2025, lower than the BoK's forecast of 1.5%. We believe that the accommodative policy will get traction in the second half, though near-term growth will remain sluggish due to ongoing restructuring efforts in the construction sector and weak private consumption. Meanwhile, consumer prices are expected to stay around 2% this year. Due to soft domestic demand, the government is likely to expand its energy support programmes and delay the public service fee hikes.

More By This Author:

U.S. Attempts To Curb China’s Dominance In Shipping, But Actions Could BackfirePositive Start To The Year In Poland Amid Revival In Household Spending

FX Daily: Euro Welcomes German Election Result

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more