The 2021 Housing Market In Charts

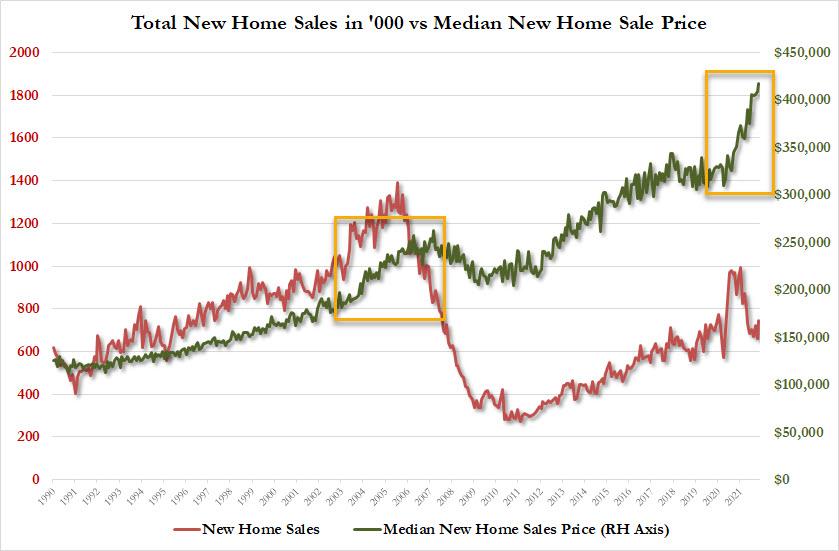

It has been an absolutely gangbusters year for housing, which as we noted earlier today just saw both median and average prices hit fresh all-time highs for new homes. In fact, as the chart below shows, new home prices are currently rising more than twice as fast as they did during the last housing bubble.

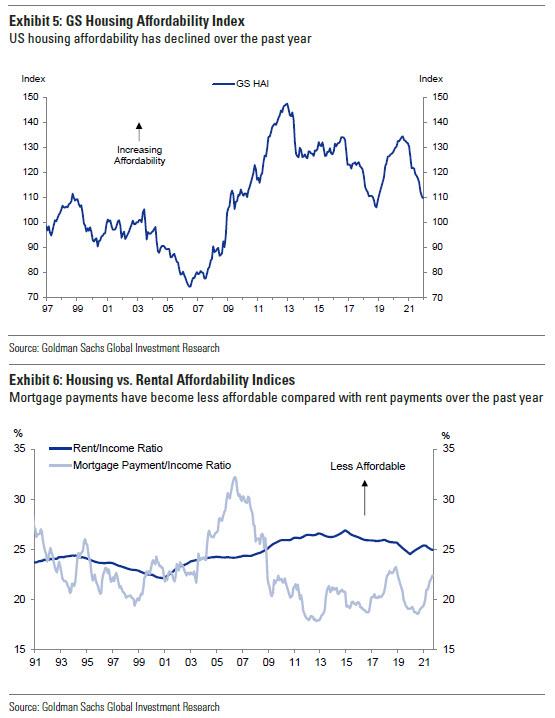

It's just as crazy when it comes to existing homes, where the NAR continues to lament the lack of new supply as more and more Millennials are hoping to stop blowing their money on rent and actually purchase a house, yet with existing home prices also at near-record levels, housing has become extremely unaffordable to most.

And while increasingly more middle-class Americans remains shut out of buying a new home, housing - which has traditionally been the one asset class that represents the bulk of middle-class America's net worth - continues to appreciate, which is good news for those lucky to be part of the US homeownership class.

With that in mind, here is a lookback at some of the key numbers of housing and mortgages in 2021, courtesy of Goldman Sachs, and a look ahead to 2022.

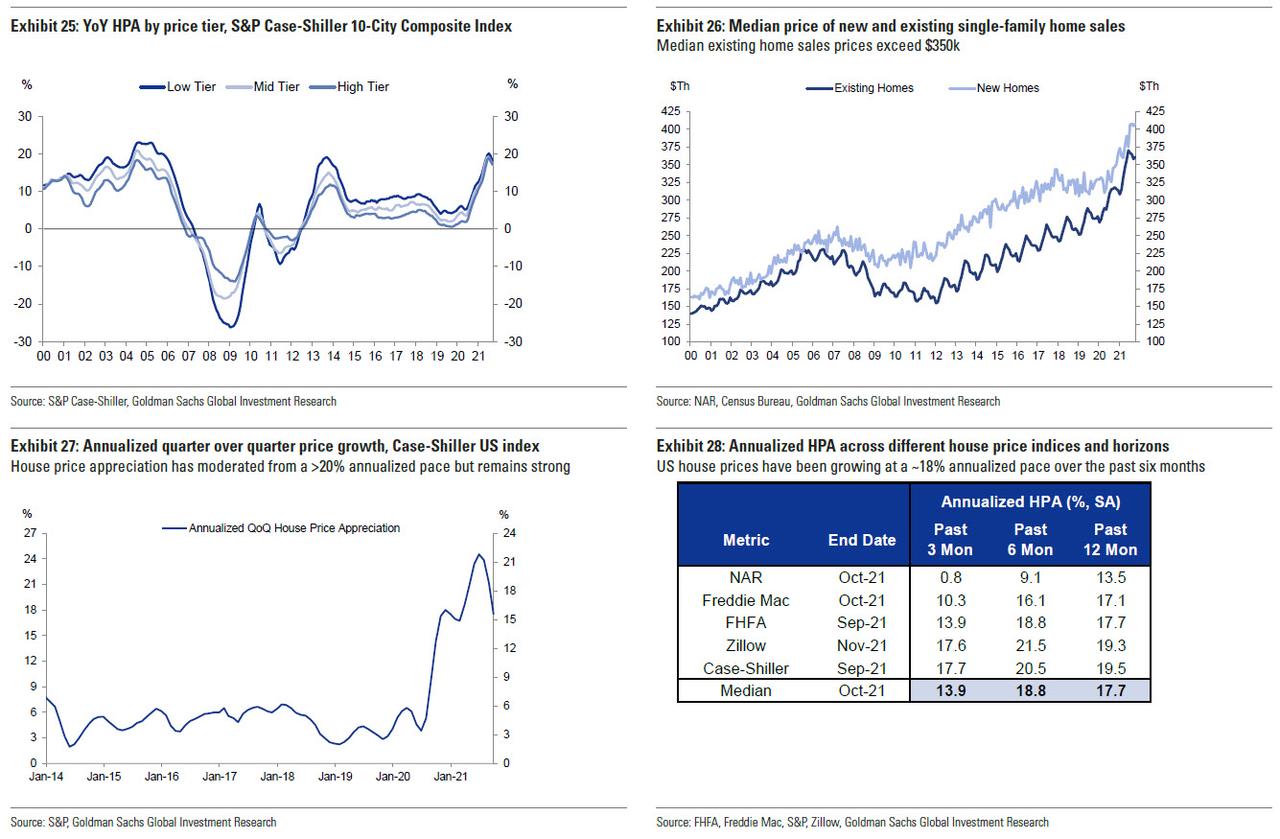

2021 was characterized by record high rates of house price appreciation and record agency MBS issuance volumes

- +45bp: 30-year mortgage rates rose by 45bp between December 2020 and December 2021.

- +20%: the Case-Shiller US house price index grew by 20% over the past 12 months.

- -1%: single-family housing starts decreased by 1% from November 2020 to November 2021, as supply chain constraints limited the pace of construction.

- 33%: 33% of outstanding conventional 30-year mortgage borrowers have a 50bp or larger refinance incentive as of 2021Q4, down from 88% in 2020Q3.

- $3.4tn: agency MBS issuance YTD has totaled $3.4tn, up from $3.0tn YTD in 2020.

- $470bn: Federal Reserve agency MBS holdings increased by $470bn over the past year.

Looking at 2022, Goldman expects the housing market to moderate but remain strong, and MBS issuance volumes to slow but still remain substantial, in 2022

- GS expect mortgage rates to increase a further 50bp in 2022, ending the year at 3.6%.

- The bank expects the Case-Shiller US house price index to grow by 10% in 2022.

- Expect single-family housing starts to increase by 4% in 2022 vs. 2021, with supply chain challenges-remaining relevant for much of the year.

- Expect 20% of outstanding conventional 30-year mortgage borrowers to have at least a 50bp incentive to refinance in 2022 Q4.

- Look for agency MBS issuance to reach $2.5tn gross and $725bn net in 2022.

- Expect Federal Reserve MBS holdings to decrease by $40bn in 2022, with the Federal Reserve ending their taper process in 2022Q1 and allowing balance sheet runoff to start in 2022Q4.

Below we chart some of the key trends in housing.

US housing affordability has declined as house prices have moved up, both in absolute terms and when compared to rents (which incidentally are also at all time high).

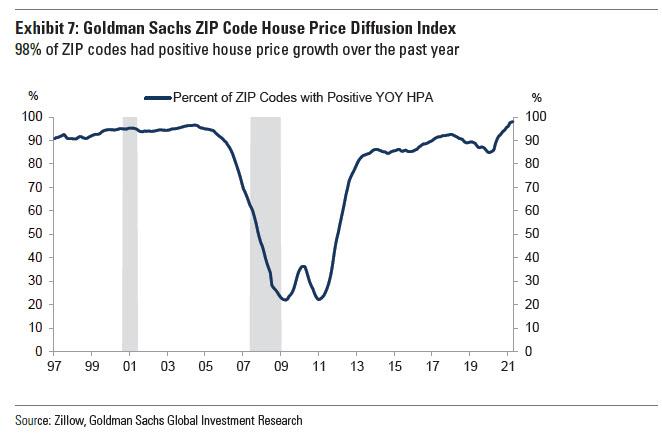

98% of ZIP codes had positive house price growth over the past year

Homebuilding activity remains constrained, and while housing starts are rising gradually and homebuilder confidence is near all-time highs, homebuyer sentiment has dipped from the summer (perhaps in response to record prices), while pending and existing home sales are now down year-over-year.

(Click on image to enlarge)

Housing supply remains tight: the supply of homes available for sale is near all time lows, especially among existing single-family homes. This has resulted in furious turnover of new inventory with average days on market for sold homes just shy of all time lows. Helping matters are extremely low rates which means that the mortgage foreclosure rate is at multi-decade lows.

(Click on image to enlarge)

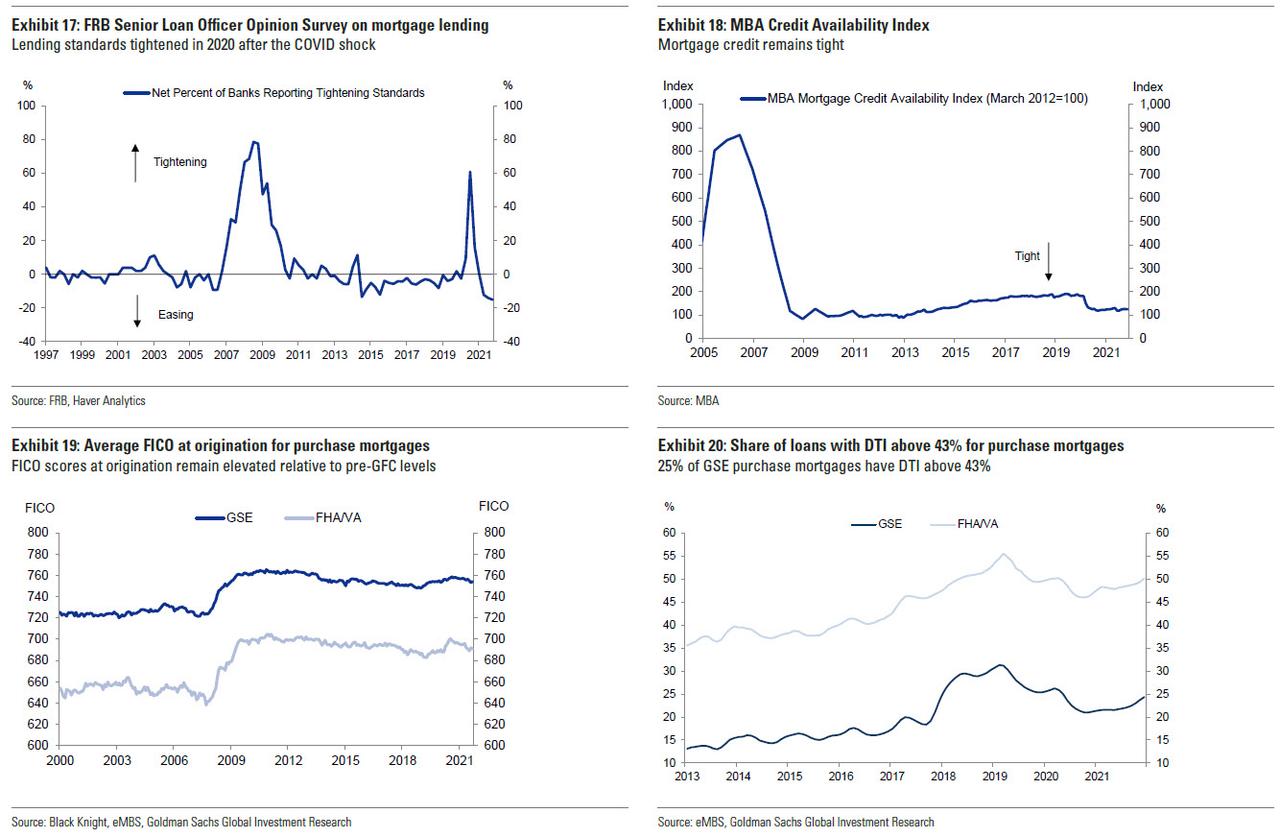

Unlike the housing bubble of 2006-2007, mortgage lending standards remain somewhat conservative even if the most recent FRB senior loan officer suggests that mortgage loan standards are easing. That said, FICO scores at origination are high (this could be the result of recent artificial increases to the FICO measurement) while the share of loans with a Debt to Interest ratio above 43% is more than 25% for GSE and 50% for FHA loans.

(Click on image to enlarge)

(Click on image to enlarge)

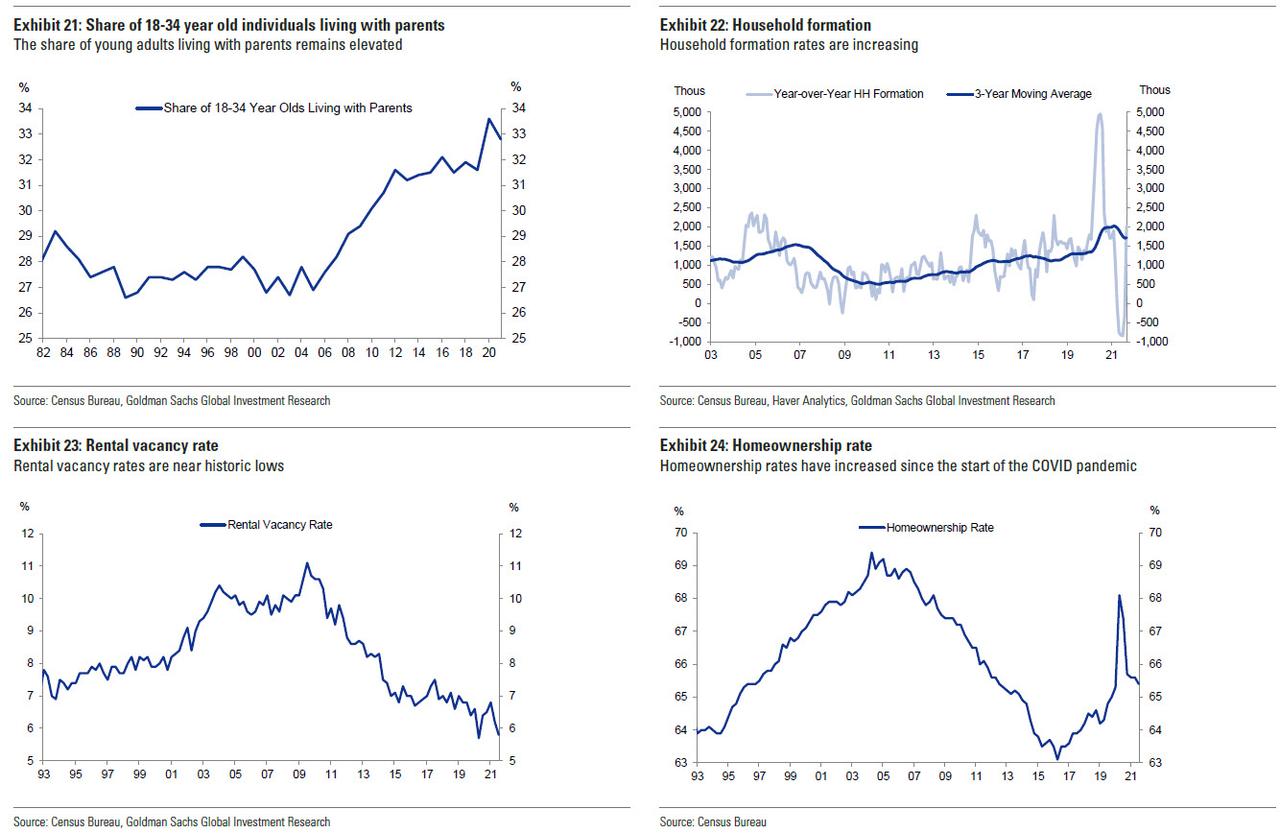

As a result of record-low rates, homeownership rates have picked up modestly over the past year although the data remains mixed: while the share of young Americans (18-34) living with their parents is down modestly from all-time highs, household formation is growing slightly even if the data tends to be volatile; and while houses are clearly being bought, rental vacancy rates remain at all-time lows.

(Click on image to enlarge)

As noted up top, with home prices at record highs, it is no surprise that Goldman finds house price growth has accelerated across all price tiers, even if on an annualized basis prices may have topped for now.

(Click on image to enlarge)

The full Goldman presentation is available to professional subscribers.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC ...

more