Texas Manufacturing Index Plunges To Lowest Level Since The Pandemic

The Dallas Fed has grim details of a decline in manufacturing in Texas. Production, employment, new orders, and capacity utilization all dropped steeply.

Texas Manufacturing Survey

The Dallas Fed reports Texas Manufacturing Activity Contracts in January

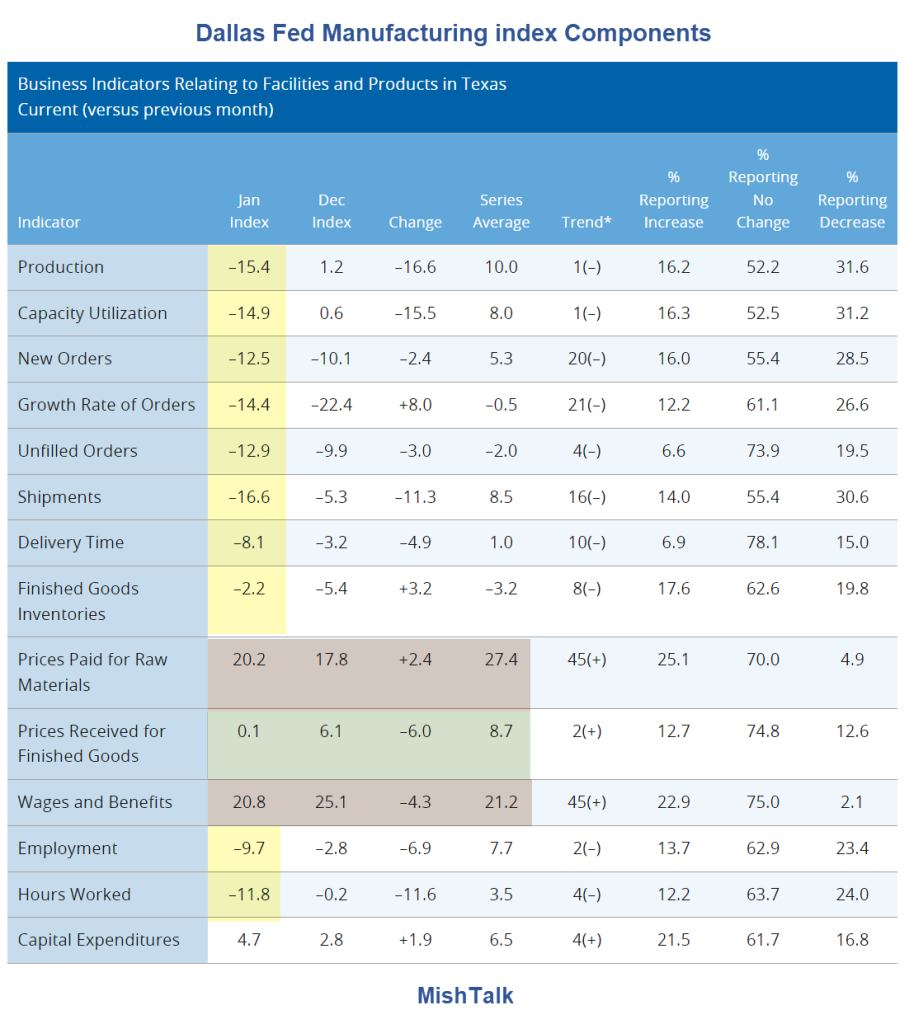

- The production index, a key measure of state manufacturing conditions, dropped 17 points to -15.4—its lowest reading since mid-2020.

- The new orders index ticked down from -10.1 to -12.5

- The capacity utilization index dropped to a multiyear low of -14.9

- Shipments index slipped 11 points to -16.6.

- The employment index moved down seven points to -9.7, its lowest reading since mid-2020. Fourteen percent of firms noted net hiring, while 23 percent noted net layoffs. The hours worked index came in at -11.8 after a near-zero reading last month.

Dallas Fed Manufacturing index Components

Worsening Conditions in Services

The Dallas Fed Services Index for January is out tomorrow.

For December, “Respondents continued to perceive worsening broader business conditions, though pessimism waned further. The general business activity index improved from -11.6 to -8.7, while the company outlook index increased from -8.1 to -0.7. The outlook uncertainty index ticked up two points to 12.6.”

Consumer Credit Hits Record $5 Trillion

For discussion, please see Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

Also see How Did Covid Change Your Propensity to Buy Things Online?

Consumers keep spending more and more, and much of that spending is online.

Should the Fed Declare Victory?

Some people want the Fed to declare victory already, despite Core PCE inflation running at 2.9 percent year-over-year.

For discussion, please see Hoot of the Day, What is the Fed Waiting On?

More By This Author:

Tax Cuts, Not Bidenomics Explains Surge In Consumer Spending In 2023How Did Today’s Economic Data Impact Fed Rate Cut Odds?

Increase In Real Spending Rose 5 Times The Increase In Real Disposable Income

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more