Tesla And Its Real Value

Summary

- Tesla may finally be at a stage where it will start showing some concrete value according to factual data.

- Tesla is coming into its own, while not only competing with electric car companies, but also competing against traditional car makers.

- The fundamentals of this company have been horrible, but is that about to change?

- Over the past 8 years plus, the stock has produced over 30% annual return.

- Factual evidence tells about the real value vs. stock price.

Tesla, Inc. (TSLA) is a vertically integrated sustainable energy company that produces solar equipment and panels, batteries and other electrical components that it installs in its high-performance, fully electrical vehicles.

The Palo Alto, California company was founded in 2003 and is focused on transitioning the world to more sustainable transportation through its electric vehicles. It has produced a few models of vehicles such as the Tesla Roadster (2008), Model S (2012), Model X (2015), Model 3 (2017), and Model Y (2019), however the company has yet to make a profit.

The company is becoming more diversified by manufacturing and selling a variety of vehicles in the US and abroad. In Q4, it delivered 63,359 Model 3 vehicles to customers in North America. In January 2019, it started to produce vehicles for Europe and China.

This article will consider the benefits of investing in this innovative and exciting business while also looking closer into the fundamentals and facts to see if the company is starting to produce any concrete signs of increasing value based on factual data. I have glanced at this company’s fundamentals from time to time over the years, but the data was disappointing because the company was not yet developed enough nor producing enough units sold. However, it seems that the company is starting to gain traction, improving its production efficiency, expanding globally, and now beginning to make significant increases in sales.

Yes, there has been some recent controversy and tons of media coverage about Elon Musk and from critics and supporters of Tesla. But when analyzing a company, it’s important to focus on the long-term track record and potential long-term future of the company. By focusing too much on short-term hype, it’s easy to get lost in the trees and to lose the big picture of the forest. After all, it’s the big-picture view which tells us where the company has been and where it’s likely heading.

I feel that it’s time for me to analyze the big picture of Tesla more thoroughly. Before fully analyzing Tesla, I predict that the company will still not show decent fundamentals, but my guess is that the fundamentals will start to reveal some progress and maybe some signs of more concrete value that can be found in this company.

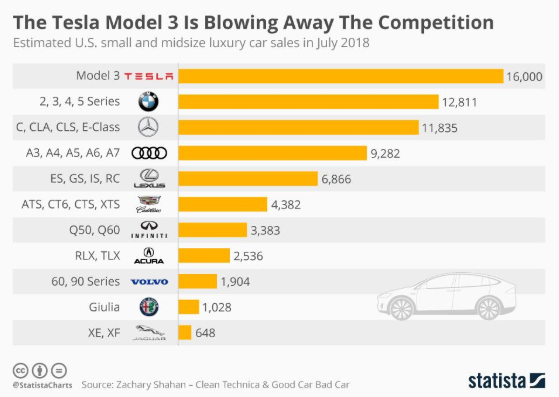

Competition

Tesla is not only a leader in electric vehicles, but it is also competing and even leading in some categories among traditional car manufacturers. Below you can see that the Model 3 estimated sales outpaced the competition in the summer of 2018.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. There is not enough data to produce a complete score, but the data that is given indicates a low company score. Therefore, Tesla is not considered to be a good company to invest in, since Tesla’s score is less than 70, which is the lowest good company score. TSLA has a mediocre score for Gross Margin Percent. It has low scores for ROE, Earnings per share, ROIC, and PEG Ratio. A low PEG Ratio score indicates that the company may not be experiencing high growth consistently over the past 5 years. In summary, these findings show us that TSLA seems to have below average fundamentals since the majority of categories produce low scores.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

(Source: BTMA Stock Analyzer )

Fundamentals

Let’s examine the price per share history first. In the chart below, we can see that price per share has grown overall during the past 10 years, but share price has not increased steadily. Instead there is somewhat of a step pattern to its share price increases. In other words, share price has a significant jump, then seems to plateau for a couple years, then has another jump, then plateaus for a few more years. Overall, share price average has grown by about 1201.16% over the past 10 years or a Compound Annual Growth Rate of 32.99%. This is a spectacular return for shareholders over the past 10 years.

(Source: BTMA Stock Analyzer – Price Per Share History)

Earnings

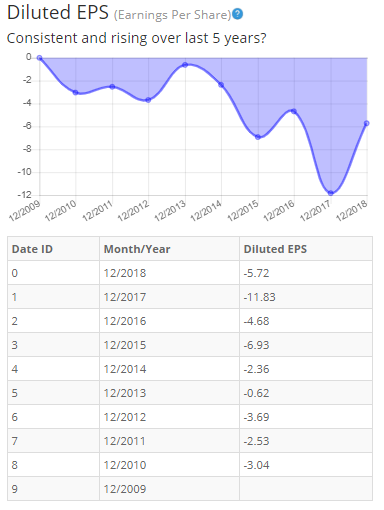

Looking closer at earnings history, we see that earnings have been horrible. According to the chart, the company has yet to make a profit. Earnings have been negative and trending mostly downward, especially since 2013.

Inconsistent earnings make it harder to accurately estimate the future growth and value of the company. So in this regard, TSLA is a terrible candidate of a stock to accurately estimate future growth and current value.

(Source: BTMA Stock Analyzer – EPS History)

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

Return on Equity

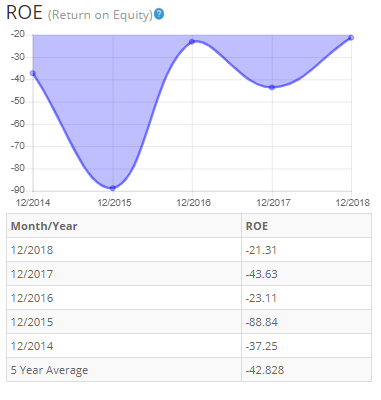

The return on equity has been negative, but increasing overall in the past 5 years. Five-year average ROE is very low at around -43%. For return on equity (ROE), I look for a 5 year average of 16% or more. So TSLA fails miserably to meet my requirements.

(Source: BTMA Stock Analyzer – ROE History)

Let’s compare the ROE of this company to its industry. The average ROE of 14 Auto and Truck companies is 7.32%.

Therefore, Tesla’s 5-year average of -42.8% and current ROE of -21.31% are well below average.

Return on Invested Capital

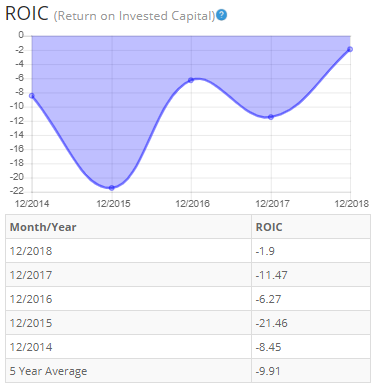

The return on invested capital has been negative for the past five years and has been slightly increasing. In 2015 and 2017, ROIC declined which was followed by increases in 2016 and in 2018. Five-year average ROIC is also terrible at around -9.9%. For return on invested capital (ROIC), I look for a five year average of 16% or more. So TSLA fails this test as well.

(Source: BTMA Stock Analyzer – Return on Invested Capital History)

Gross Margin Percent

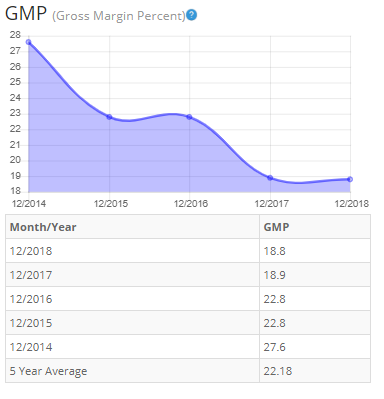

The gross margin percent (GMP) has been generally decreasing for the past five years except for 2016 when GMP was unchanged. Five-year GMP is low at around 22%. I typically look for companies with gross margin percent consistently above 30%. So TSLA has not proven that it has the ability to maintain acceptable margins over a long period. It is also worrisome that the margins continue to decrease.

(Source: BTMA Stock Analyzer – Gross Margin Percent History)

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is greater than 1. This is typically a bad indicator, telling us that the company owes more than it owns.

TSLA’s Current Ratio of .83 is unsatisfactory, indicating that it doesn't have a good ability to use its assets to pay its short-term debt. Ideally, we’d want to see a Current Ratio of more than 1, so TSLA does not meet this amount.

According to the balance sheet, the company seems to not be in good financial health. In the long term, the company could use improvement in regards to its debt-to-equity. In the short-term, the company’s financial situation is unsatisfactory because the current ratio indicates that it can’t effectively pay off its short-term debt.

The Price-Earnings Ratio is calculated using EPS, and since Tesla has yet to have a positive EPS, it has no P/E ratio. A negative P/E ratio indicates that the company has negative earnings or is losing money.

Tesla does not currently pay a regular dividend to its shareholders.

(Source: BTMA Stock Analyzer – Misc. Fundamentals)

Value Vs. Price

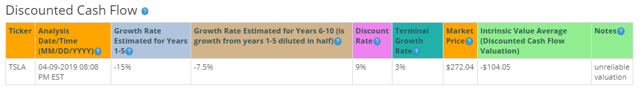

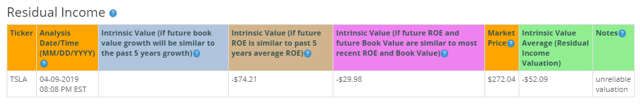

For valuation purposes, I will be using two of BTMA Stock Analyzer’s valuation methods. Because of Tesla’s negative earnings history and negative figures for ROE and ROIC, these valuations are unreliable.

The only purpose of providing these valuation estimates is to try and give some present date estimate to get an idea of TSLA’s valuation so that future valuation analyses can have some figures to be compared with to show progress.

Discounted Cash Flow valuation method shows an estimated value of approximately -$104.

(Source: BTMA Stock Analyzer – DCF Valuation)

Residual Income valuation method shows an estimated value of approximately -$52.

(Source: BTMA Stock Analyzer – Residual Income Valuation)

These valuation methods show that Tesla is currently overpriced. This is understandable since according to the factual data, the company has failed to make any profit. Therefore, it shouldn’t have any positive value.

By strictly using the factual data, it would be speculating to award Tesla a positive valuation at this time.

However, if you consider that Tesla has showed great growth in its total shareholder equity, this could suggest that the company is worth some positive value.

In addition, if you consider that the company has had huge upfront costs, which could produce significant ongoing revenues down the road, then this would also suggest that the company has some additional potential value.

So in a nutshell, if just looking at the factual data, Tesla isn’t worth a positive value at this time but when considering a belief that this company will continue to grow and will eventually generate positive earnings in the near future, then each individual investor could designate their own value for this company. The valuation therefore, depends on each investor’s belief and confidence in this company.

Forward-Looking Conclusion

According to the facts, Tesla is not financially healthy in a long-term sense in having enough equity as compared with debt, nor is it healthy in the short-term because the current ratio indicates that it doesn’t have enough cash to cover current liabilities. If and when Tesla begins to generate substantial profits, then we can really begin to understand a more concrete idea of this company’s future financial situation.

Other fundamentals are terrible, including ROE, ROIC, and EPS.

Lastly, this analysis shows that the stock is overpriced.

Predicted Growth

“Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 35%. This year, analysts are forecasting earnings increase of 128.53% over last year. Analysts expect earnings growth next year of 270.59% over this year's forecasted earnings.” (Source: Forecast Earnings Growth)

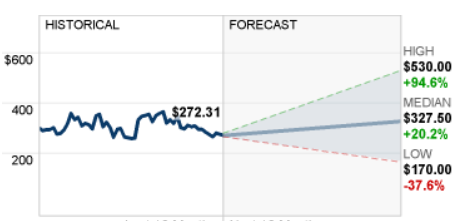

Another source has a wide range of stock price growth forecasts for TSLA, ranging from a worse-case scenario of -37%, to a best-case scenario of 94% growth. As you can see, growth expectations for this stock are all over the place and unreliable. I believe it is fair to say that everyone is wildly guessing when it comes to the future growth of Tesla.

Because of the exaggerated differences in growth predictions, I cannot say with any level of accuracy what kind of return TSLA can generate in the future. But do not be discouraged, Tesla is not your normal company, nor is it in a normal situation. Therefore nobody can realistically predict the future growth or returns of Tesla with any great conviction.

There are still many hurdles for Tesla to overcome in reaching long-term stable profitability. In addition, the company is a pioneer in transitioning the world into high-performance electric vehicles and they also have to overcome their powerful critics in the traditional industries of automobiles, energy, and other fossil fuel supporters.

It could be suggested that Tesla is in a similar position as Ford was when convincing the world to transition from horse to automobile. The task will not be easy, but if Tesla succeeds then the payoff for the company and its shareholders could be huge.

To better understand how this stock varies in possible returns, let’s look at real past return results of the company.

______________

8 Year Return Results if Invested in TSLA:

Initial Investment Date: 4/9/2011

End Date: 4/9/2019

Cost per Share: $25.27

End Date Price: $272.31

Total Return: 977.60%

Compound Annualized Growth Rate: 34.60%

_______________

3 Year Return Results if Invested in TSLA:

Initial Investment Date: 4/9/2016

End Date: 4/9/2019

Cost per Share: $249.92

End Date Price: $272.31

Total Return: 8.96%

Compound Annualized Growth Rate: 2.91%

_________________

From these scenarios, we have produced annual return results from 2.9% to 34%. The early growth of the company produced greater returns, but as the company has grown larger and more mature, these returns have greatly decreased.

As a comparison, the S&P 500’s average return from 1928 – 2014 is about 10%. Therefore, if an investor is simply looking for a passive and somewhat low-risk diversified return average of around 10%, a low fee S&P index fund could be a good choice. However, if you are a risk-taker wanting the possibility of a much greater return, then TSLA may be more attractive for you.

For me, the choice is certain. When looking at this unique investing opportunity, my logic tells me to look at the terrible factual fundamentals of this company and to stay away. In this realistic and logical view, TSLA is not a good investment at this time.

On the other hand, if I truly believe in Tesla’s mission to make a more sustainable, greener form of transportation that will help the environment and lead to other positive ways to reduce climate change, then I would consider investing in the company as a form of charity. With this mindset, I’d feel like I’m donating to a good cause, with a potential future payoff in a better world and possibly a large monetary payoff if the company succeeds.

In another scenario, if I’m a solid believer in the company and feel that Tesla will soon generate profits and continue to be around in 10 years successfully profiting from sales of cars, solar equipment, and batteries, then I would consider using my own conviction as a gauge of deciding to invest.

To be clear, I believe that no true value investor that relies solely on factual data could confidently invest in this company. This is a special-situation stock that requires each investor to ask themselves if they’ll invest in the mission of Tesla or in their own confidence about how successful this company could be in the future.

Disclosure: None.

If you want to be notified about good stocks that are currently selling at discount prices, then try out the more