The AI Fad Just Burned To The Waterline

Photo by Steve Johnson on Unsplash

While everyone was busy reassuring themselves the stock market was still A-OK, the driver of the market--the AI fad--just burned to the waterline. Yes, the current euphoric expectations for AI are a fad, the latest in the endless stream of "gotta have" status signifiers and cultural frenzies.

The core dynamic in all fads is Human Wetware 1.0. Though we glorify our individuality--The primacy of the Individual is the key characteristic of Modernity--we remain a herd animal, alert to every twitch in the herd's emotional state and anxious to join the herd when it starts running, lest we're left behind or lose status.

CEOs are just as prone to fads as the rest of us, and this is how the AI fad gathered momentum. A decade ago the warm-and-fuzzy tech fad that enamored every corporate HQ was fuzzy logic, one of the long line of precursors to the current AI mania. So labels touting "fuzzy logic" were slapped on rice cookers as everyone scrambled to cash in on the latest tech fad.

And so now every package of Kroika Cookies is emblazoned with "powered by AI!" Indeed. The leaders of the herd are especially keen to study every shift in the zeitgeist and the pecking order, as the greatest sin for CEOs is to be revealed as incompetent / clueless by missing the latest boat in corporate fads.

Here is one example of the catastrophic consequences not of missing the boat but of blindly climbing on board. On a flight to Shanghai in May 2000, shortly after the NASDAQ dot-com bubble had peaked, my seatmate was a senior engineer working for a Silicon Valley semiconductor equipment maker. Over the course of the long flight, he recounted the domino-like chain of disastrous results of the CEO jumping on the "gotta offshore production" fad that was sweeping through Corporate America.

The net result of moving production to Southeast Asia and China was 1) the wholesale theft of intellectual property (IP) and 2) the collapse of quality, requiring technicians to be flown in to fix all the quality problems.

But to not move production overseas would have been perceived as "missing the boat," so everyone rushed to join the thundering herd, whether it made any sense or not.

The second dynamic in play now is this: monopolies don't care about efficiency or quality, as the user / consumer has no real alternative. The tech world is brimming with stories of corporate wealth being squandered on teams developing efficiencies that are shelved upon completion. The more money gushing into the corporate coffers, the less interest there is in efficiencies.

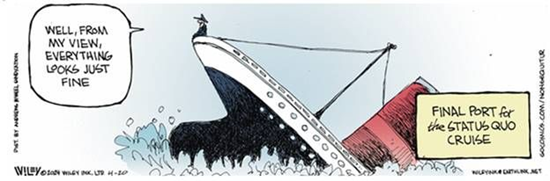

Keeping the Good Ship Status Quo on course is good enough--until the Status Quo burns to the waterline. Then the scramble is to cover the disastrous mis-allocation of corporate capital and identify the next fad to join.

The third dynamic is: this isn't about one company. It's about a toolbox that's already infected the entire tech world. It doesn't matter if DeepSeek disappears tomorrow: the toolbox of software structures they've released has already entered the bloodstream of global tech and has already transformed the DNA. There's no going back to brute-force processing as any sort of competitive advantage. Rather, it's a cost anchor that will drag any denialist laggards to the bottom.

The fourth dynamic is: there's nothing investable in this disruption because everyone can now develop the same open-source tools and approaches. there is no monopolistic moat to guarantee profits, and no revenue stream to milk. Rather, like deploying billions of dollars on data farms to improve search, there is no revenue at all. Nobody's paying a single dollar for AI enhanced search.

As I've noted before, when the tools and techniques are freely available to all, there's no scarcity value to any of it. And with no scarcity value--no value proposition so mighty that people will pay a premium for it--then profits are thin to zero.

The "smart money" has noted the AI fad has burned to the waterline, and has been frantically assuring "dumb money" that the stock market bubble is still intact and poised to bubble higher, so there's no reason to sell, and every reason to "buy the dip" so the "smart money" can sell, sell, sell near the top and let the "dumb money" absorb the coming 80% decline as a fad that was poorly conceived from the start has burned to the waterline, and the tiniest wave will send it to the bottom.

The "safe bet" was on heavily moated tech behemoths dumping billions of dollars into the "competitive advantage" of energy-ravenous processing power. That "safe bet" is now in Davy Jones' Locker. The reality that "AI has no revenues and no profits" is lingering above the burned-out hulk as a haze of doubt and confusion.

What's the next fad? Stay tuned. It might just be a retro revival of the time-tested fad for cost-cutting and "return to basics," starting with mass layoffs and slashing capex budgets.

Sometimes wide moats and billions of dollars to blow lead not to glory but to hubris, which beckons Nemesis.

More By This Author:

The Easy Credit, High Interest Rate SwindleHigh Interest Rates Are Healthy, Low Rates Are Poison

Fix This Or Nothing Else Matters

Disclosures: None.