Ranked: Semiconductor Production By Country Or Region (1990-2032F)

(Click on image to enlarge)

![]()

The global semiconductor industry has undergone a dramatic transformation since 1990, reflecting broader shifts in technological manufacturing and economic power.

Once dominated by European and American manufacturers, the industry has experienced a significant geographic redistribution in recent decades.

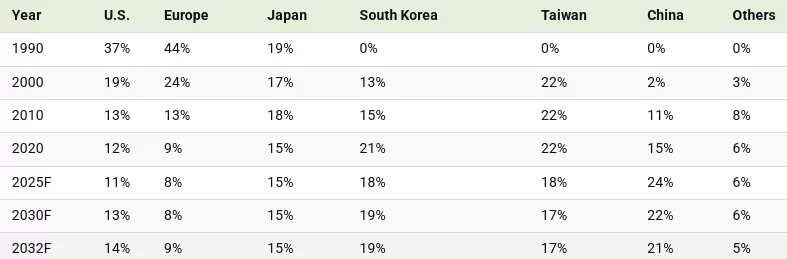

This visualization shows the share of global semiconductor production by country or region, from 1990 to 2032 (forecast).

The data comes from the VLSI Research Projection SEMI May 2024 update, with BCG analysis via J.P. Morgan Asset Management.

Asian Countries Are Leading Semiconductor Production

Below, we show the share of global semiconductor production by location, from 1990 to 2032F.

It’s worth noting that all values are shown in 8″ equivalents and exclude capacity below 5kwpm or less than 8″. The “Others” category includes Israel, Singapore, and the rest of the world.

The United States’ decline in semiconductor production share represents one of the most significant shifts in this landscape.

From a commanding position of 37% of global production in 1990, America’s share has steadily eroded to a projected 14% by 2032.

This decline reflects broader trends in manufacturing outsourcing and the emergence of specialized manufacturing hubs in Asia.

Asia is All-in on Chips

China, on the other hand, has seen a dramatic rise in its share of semiconductor production.

Starting from virtually no production capacity in 1990, China has leveraged massive government investment and strategic planning to build a robust semiconductor manufacturing base, with a projected 21% market share by 2032—the most out of any region.

Meanwhile, Taiwan and South Korea have emerged as semiconductor powerhouses in recent decades, with Taiwan projected to account for 16% of global semiconductor production and South Korea accounting for 17% by 2032.

Their consistent growth trajectories have transformed them from minor players to critical links in the global technology supply chain. Taiwan’s semiconductor industry, particularly TSMC, has become especially crucial for producing the world’s most advanced chips, while South Korea’s success has been driven by giants like Samsung and SK Hynix.

More By This Author:

How Many New Mines Are Needed For The Energy Transition?Ranked: Semiconductor Foundries By Revenue Share

Visualizing America’s $1.7 Trillion Insurance Industry