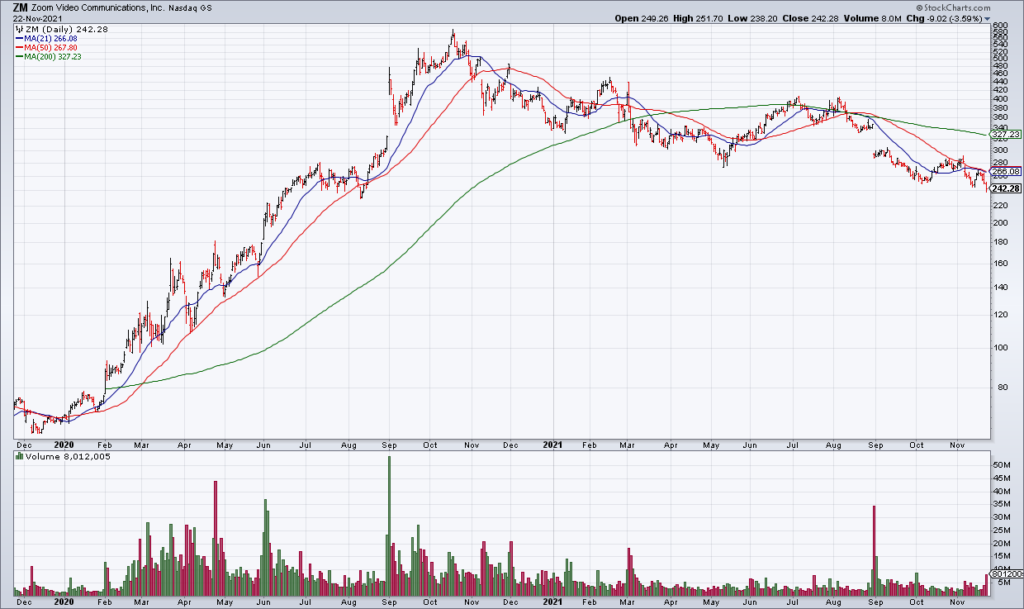

Pandemic Darling Zoom Down Over 50% From Highs

Today and the past few weeks are why!

— Chris Perruna (@cperruna) November 22, 2021

Valuations now matter.

The (growth) market (below the surface) has been giving plenty of hints.

Breadth has been weak. https://t.co/vjn0gywEOs

While my focus is the intraday reversal in the QQQ and a potential market top, a secondary story Monday was earnings from pandemic darling Zoom (ZM). The report looked fine to me with revenue of $1.051 billion and EPS of $1.11, up 35% and 12% year over year, respectively. 4Q guidance was for revenue between $1.051-$1.053 billion and EPS between $1.05-$1.06.

However, as we have seen throughout 3Q earnings season, now is not the time for expensive tech. At 50x its 2021 EPS guidance and its business trailing off after the boon of the pandemic, ZM is still on the outs. Already down more than 50% from its 2020 highs, ZM closed the after hours down another 6.31%.

#earnings for the week https://t.co/lObOE0dgsr $ZM $DKS $BBY $NIU $XPEV $HPQ $DE $AEO $DLTR $ANF $CRNC $PDO $FUTU $MDT $GPS $TWST $URBN $AVYA $BURL $ADI $JWN $OGI $ZH $DELL $A $CBRL $ADSK $JACK $KMDA $GENI $KEYS $SR $ROAD $SJM $ARWR $TITN $NTNX $AMWD $VMW $PSG $KC $MOV $J pic.twitter.com/0gpxeqSkTr

— Earnings Whispers (@eWhispers) November 20, 2021

Anything can happen but I wouldn’t want to be long tech darlings Autodesk (ADSK), Nutanix (NTNX) or Pure Storage (PSTG) all of which report earnings Tuesday after the close.

$ZM may soon become a favorite again with the new #Omicron variant!