New Tax Bill Hits Microsoft With $20 Billion Bill

The ripples of the GOP tax bill, now law, are continuing to reverberate in the investment community. Last week, we looked at Apple's almost $40bn tax bill on its $200bn+ overseas cash before any deductions - a sizeable bill indeed. Here's a look at the Cheddar TV segment discussing this phenomenon.

Microsoft (MSFT) is another tech giant to be hit by the bill's deemed repatriation provision. Under the bill, "all foreign profits are 'deemed' to have been brought back [to the US] already and are immediately taxed."

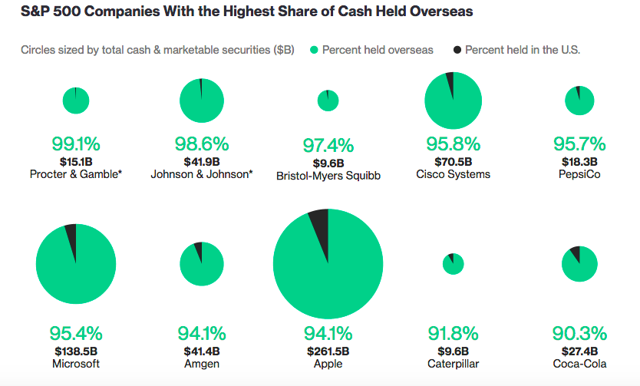

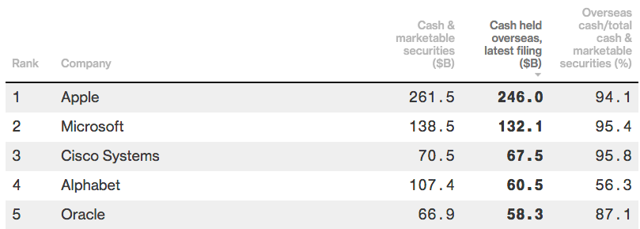

As we can see from the chart above, 95% of Microsoft's $138bn in cash are held overseas, or roughly $132bn. In fact, it ranks #2 behind Apple (AAPL) in total cash overseas by US companies.

Now that the details of the GOP tax plan are becoming more widely known, Microsoft will soon face investors and analysts on its upcoming earnings call, and this cash will certainly be a topic of conversation.

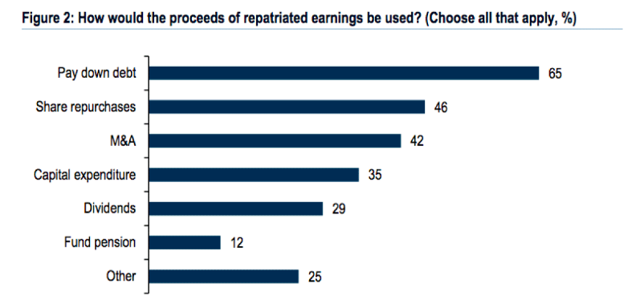

At the outset, investors will rightly inquire about what to do with the remaining cash, now that the company cannot "stash" it away under the deemed repatriation provisions. A recent Merrill Lynch survey of S&P companies may shed some light on the subject:

Let's begin with Microsoft's debt load. After the LinkedIn acquisition, Microsoft currently has around $90bn in debt with a TTM cash flow of $40bn. Retiring some of this debt is a likely scenario, as it seems for many of the S&P companies polled above.

In its capital return program, Microsoft has been more friendly to dividends than to share repurchases. It has repurchased around $10bn in the last twelve months and returned $12bn in dividends. With a dividend yield of just under 2%, we believe an increase in the quarterly dividend is another likely scenario for Microsoft. With 7.7bn shares outstanding, the company could raise the dividend from $1.68 to $2, or a roughly 20% increase and be able to finance this through its cash quite easily. We expect shareholders push for an even greater increase.

Disclosure:

I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. This article is meant for ...

more

Any updates on this article?

This is one of the few plans from the #Trump administration that I actually like. It's about time someone went after these companies.