I Hired A Team Of Secret Shoppers To Find Out How Businesses Were Opening In Dallas. It’s Not Good.

I wanted to get an understanding of what opening meant to businesses around Dallas. Were they opening? What precautions were they taking? Were employees in safe environments? And bigger picture, I wanted to know if these are places that I would feel safe taking my family to.

So I hired a company that specialized in this type of project, hiftsmart.com, and asked them to let me know how Dallas businesses were responding to the Open Order for Texas.

We will do this again a couple more times so we can learn what the trends are and try to learn from it.

This is what we found:

Methodology:

- We called ~1000 restaurant and retail locations based on popularity (we used # of reviews on Yelp by category as a proxy) to assess full re-open rate (open for dine-in, in-person shopping etc.)

- We conducted physical audits at ~300 locations across restaurants and retail locations in Dallas to assess compliance against state re-opening protocols

Overview:

1) Re-opening Rate: Only 36% of businesses chose to open on the opening weekend. Media coverage, showcasing owner sentiment and infection statistics, paint a picture of a large degree of latent fear in the marketplace.

(Click on image to enlarge)

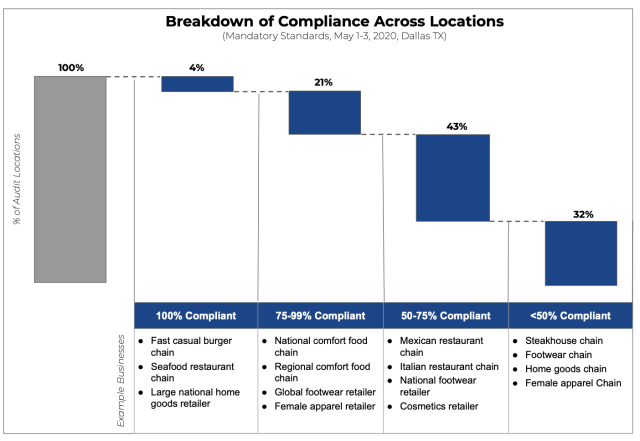

2) Aggregate Degree of Safety Protocol Compliance – By Locations: Overall – 96% of businesses were non-compliant across all mandatory protocols and all locations. The extent of non-compliance is dramatic with ~1/3 of all locations being <50% compliant across mandatory protocols as established by the Governor’s office. The chart below breaks out the degree of compliance across mandatory compliance % buckets.

3) Aggregate Degree of Safety Protocol Compliance – By Protocols: On average, ~60% of mandatory protocols were followed and ~54% of all suggested protocols were followed. In aggregate – locations followed ~58% of all mandatory + suggested protocols. The following chart shows an aggregate view of all protocols and the degree of *non-compliance* (the top is what is not followed and the bottom is what is more followed) in order of most to least non-compliant across locations.

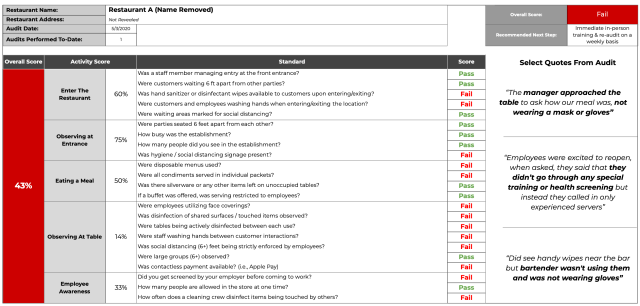

4) Individual Location Assessments: Overall – there is a wide discrepancy among individual level performance by location type. Below is a preliminary view of what a single location scorecard could look like that breaks out individual performance. We have the data ready for hundreds of locations and will have it for all ~800 visits across the rest of the month. I think trending the same-location compliance across multiple visits will be a critical addition to show improvement over time.

(Click on image to enlarge)

5) Comparative Benchmarking Assessments: We’ve done very preliminary levels of comparative analysis, but early assessments show a pattern in the data of highly variable compliance within a parent franchise.This is really interesting because a larger parent corporation would be highly concerned with variable degrees of compliance among their corporate-owned restaurants and would push for standardization and measurement, not dissimilar from regular mystery shopping and performance auditing workflows.

![]()

Attachments area

Shiftsmart Safety Auditing – Dallas Case Study (May 1-3 2020)