Baidu: Positioned To Thrive After Coronavirus Fades

Summary

- Baidu has dipped $20 on the coronavirus market weakness.

- The company is positioned to thrive when the Chinese economy rebounds, but investors should brace for weak Q1 guidance.

- The stock has fallen back to the insane 1.5x EV/S.

Over the last year, Baidu (NASDAQ:BIDU) has suffered a string of hits to the Chinese search stock due to internal problems, but mostly, the company has been hit by Chinese economic weakness and regulations. The stock traded up to $280 back in early 2018 and dipped to only $120 at the open this week following the fears surrounding the coronavirus in China. The stock remains an exceptional value on this prolonged weakness and superb valuation per previous research.

Image Source: Baidu website

Expect Q4 Weakness

A lot of the issues hitting Baidu during 2019 where the trade war impacts with the U.S. and the Chinese government restrictions on online marketing in the healthcare vertical. The company hasn't generally seen a major impact from search engine market share losses in what should've been a fast growing market.

Back in Q3, Baidu saw the mobile ecosystem surge. Demand for the Baidu App, newsfeed network, and Smart mini program all saw robust growth. Investors should expect the same during Q4.

The issue remains the advertising network for their core business. The recent Wuhan coronavirus outbreak will hurt guidance for the Q1 quarter that includes the Chinese new year.

The problem remains the core marketing revenue struggles. For Q3, Baidu saw those revenues decrease 2% from the prior year, while increasing 8% sequentially. The Chinese search giant has guidance for total revenues growing up to only 6% for the quarter to reach a high of $4.02 billion.

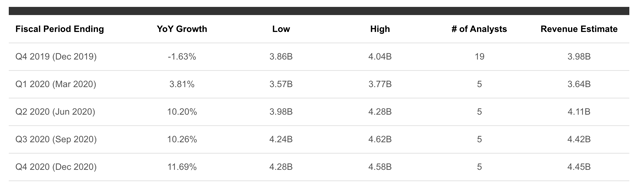

Analyst estimates are for sales of $3.98 billion to nearly match the high end of estimates, but the number is listed as a decline. Baidu has so many moving parts from the last couple of years that financial comparisons become very difficult.

Source: Seeking Alpha earnings estimates

Back in Q4'19, Baidu is listed as generating revenues of $4.05 billion, but the company divested several businesses during the year.

Dominate Market Leader

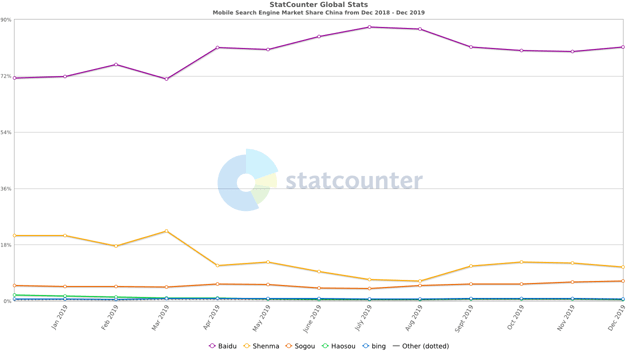

During Q3, Baidu saw their search engine market share dip into the low 60% range. The company saw a rebound to 67% in December, and the number remains highly volatile.

The key mobile search engine market share is more stable above 80%. Baidu gets the majority of their revenue from mobile these days and has seen market share remain far above the lows of last Q1.

Source: Statcounter

The big issue is that the digital ad market in China isn't growing at the rate one would expect. Some estimates have the growth rate down to only 10%, while the global digital ad market is still growing in excess of 15%.

The market is far overplaying the core online advertising weakness due to TikTok owner ByteDance (BDNCE). The company is a competitor for ad dollar spending, but corporations still need to spend via search advertising and newsfeeds to acquire customers.

The news of ByteDance surpassing Baidu and Tencent Holdings (OTCPK:TCEHY) for online advertising is mostly a novelty. The short-viral video service generated $7 billion in ad revenue in the 1H'19 to exceed the 17% market share of Baidu.

Continue Reading on Seeking Alpha.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any ...

more