3 Reasons Why Facebook Bears Are Wrong

The data privacy scandals have produced plenty of volatility and uncertainty around Facebook (NASDAQ:FB) stock in the past year. However, the numbers from Facebook are showing that the main bearish arguments are too shortsighted.

The bearish case on Facebook is focused on 3 main points: the negative impact from the data privacy scandals, an abrupt slowdown in growth, and excessive valuation. Taking a deep look at these arguments, however, they don't seem to be well-grounded in reality.

1. Sustained User Growth And Engagement

The data privacy scandals have inflicted considerable damage to the company's reputation. Facebook needs to provide all the guarantees regarding data privacy going forward, and the company does not have any room for error left in that area. Nevertheless, the numbers show that the platform is still generating solid traction among users and advertisers.

One of the main bearish arguments affecting Facebook stock in recent months is that users would supposedly stay away from Facebook after the reputational damage produced by Cambridge Analytica and data privacy concerns. However, the evidence is indicating that this is not the case, and Facebook continues producing solid user growth and engagement levels.

Facebook ended the second quarter of 2019 with 1.59 billion daily active users, an increase of 8% year over year. Monthly active users also rose 8% to 2.41 billion. The company estimates that 2.1 billion people use one of its family of services - Facebook, Instagram, WhatsApp, or Messenger - every day. Management said in the conference call that the company now has over 3 million advertisers across Facebook, Instagram, and Messenger.

The traditional media companies are being seriously hurt by competition from Facebook and other social media platforms. This can explain to a good degree why the old media is seeing Facebook as such a negative force of evil.

The company certainly deserves a lot of criticism for its data privacy mistakes, but it looks like users are not as concerned about this problem as the traditional media corporations would have you believe.

If Facebook does not make any more serious mistakes in this area, it's fair to say that the company is leaving those scandals in the past and still generating solid traction among users.

2. Growth Potential Remains Strong

One of the most important factors to consider when investing in growth stocks is the sustainability of growth rates over the long term. Growth tends to naturally slow down as a company gains size over time, and Facebook is expected to generate over $70 billion in revenue this year, so it's not easy to continue growing rapidly from such a massive revenue base.

Facebook just can't be expected to grow at the same rate it was growing when social media was a novelty and the company was comparatively much smaller than it is today. However, the business is proving an extraordinary ability to sustain vigorous performance in spite of its gargantuan size.

Revenue during the second quarter of 2019 came in at $16.9 billion, an increase of 28%. The number surpassed Wall Street expectations by $700 million, and the growth rate even accelerated versus 26% in the first quarter of 2019. Mobile advertising revenue represented 94% of advertising revenue for the second quarter of 2019, up from approximately 91% in the second quarter of 2018.

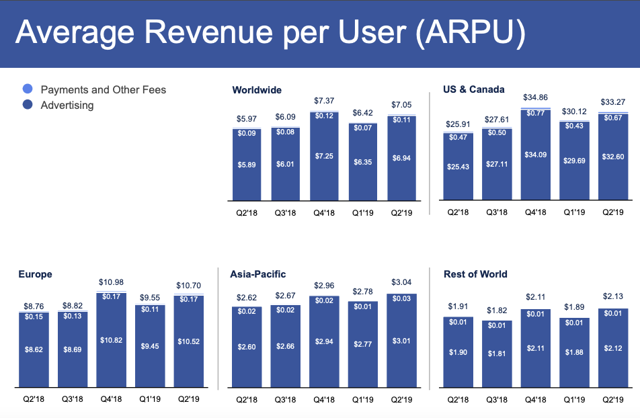

The bearish argument for a steep slowdown in growth seems to be missing the fact that Facebook is making more money per user, so revenue is growing at a much faster rate than the user base. Worldwide revenue per user was $7.05 last quarter, growing by 18% year over year.

Source: Facebook Investors Relations

There is a very important consideration to keep in mind in this area. Revenue per user in the US and Canada, the company's most mature and profitable region, increased by a vigorous 28.4% last quarter, reaching $33.27.

Even in markets where Facebook already has high monetization levels, the company is still driving strong growth in monetization, and this speaks well about its ability to drive sustained revenue growth through more effective and better-targeted advertising.

In other regions of the world, the company is making only a small fraction of the revenue per user that it makes in the US and Canada. It will take time for monetization levels to rise in regions with lower per capita income and smaller advertising markets. However, over the long term, Facebook has massive room for increased monetization in Asia and other emerging markets.

The company is building some exciting new ways for people to shop directly on its apps. Instagram Checkout is in closed beta mode, and the company has recently launched a new feature that enables creators to tag products in their posts. This gives people an easy way to shop from their favorite creators without leaving the app.

The company is testing WhatsApp Payments in India and, according to management, the test is surpassing expectations. Facebook is already planning to launch payments in more countries within the next year.

The Libra project is still in the initial phase, and it's hard to tell what kind of direct impact it could have in the short term. Over the long term, however, the possibilities are clearly intriguing.

Facebook is also actively expanding into virtual reality and augmented reality, an area where the company has plenty of potential to leverage its strategic strengths.

In Zuckerberg's words:

The reason augmented and virtual reality will deliver a qualitatively better experience than traditional computing platforms is that they deliver the feeling of presence - that you're actually there with another person or in another place. The feeling of presence is so important to social interactions and how we're wired to interact as people. So even if it has taken longer than we expected to deliver this at scale, I continue to believe that this will be one of the most important contributions we make to the way we all use technology over the long term.

Facebook is not only gaining more users but also driving rapid increases in monetization, particularly in its most profitable markets. This is allowing the company to increase revenue at a much faster rate than user growth. In addition to this, the company is barely getting started in areas like Instagram Checkout, WhatsApp monetization, Messenger, Libra, and Virtual Reality.

3. Valuation Is Still Reasonable

When discussing Facebook and other FAANG stocks, the fact that these companies have delivered big returns in the past several years is generally quoted as one of the main reasons why future returns could be subdued.

However, valuation is about comparing the stock price with different indicators of fundamental value such as earnings and cash flows. Even if the stock has appreciated substantially, this does not mean that it is overvalued in comparison to fundamentals, especially in cases when earnings are also growing at full speed.

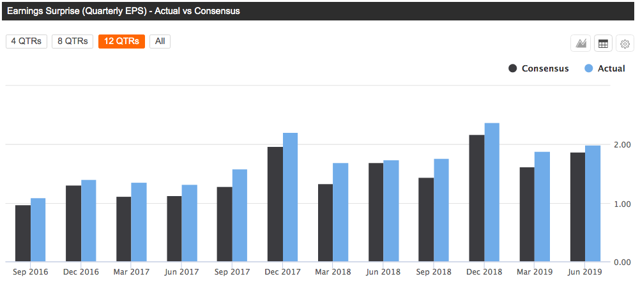

Facebook is expected to make $7.93 in earnings per share during the current year and $9.63 next year. Under these assumptions, the stock is trading at forward price to earnings ratios of 25 and 21 for 2019 and 2020 respectively.

This is hardly an excessive valuation for a business that is generating revenue growth well above 20% and producing adjusted profitability levels in the neighborhood of 40% of revenue at the operating level.

Not only is the stock very reasonably priced based on current earnings expectations, but Facebook also has an impeccable track record in terms of delivering earnings numbers above those expectations. As long as this trend remains in place, fundamental momentum would mean that the stock is cheaper than what current expectations are reflecting.

Source: Seeking Alpha Essential

Valuation ratios need to be analyzed in their proper context. A company with strong financial performance and vigorous momentum deserves a higher valuation than a business producing mediocre financial performance and languishing momentum. But it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective.

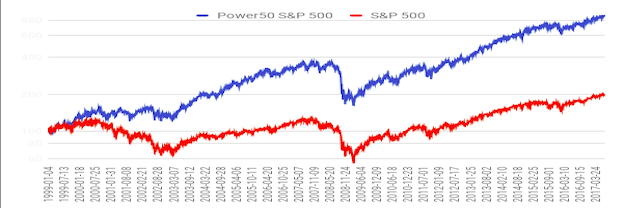

The PowerFactors algorithm is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this bodes well for investors in Facebook. The stock has a PowerFactors ranking above 99 as of the time of this writing, meaning that Facebook is in the top 1% of stocks in the US market when considering valuation and other quantitative return drivers together.

If the company continues delivering sustained revenue growth and rock-solid profitability, then Facebook stock should offer attractive upside potential from current valuation levels.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am long Facebook.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more